0 Introduction

Within the context of global energy shortages and increasingly severe environmental issues,promoting the development of renewable energy has become the preferred strategic direction for many countries [1].The transition to renewable energy is further accelerated by declining technology costs and policy support,as evidenced by the rapid deployment of solar and wind power in recent years [2].China is actively advancing the construction of a new power system dominated by renewable energy [3],with the aim of optimizing and upgrading the energy structure and achieving “dual carbon” s trategic goals [4].Recent studies have highlighted China’s leadership in renewable energy capacity expansion,but challenges remain in grid flexibility and market design [5].However,clean energy sources such as photovoltaic (PV)and wind power,which are characterized by their randomness and volatility in power generation,pose new technical challenges to system stability,power quality assurance,and dispatch planning when they are integrated into the grid on a large scale.The intermittency of renewables necessitates advan ced forecasting and balancing mechanisms,as discussed in [6],which evaluated machinelearning-based approaches for improving renewable energy predictability.Developed nations such as Nordic countries have established local flexibility markets (LFMs)with virtual power plant (VPP)–distribution system operator hierarchical coordination mechanisms.Distributed energy resources were integrated into LFMs by employing a hierarchical robust optimization model to address voltage stability issues under high renewable energy penetration [7].The United States (US) market has relied on segmented bidding strategies and Stackelberg game models for VPPs.This approach mitigates bid rejection risks caused by uncertainties from diverse market participants through aggregated adjustab le capacity interval partitioning,followed by the transformation of equilibrium problems with equilibrium constraints into mixed-integer linear programming solutions [8].The core innovation of Germany’s balancing group mechanism (BGM) is its integration of blockchain-enabled balancing groups and robust bidding strategies driven by information gap decision theory.Three strategic profiles were designed for VPP bidding,namely balanced,conservative,and aggressive strategies,each corresponding to tailored robustness and opportunity functions [9].The United Kingdom(UK) has promoted European market coupling,whereas the US utilizes flow-based methodology to optimize inter-re gional transactions.Both implement peer-to-peer(P2P) trading with real-time deviation handling [10].

Chinese research focusing on VPP optimization models has made significant progress in terms of power system balancing.Ref[11]proposed a bi-level stochastic optimization framework for VPPs participating in energy and reserve markets,minimizing operational costs while managing renewable uncertainty through conditional value at risk (CVaR) theory.Similarly,ref [12]developed a master–slave bidding model for carbon-electricityreserve markets,integrating the CVaR to balance economic and low-carbon objectives.These models demonstrate the capacity of VPPs to coordinate distribut ed resources and optimize market strategies.In terms of trading mechanisms,blockchain applications were explored in[13],in which a P2P energy trading platform for microgrids was designed,en hancing transparency and reducing transaction costs.Ref [14]proposed a residual soft option critic framework for artificial intelligence (AI)-driven decision-making,improving VPP operational efficiency through deep reinforcement learning.Chin a’s provincial power grid structure and uneven resource distribution necessitate regional mechanisms [15].Current balancing services rely on demand response and ancillary markets[16],but imperfect compensation mechanisms limit flexible resources such as energy storage[17].Dynamic pricing and multi-agent coordination frameworks have shown potential to unlock demand-side participation [18].Theoretical models such as the stochastic two-stage decision-making framework for energy aggregators have provided methodological support[19],whereas practical cases including like VPP pilots have validated the technical feasibility [20].

In summary,balance regulation systems centered on VPPs leveraging mature market mechanisms and technological means have been established,thereby enhancing system flexibility and reliability.Progress has been made in VPP optimization,market mechanisms,and AI applications.However,current studies tend to focus more on theoretical models and lack systematic balance mechanism designs tailored to the power grid structure,resource distribution,and market development stage of China.Moreover,balancing services are still heavily reliant on traditional methods,and a market mechanism with VPPs as balancing responsibility parties (BRPs) has yet to be established.Therefore,this study systematically analyzes the balancing mechanisms of typical foreign electricity markets,with a focus on the practical experience of Germany’s BGM.This work innovatively proposes a new balancing mechanism with VPPs as independent BRPs by integrating the structural characteristics and development stage features of China’s electricity market.A bi-level optimization model is constructed based on the resource aggregation characteristics of VPPs.The upper level aims to minimize the operational costs of the regional power system,whereas the lower level aims to maximize the profits of VPPs as independent BRPs.The effectiveness and practical feasibility of the model are validated through case studies using actual operational deviation data from typical regions.

1 Analysis of domestic and international power balance mechanisms

With the ongoing optimization of the global energy structure and acceleration of low-carbon transformation,the integration of large-scale renewable energy has become a prominent feature in the development of power systems worldwide.Consequently,given the high penetration of renewable energy,the supply–demand balance of power systems faces significant challenges,necessitating the exploration of effective solutions.This section systematically reviews the research progress in the field of power supply–demand balance mechanisms both domestically and internationally,and summarizes relevant practical experiences.

1.1 Research on foreign power balance mechanisms

Diverse practices have been explored in the mechanisms for balancing renewable energy integration globally.The Nordic electricity market employs a dual classification method for balancing resources,including frequency control and restoration reserves.Small-scale distributed power sources and end-users achieve flexible responses and supply of balancing resources based on real-time electricity price signals through the experimental market mechanism Ecogrid in the European Union[21].In the US,Pennsylvania–New Jersey–Maryland (PJM) utilizes a real-time economic dispatch system to manage real-time balance and calcul ate clearing prices,adopting a dual settlement system[22].In the UK,system operators select the most suitable generating units or adjustable loads in the balancing market based on short-term load forecasts to ensure power supply–demand balance [23].Germany has effectively reduced balancing costs and enhanced system flexibility through its BGM [24].

In summary,balancing market models and mechanisms vary across countries.The Nordic market emphasizes cross-border transactions and encourages the participation of small-scale players.PJM in the US relies on real-time economic dispatch and a dual settlement system to achieve power system equilibrium.The UK market focuses on refined bid/offer trading modes and imbal ance settlement methods.In contrast,Germany’s electricity market model provides valuable insights for China,as it achieves distributed balancing of the power system through the BGM,thereby reducing frequency regulation volumes and costs [25].

1.2 Research on domestic power balance mechanisms

At present,the construction of China’s power balance market is in the pilot and gradual promotion stage,transitioning from the traditional planned dispatch mode to a more market-oriented model.The balance mechanism is key to handling real-time imbalance issues in power systems[15].Owing to the provincial-based power supply pattern and uneven spatiotem poral distribution of power generation resources[26],cross-regional power balance exchange has become an inevitable option in constructing new power systems[27].In terms of responsibility definitions,China’s current balance mechanism draws on international experience to clarify balance responsibility allocation[28],establishes responsibility-sharing models for new energy participation [29],and implements cost-sharing mechanisms based on bilateral transaction rights and obligations[30].It stimulates the potential of multi-party collaboration for subject coordination design [31].In terms of market mechanism upgrading,by integrating the advan tages of inter-provincial power grid interconnection[32],the mechanism provides a market-oriented balance framework that is suitable for a high proportion of new energy access,and impr oves the enthusiasm of emerging subjects to provide services through economic incentives[33].

In summary,at present,market balance is mainly achieved through demand response and ancillary service markets [34].However,imperfect provincial subsidy and compensation mechanisms lead to insufficient utilization of flexible resources such as energy storage [35],and the demand for market balance is continually increasing.Thus,optimization of the regional collaborative balance model is urgently required.

2 VPP participation in BGM

2.1 Concept of balancing groups in Germany

1)Definition of balancing group

A balancing group (BG) consists of multiple market entities,such as power generators,electricity retailers,and consumers.Members of the BG must achieve an internal power production–consumption balance,and any shortfall must be adjusted through market transactions.BGs are required to forecast power supply and demand,adjust their buying and selling plans based on the forecast results,and report to the transmission grid operator to achieve overall power balance.Germany has four major transmission system operators (TSOs),with each dispatch area comprising approximately 100 to 200 BGs [36].BGs are formed by market entities within the same transmission control area and members must belong to the same dispatch region;cross-region formation is not permitted.This model encourages market participants to assume balancing responsibilities voluntarily.In the event of balancing deviations,they are subject to deviation settlement,which incentivizes BGs to ensure self-balancing of generation and consumption through regulatory strategies and market transactions [37].

2)Participants in BGs

According to the German government’s Grid Connection Ordinance,the BGM involves three types of system operation participants:BRPs,TSOs,and balancing service providers (BSPs) [38].

In the German electricity market,BRPs are key entities that are responsible for ensuring power supply–demand balance.They include large power plants,industrial consumers,and new market participants such as aggregators.BRPs manage a certain volume of generation and load resources,encompassing both renewable and traditional power units.BRPs are responsible for formulating and updating power output curves in real time through two core processes,namely “declaration” and “adjustment”,to maintain a power balance in their designated areas.They must report their forecasted output curves to the TSOs a nd adjust them based on actual operational data to minimize prediction deviations.TSOs record the output deviations of BRPs and settle them through the reserve market,with BRPs bearing the imbalance costs.The reserve market prices are set higher than those in the spot market,thereby creating an imbalance price differential,to incentivize BRPs to manage power balance effectively.The specific functions of BRPs are summarized in Table 1.

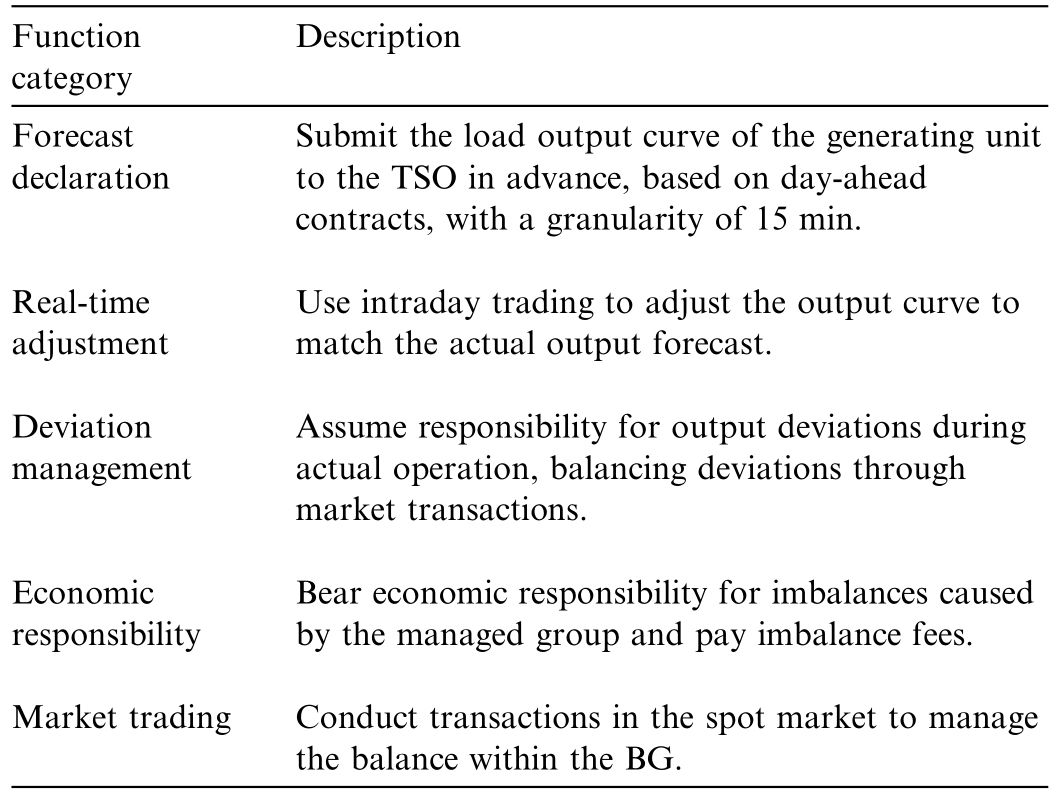

Table 1 Specific functions of BRPs.

As the core operational entity of the power system,the TSO undertakes critical functions in regional balancedispatch.Its specific responsibilities include managing the declared curves of BRPs and the real-time dispatch of reserve resources.TSOs optimize the closing times of intra-day trading in the spot market and the granularity of trading products,thereby enhancing the ability of BRPs to adjust their declared curves and improving the real-time operational efficiency of the system.The TSO is responsible for the operation of the transmission network,coordinating power transactions in the day-ahead and real-time markets,resol ving network congestion issues,and ensuring power supply–demand balance by participating in the spot market and procuring various types of reserve products in the reserve market.In addition,the TSO handles the settlement of imbalance funds and monitors power supply security to ensure stable operation of the power system under extreme conditions.

The participation of BSPs is crucial for stable power system operation,especially as the proportion of renewable energy continues to increase.BSPs are market participants that own reserve provision units or groups and can provide balancing services to TSOs,including balancing energy and capacity.The role of BSPs in the power market is to respond to the dispatch instructions of the TSOs by rapidly increasing or decreasing the power output to balance unexpected fluctuations in the grid.BSPs receive capacity payments for their availability and energy payments when activated by the TSOs in the balancing market.The specific details are summarized in Table 2.

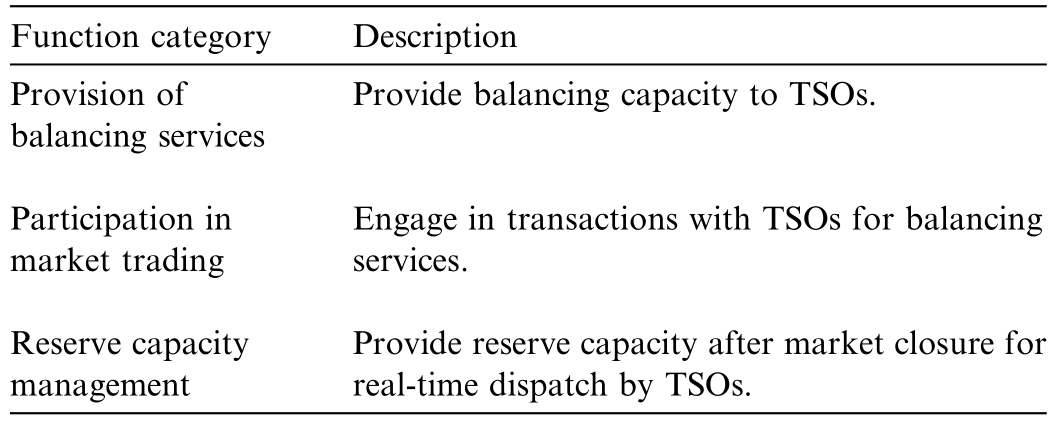

Table 2 Specific functions of BSPs.

2.2 Operational model of BGs

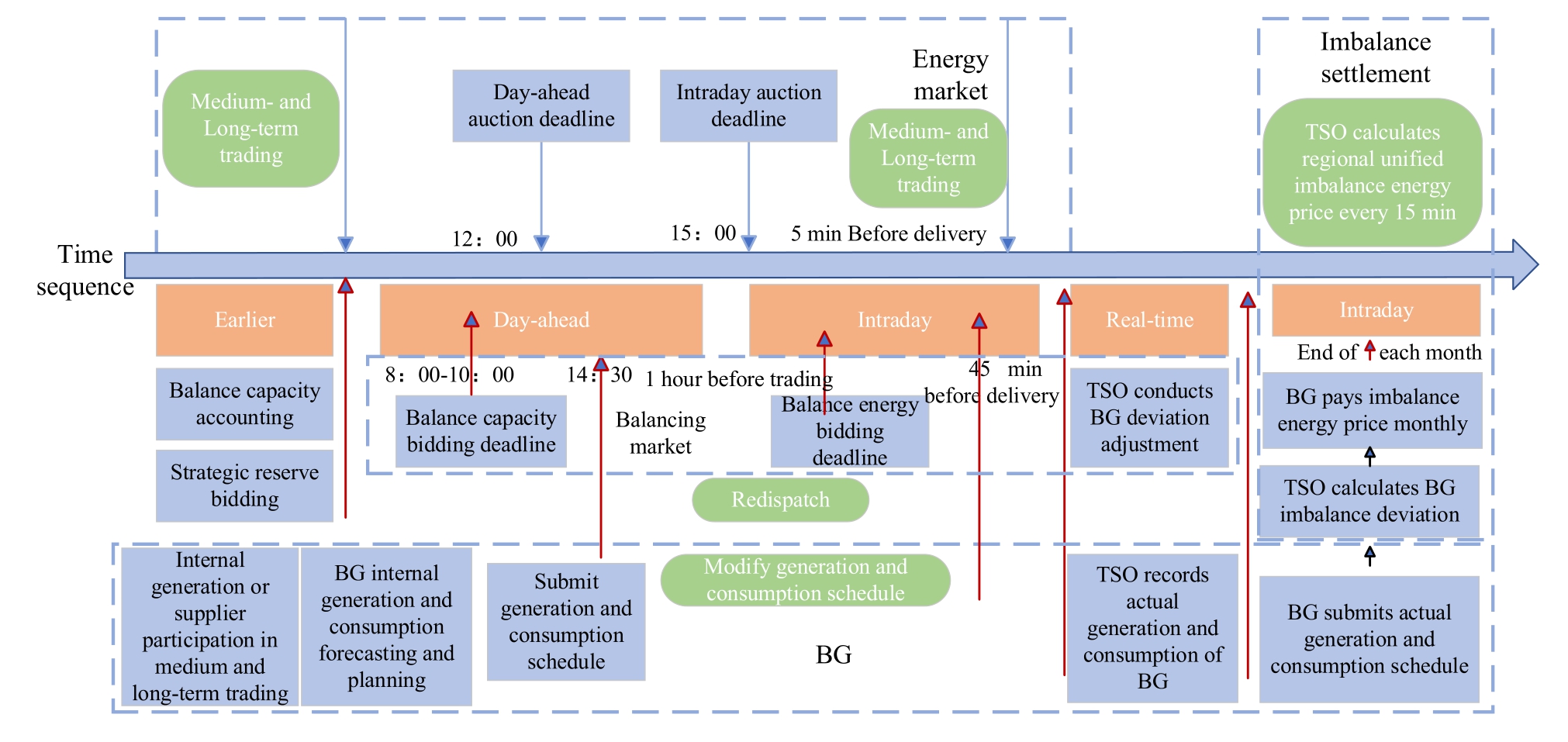

In the German electricity market,BGs exist as nonmarket entities,whereas BRPs serve as market entities,typically in the form of large electricity retailers or powergeneration companies [39].BRPs are required to formulate generation and consumption plans based on their balancing needs,conduct power transactions through the spot market or reserve market,and submit relevant plans to the TSOs [40].When system imbalances occur,the TSOs must activate the reserve ancillary services that it has procured within a timeframe ranging from 30 s to several hours.These services involve purchasing replacement power or absorbing excess power to provide the necessary reserve capacity,thereby maintaining system frequency stability.Reserve ancillary services are uniformly procured by TSOs,and the associated costs are allocated to the BGs,which are responsible for the imbalances.The electricity prices in the real-time balancing market are typically significantly higher than those in the day-ahead market[41].This price differential provides substantial economic incentives for BRPs to participate actively in spot market transactions,thereby improving the accuracy of forecasts for renewable energy generation and consumer load,and effectively reducing imbalance deviations during actual operations.Fig.1 depicts the transactional relationships of BGs in the German electricity market [42].As shown in the figure,the BG operational process unfolds in a time-sequential manner: Initially,the BG completes balance capacity accounting and strategic reserve bidding,while concurrently engaging in medium-/long-term energy trading through internal generation or supplier partnerships.Subsequently,it enters the day-ahead phase to submit generation/consumption schedules and participate in day-ahead auctions for price determination.Prior to the real-time phase,balance energy bidding must be finalized with potential schedule adjustments.During real-time operations,the TSO executes energy deviation adjustments based on the actual generation/consumption data and records these metrics.The process culminates in the imbalance settlement phase,in which the TSO calculates imbalance energy prices and deviation quantities,with the corresponding payments made by the BG.This integrated workflow ensures stable energy supply and optimized allocation through capacity accounting,reserve bidding,multi-stage bidding mechanisms,and real-time TSO regulation.

Fig.1.Key timeline diagram of the German BGM.

2.3 Mechanism for multi-agent VPPs participating in BGs at the regional level

Against the backdrop of the development of new power systems,this study focuses on the complex operational environment resulting from the high penetration of renewable energy,diversified loads,and integration of emerging market entities.It systematically analyzes core issues such as the intensification of grid imbalance risks,increasing system balancing costs,and the inefficiency of BGs submitting actual generation and consumption schedules in traditional balancing models.

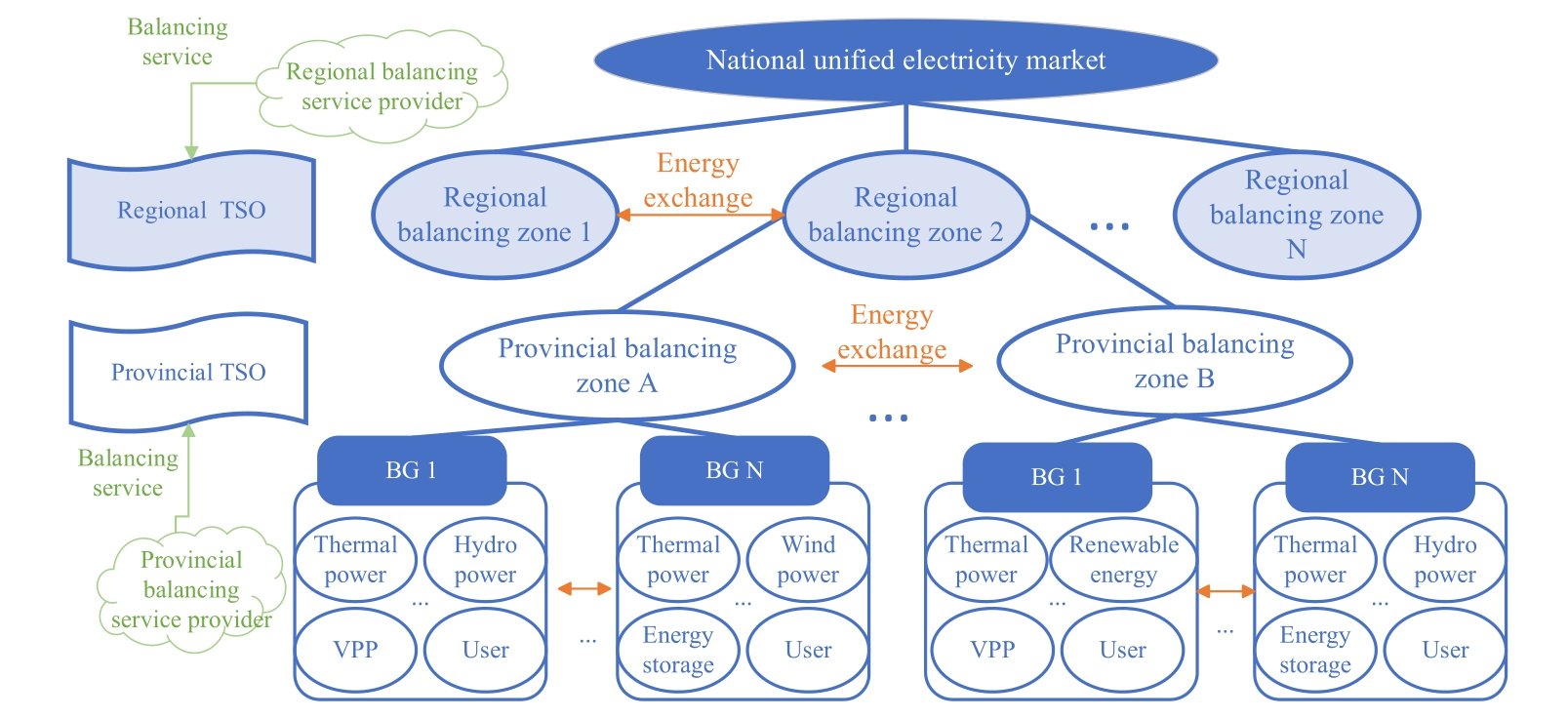

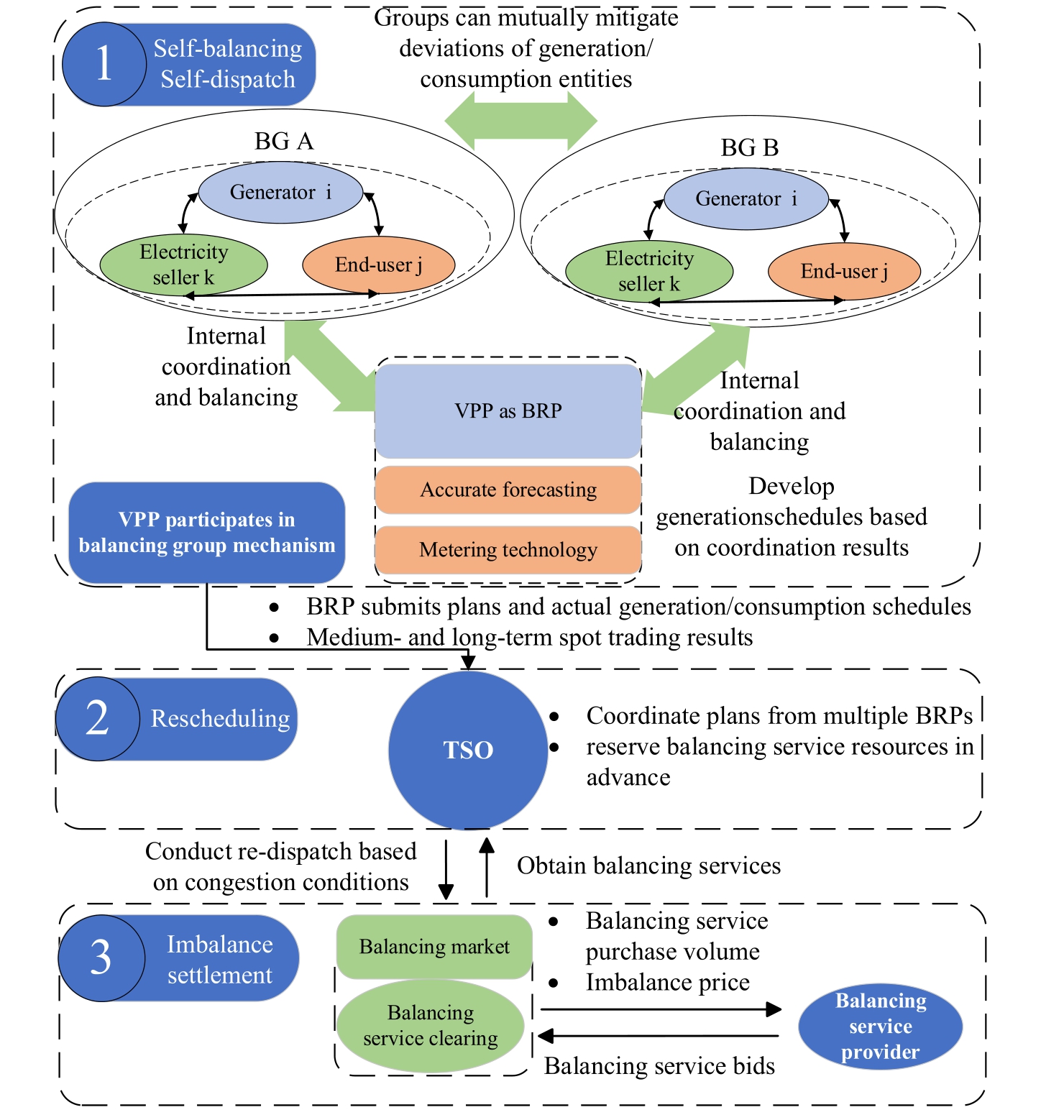

Building on Germany’s BG concept,this study proposes a BG model tailored to China’s provincial electricity market struc ture (dominant medium-/long-term trading;developing spot/ancillary markets).As shown in Fig.2.Positioning VPPs as BRPs requires careful adaptation to the Chinese context:

Fig.2.Exploration of BGM adapted to Chinese context.

1) Embedding in China’s market structure: BRPs operate provincially.Provincial electricity trading centers(or authorized bodies) handle BRP registration,qualification,curve oversight,and deviation settlement,coordinating with provincial dispatchers.A hierarchical balance structure is key: VPP–BRPs maintain internal balance via aggregated distributed resources (generation,storage,and load),whereas provincial dispatchers manage the overall system balance and inter-provincial flows.VPP–BRPs must be integrated into provincial markets by forming baseline curves in medium-/long-term markets,adjusting curves/minimizing deviations via dayahead/intra-day spot trading,and potentially acting as BSPs in ancillary markets for revenue and enhanced flexibility.

2) Addressing core Chinese challenges: Assigning BRP responsibility and deviation-based costs incentivizes VPPs to activate scarce distributed flexibility (especially user side).Faced with renewable volatility,high deviation penalties drive VPPs to improve their forecasting and internal optimization,thereby reducing reliance on system-wide balancing and lowering costs.Market-based deviation settlement must align with China’s existing rules for traditional generators to avoid conflicts.

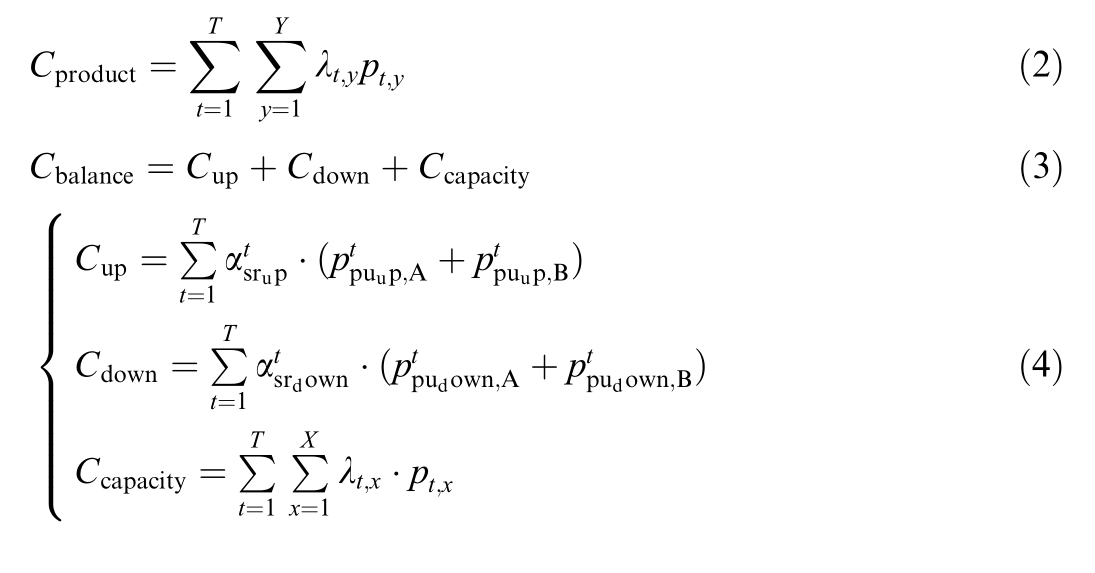

In summary,this VPP–BRP model integrates German experience with specific Chinese needs (e.g.,high renewables and flexibility gaps).Drawing on the design principles of BGs in Germany,this study proposes a BG model and operational mechanism tailored to the characteristics of China’s new power system.A bi-level optimization model is constructed by integrating VPPs—an emerging market entity—into the operational framework of BGs.The objective of the upper level is to minimize the operational costs of the regional power system,whereas that of the lower level is to maximize the revenue of VPPs as BRPs.By assigning clear market roles and economic accountability to VPPs,it unlocks distributed resource potential,enhances balance efficiency,reduces costs,and offers an innovative market solution for China’s new power system.Fig.3 shows the main flowchart of the mechanism for VPP participation in BGs.The operational process of a VPP acting as a BRP in BG management is as follows: Initially,the VPP coordinates real-time supply–demand matching between generators and power consumers within BGs A and B,ensuring dynamic alignment of generation and consumption through selfbalancing and dispatching.Subsequently,it engages in balancing mechanisms by submitting medium-/long-term spot trading outcomes and formulating generation plans to address supply–demand fluctuations.When grid congestion occurs,the TSO intervenes for re-dispatching,prompting the VPP to procure the necessary balancing services through the balancing service market based on the TSO adjustments.Concurrently,the VPP collaborates with the TSO to pre-reserve balancing resources and develop contingency plans.Ultimately,the VPP achieves real-time system balance and stable power grid operation through the synergistic integration of internal coordination,market transactions,and TSO-driven dispatching.

Fig.3.Framework of VPP participating in BGM.

3 Bi-level optimization model for VPP participation in BGs within a region

The proposed bi-level optimization model exhibi ts tight coupling:

Upper level (regional system layer): With the objective of minimizing the total system operating costs (including generation,balancing,and load management costs),its decision variables encompass system-wide deviation service procurement quantities.Its price constraints directly bound the deviation service pricing range of the lowerlevel BRP.

Lower level (VPP–BRP layer): With the objective of maximizing its own profit (including service revenue and market arbitrage revenue,minus penalty and resource costs),its decision variables include deviation service prices,regulation power,and market trading strategies.Its critical output is the unmitigated net deviation within its group.The unmitigated net deviation output from the lower level is directly equivalent to the reported deviation demand of the BGs in the upper-level model.This constitutes the primary source of the system balancing cost of the upper level,directly affecting its total cost objective.This structure inherently represents a Stackelberg game.The upper level acts as the leader,making the first move by setting rules (price constraints).The lower level acts as the follower,optimizing its response.The aim of the overall model is to minimize the upper-level cost while maximizing the lower-level profit,subject to all constraints.The subsequent sections detail the mathematical formulations of each level and solution methodology.Spot market purchasing/selling of electricity serves as a marketbased tool for the lower-level VPP to achieve internal group balance.Transaction outcomes are transmitted to the upper-level model through the declared deviation values of the BGs.These values already incorporate the deviation correction effec ts from spot market activities.Consequently,the costs and revenues from lower-level spot market transactions are directly integrated into the revenue function of the VPP.At the upper level,the system procures BSP services based solely on the net deviation demands reported by the groups,which already account for spot market effects.This design prevents double counting of costs and aligns with the layered architecture logic of electricity markets in which energy transactions are managed by responsible entities while balancing services are handled by system operators.

3.1 Upper-level model: Regional system operation

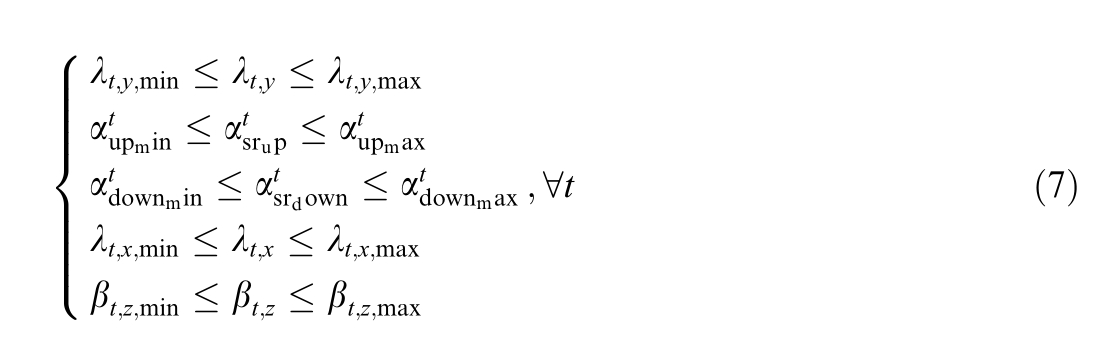

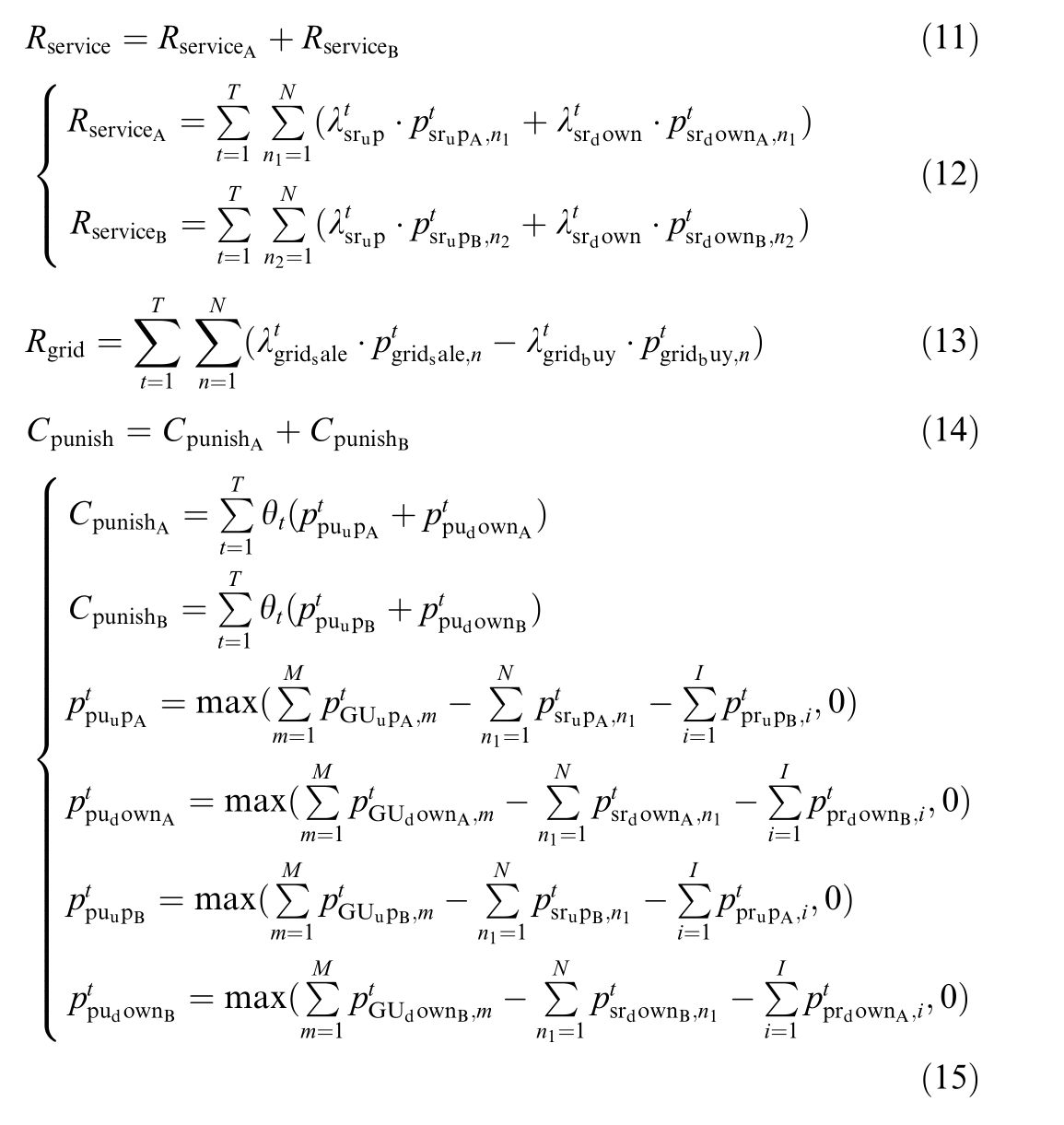

In the proposed bi-level optimization model,the upper level represents a system comprising dual BGs,with the optimization objective of minimizing system operating costs.Power generation entities incur generation costs based on the output forecasts and load demand.The TSO procures capacity in advance and purchases upward and downward regulation services based on the deviation adjustment prices,resulting in balancing costs.The system implements load management under a demand response mechanism,incurring compensation costs.A model for minimizing the internal operating costs within the regional system is constructed based on these considerations,as shown in Eq.(1).

where Cproduct represents the total generation cost of the system,Cbalance denotes the system balancing cost,and Cloadmanage is the internal load management cost of the system.Specifically,

In the above,λt yrepresents the unit cost price of resource consumption for power generation during time period t.p t ydenotes the power generation of generator unit y within the region during time period t.T is an operating cycle.Y is the total number of generator units in the region.![]() are the prices for upward and downward deviation regulation services purchased by the TSOs from BSPs during time period t,respectively.

are the prices for upward and downward deviation regulation services purchased by the TSOs from BSPs during time period t,respectively.![]() represent the upward and downward deviation regulation power demands declared by BG A during time period t,whereas

represent the upward and downward deviation regulation power demands declared by BG A during time period t,whereas ![]() represent those declared by BG B during the same period.λt xis the unit capacity cost price for purchasing type x capacity at time t,and p txis the purchased capacity of type x at time t.X is the total number of capacity purchase types.βt zis the unit cost price for load curtailm ent during time period t,and p t zis the amount of load curtailed within the region during time period t.Finally,Z is the total number of curtailable loads.

represent those declared by BG B during the same period.λt xis the unit capacity cost price for purchasing type x capacity at time t,and p txis the purchased capacity of type x at time t.X is the total number of capacity purchase types.βt zis the unit cost price for load curtailm ent during time period t,and p t zis the amount of load curtailed within the region during time period t.Finally,Z is the total number of curtailable loads.

The constraints for the upper-level model are as follows:

1) Maximum power generation constraint:

2) Price co nstraint:

3) Capacity constraint:

4) Load curtailment constr aint:

3.2 Lower-level model: VPP participation in BGs

The previous phase of research primarily focused on models in which VPPs participate in a single BG to maximize revenue and minimize operational costs for internal entities.However,given the large number of BGs in Germany and their potential for complementary advantages,the original study did not account for scenarios involving energy exchange between BGs[43].Therefore,an extended investigation is warranted.The current phase focuses on energy exchange between two balancing groups and their complementary advantages to simplify the complex model,expanding the scope from a single BG to two and elevating the objective from minimizing internal entity costs to optimizing regional operational costs.Each BG is composed of power generation,power consumption,and existing internal energy storage configurations entities,which are managed uniformly by a single BRP.As an independent BRP,the core function of the VPP is to aggregate and manage adjustable resources within the region.These adjustable resources (such as distributed energy storage systems,interruptible loads,and small-scale flexible generation units) are physically located within specific BGs,serving as key flexible elements for achieving internal generation–consumption balance within the BGs.The VPP optimizes the dispatch of these resources to provide deviation regulation services (serving generation and consumption entities within groups A and B),participate in electricity market transactions (arbitrage through electricity buying/selling),and bear the potential deviation penalty costs.Entities within the group forecast their electricity quantities and submit plans to the BRP,which can participate in spot market transactions based on real-time market prices to buy or sell electricity.The BRP provides deviation regulation services by reasonably dispatching its internal adjustable resources and charges service fees to the entities within the group.The costs include the deviation assessment fees borne by the BRP,wear and tear costs of its internal adjustable resources,and the construction costs of these resources.A profit maximization model for the BRP is constructed on this basis,and the profit distribution problem is expressed as shown in Equation (10).Future research will continue to scale this model to multiple inter-connected balancing groups,enabling complementary advantag es among them to reduce regional operational costs progressively.

In Equation (10),Rservice represents the revenue earned by the BRP for providing deviation services to entities within the group.Rgrid denotes the revenue obtained by the BRP of the BG from participating in the electricity market transactions using adjustable resources.Cpunish is the cost of the deviation pen alties imposed by the TSO.Cconstraction represents the construction costs of the adjustable resources by the BRP of the BG.Closs is the wear and tear cost of using adjustable resources.The specific formulations are as follows:

Cp is the average power cost coefficient for all adjustable resources and Pmax is the maximum regula tion power of the adjustable resources.Ce is the average capacity cost coefficient for all adjustable resources and vmax is the maximum regulation capacity of the adjustable resources.Tlife is the average lifespan of the adjustable resources constructed by the BRP.μ is the entity wear and tear cost coefficient for the adjustable resources.

The constraints for the lower-level mod el are as follows:

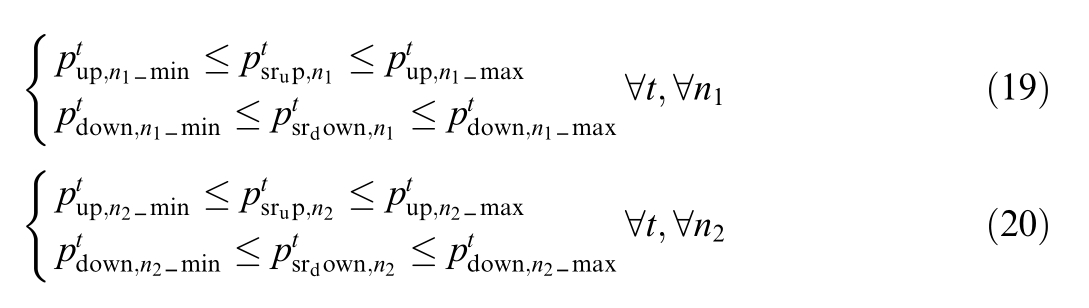

1) Maximum regulation power constraint:

2) Number of adjustable balancing resources:

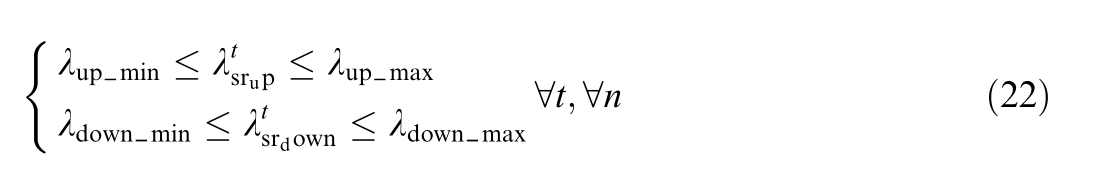

3) Deviation regulation service price constraint:

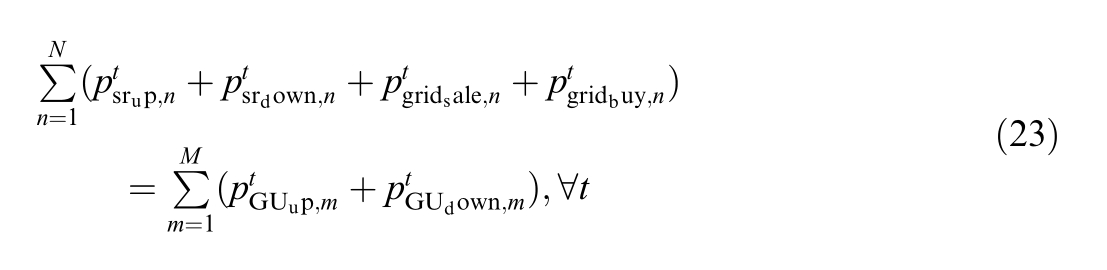

4) Power balance constraint:

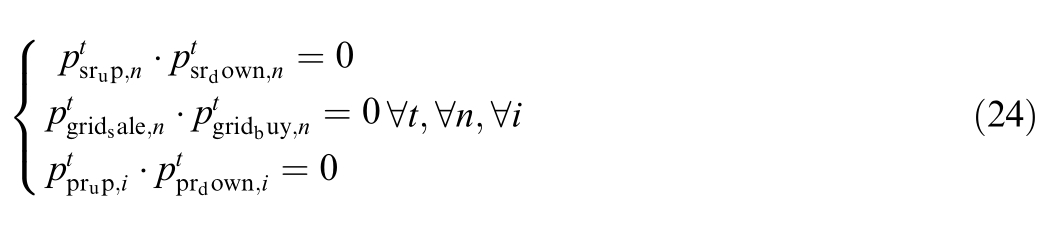

5) Mutual exclusion constraint for adjust able resource power:

6) Reported power constraint:

7) Mutual exclusion constraint for power demand:

3.3 Model solution

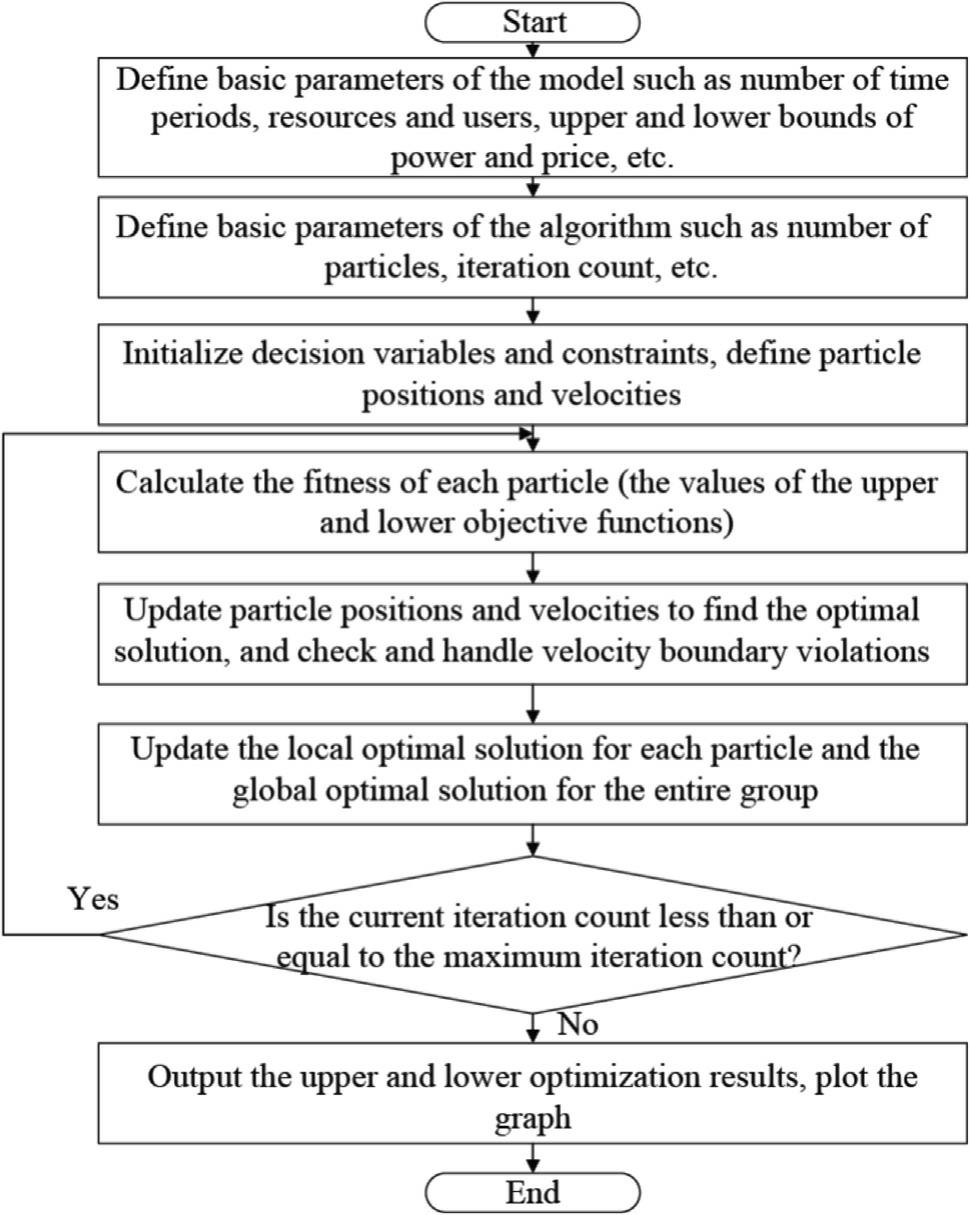

This study adopts particle swarm optimization (PSO) to solve the bi-level optimization model,primarily owing to its unique algorithmic characteristics and problem adaptability.PSO performs a global search by simulating bird flock foraging behavior.PSO exhibits lower parameter sensitivity in continuous variable optimization compared with the crossover–mutation mechanism of the genetic algorithm,making it particularly suitable for handling continuous interactions between upper-/lower-level decision variables in the bi-level model.Comparative experiments have demonstrated that PSO achieves 25–40%faster convergence than ant colony optimization while maintaining higher global optimal solution acquisition rates when addressing nonlinear bi-level optimization problems [44].In terms of application to the proposed model,PSO shows a stronger capability to escape local optima when processing multi-peak objective functions,which effectively matches the complex constraints requiring VPPs to balance deviation service revenues and penalty costs dynamically in the lower-level model.For parameter configuration,we adopt the adaptive inertia weight![]() with acceleration coefficients c1=c2=2.This configuration,as verified through 200 iterations,achieves an effective balance between computational efficiency and solution quality.PSO demonstrates higher parameter-tuning efficiency compared with simulated annealing,which requires meticulous adjustment of annealing temperatures,thereby better aligning with the real-time decision-making requirements of electricity markets.

with acceleration coefficients c1=c2=2.This configuration,as verified through 200 iterations,achieves an effective balance between computational efficiency and solution quality.PSO demonstrates higher parameter-tuning efficiency compared with simulated annealing,which requires meticulous adjustment of annealing temperatures,thereby better aligning with the real-time decision-making requirements of electricity markets.

Fig.4 illustrates the solution process framework,which centers on the PSO algorithm .The specific solution steps are as follows:

Fig.4.Algorithm solution flow.

Parameter initialization and variable setting: Define the parameters required for the model and algorithm,and initialize the decision variables (including the power,prices,and deviation demands submitted by various entities)and their constraints using random functions.

Fitness evaluation and particle update: Calculate the fitness value of each particle and update its velocity and position information based on this value to explore a better solution space.Perform boundary detection and correction on particle velocities to ensure that the updated velocities and positions satisfy the predefined constraints.

Optimal solution update and strategy storage: Update the local optimal solution for individual particles and the global optimal solution for the particle swarm.Simultaneously,store and update the decision variable strategies related to the model and their corresponding objective function values.

Iteration termination judgment and result output:Determine whether the current iteration count has reached the maximum number of iterations preset by the algorithm.If not,return to step (2)to continue iterative calculations;if reached,terminate the solution process and output the optimal values.

4 Case study analysis

4.1 Case study parameter settings

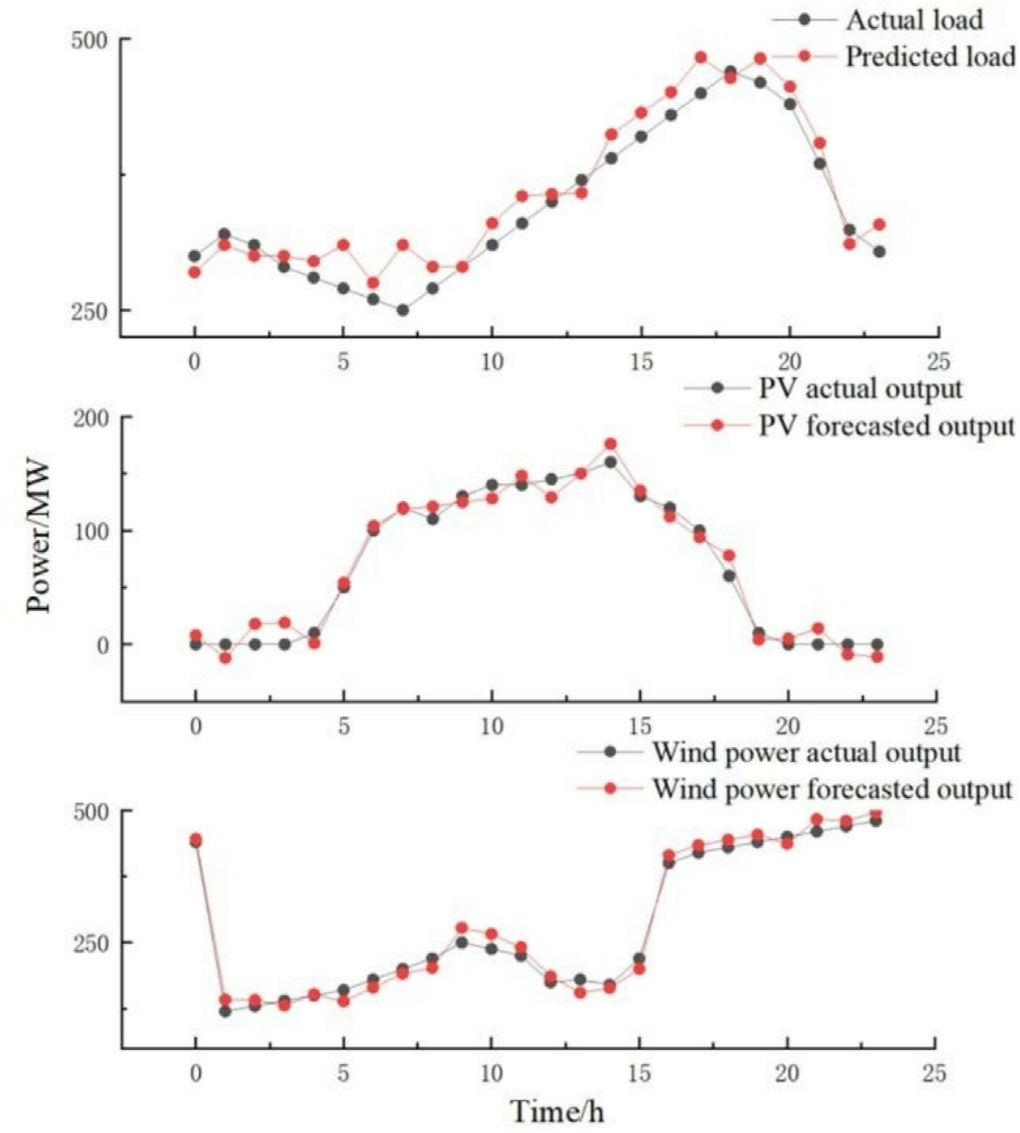

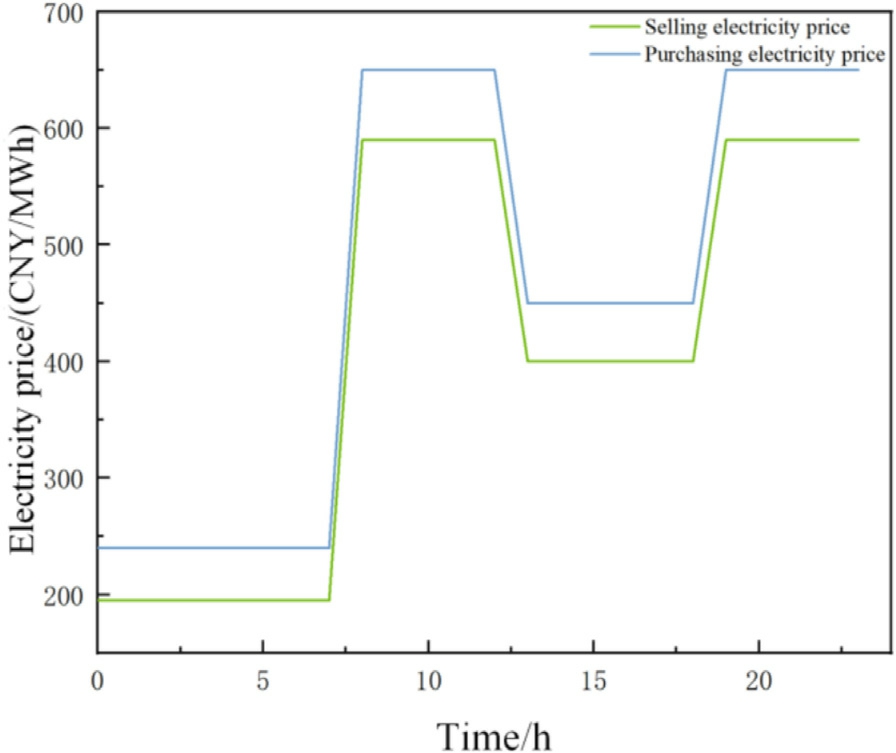

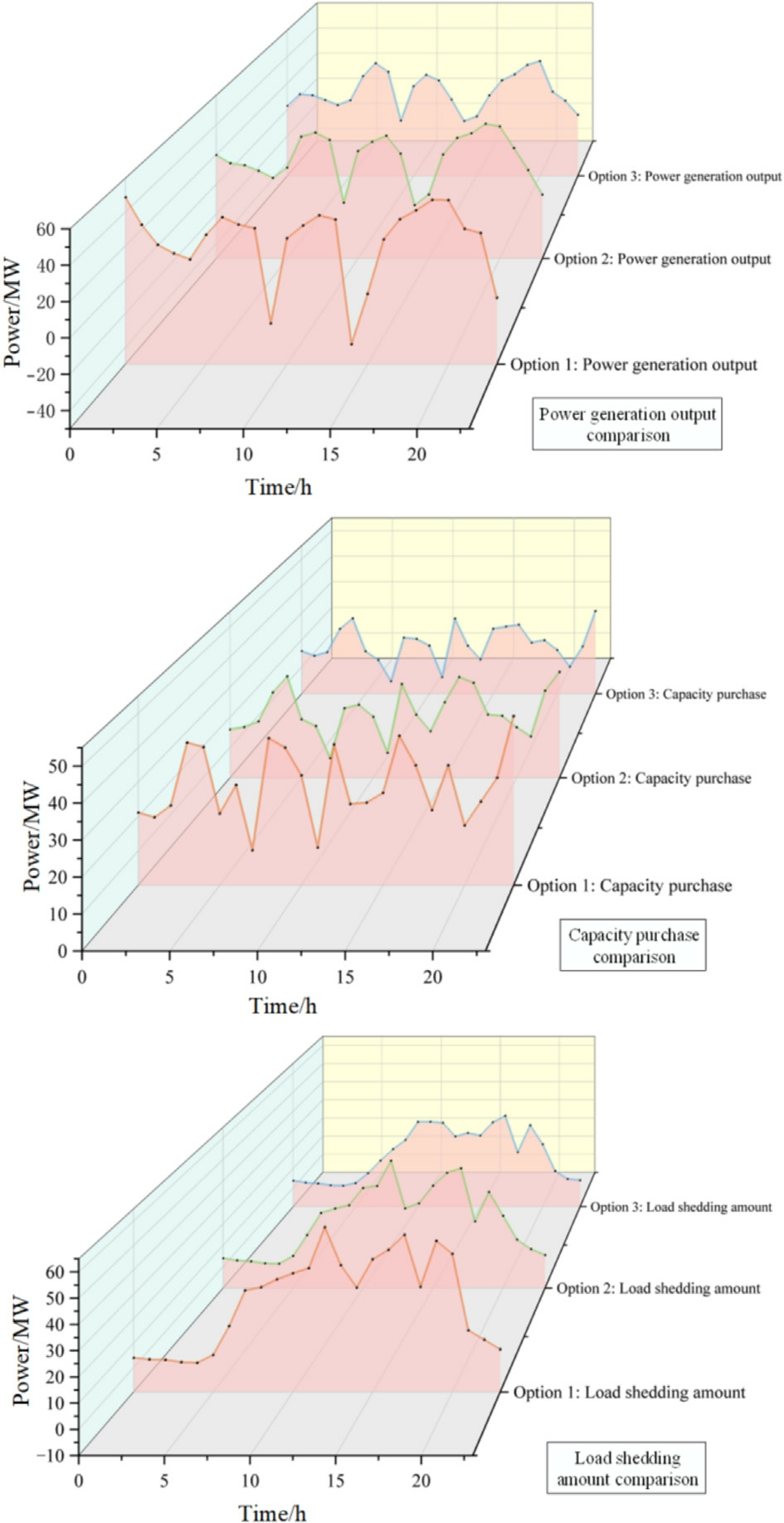

A regional PV power station,wind farm,and user load were used as the research objects,and the 24-h total output and load demand were predicted based on the historical output and load curves (Fig.5).The time-of-use purchase/sale electricity prices in the market are shown in Fig.6.

Fig.5.Output and load curves of all power generation and consumption entities in 24 h.

Fig.6.Time-of-use electricity price.

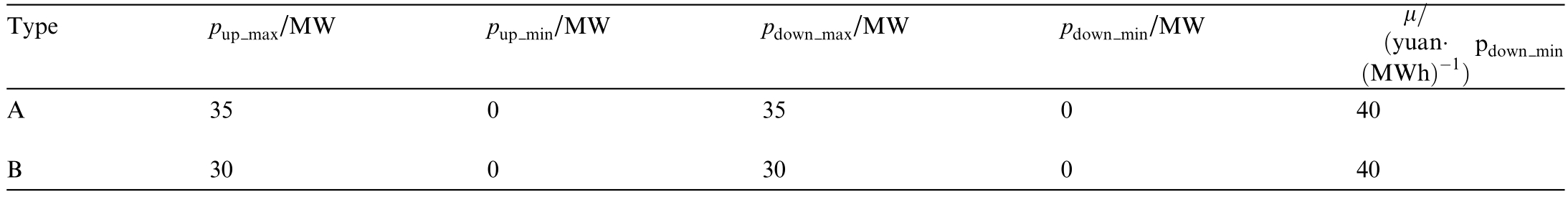

The BRP comprised two regulating groups,A and B.The specific configurations of BGs A and B involved selecting one PV power plant,one wind farm,and one user load entity within a certain region.Predictions were performed based on the historical typical power output and power load curves of the region,followed by a comparison with the actual power output or load data from a specific day.This process generated the total power output and load curves for all entities across 24 hourly periods of that day.The model initially simplified the process by assuming a unified number of internal generation/consumption entities per group (denoted as M=3).BG A managed by the BRP VPPs had a total of four regulating resources(energy storage system: two sets;small gas turbine: 1 unit;interruptible industrial load: one group).BG B managed by the BRP VPPs had a total of two regulating resources(energy storage system: one set;thermostatically controlled commercial load cluster: one group).The con struction costs of the adjustable resources were allocated evenly,with an average power cost of 100,000 CNY/MW and an average capacity cost of 50,000 CNY/MWh.The specific parameters are listed in Table 3.Other parameters are detailed in Table 4.

Table 3 Parameter settings of adjustment resources in BRP.

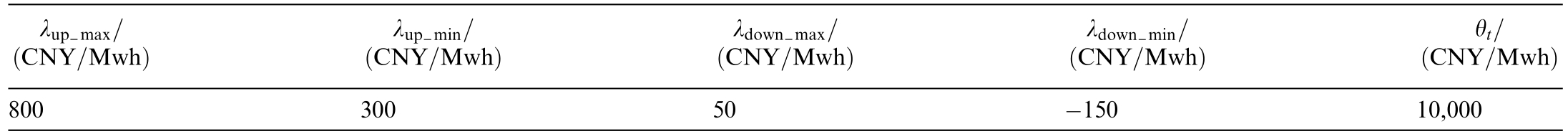

Table 4 Price parameter settings.

4.2 Analysis of case study results

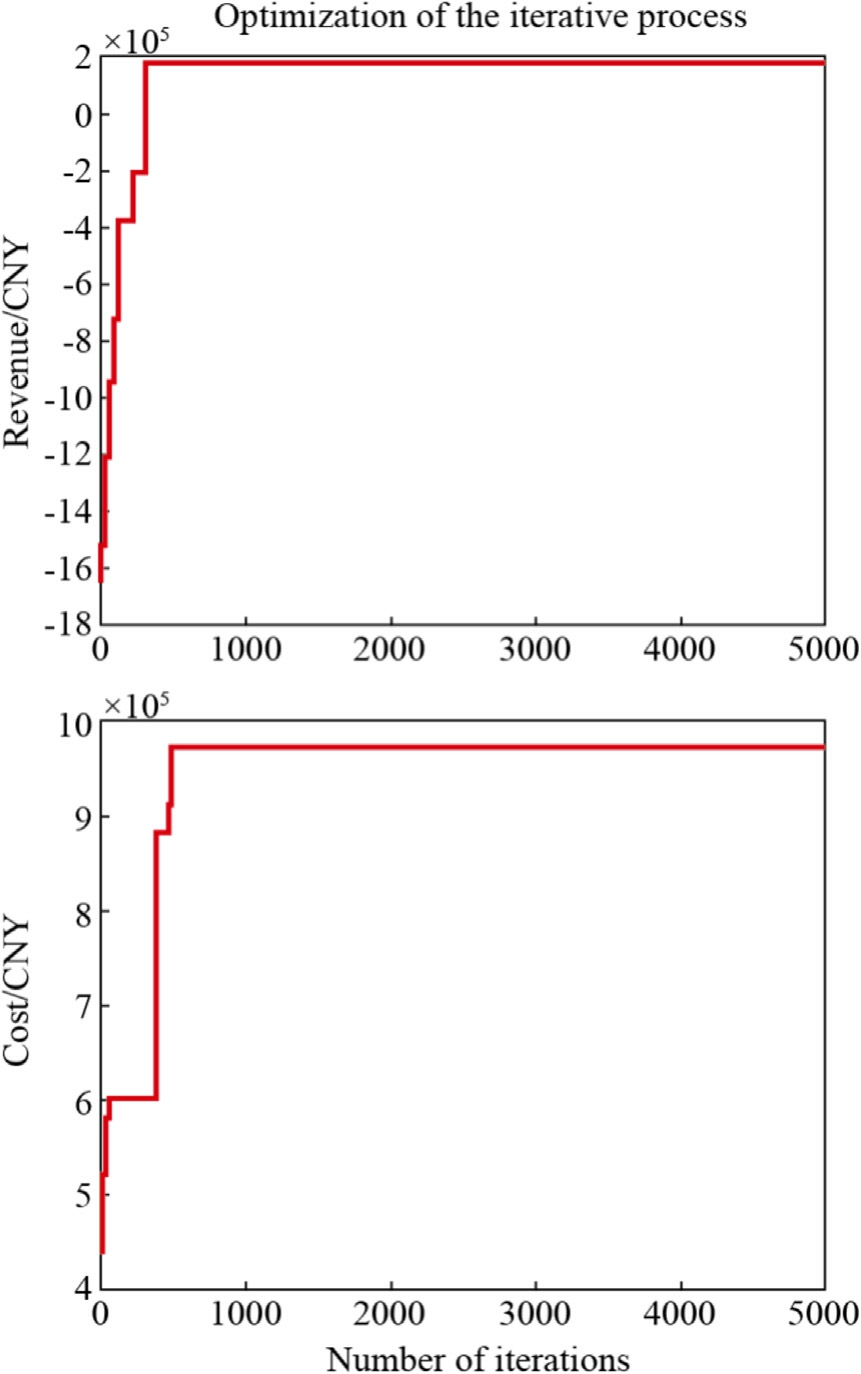

The MATLAB software was used for modeling and solving the problem,with 10 particles set for 5000 algorithm iterations.After approximately 600 generations,the minimum daily cost for regional system operation was calculated as 974,263 CNY and the maximum daily revenue for the VPP acting as the B RP was 169,835.7632 CNY.The iterative process of the algorithm is illustrated in Fig.7.

Fig.7.Algorithm convergence process.

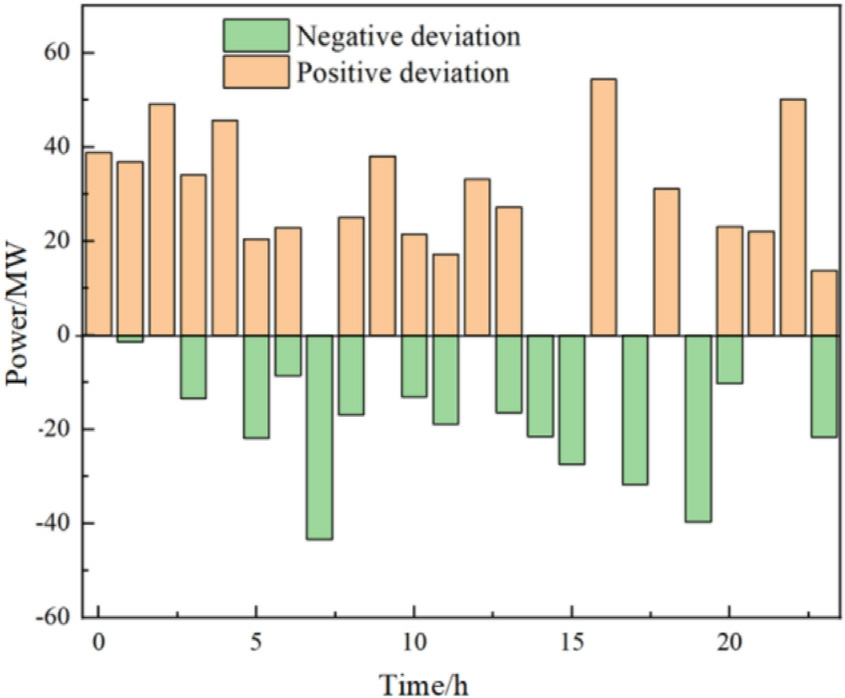

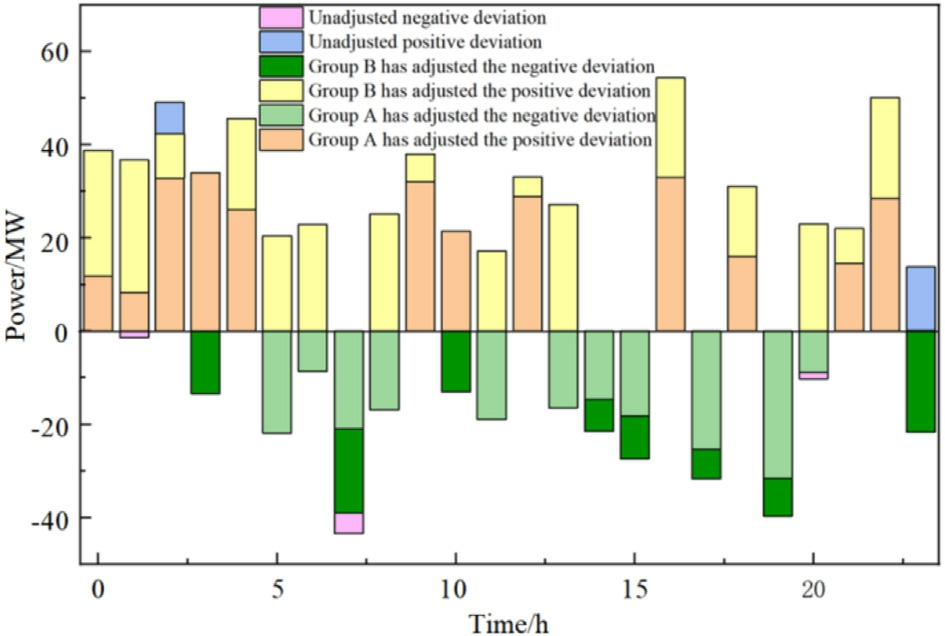

All generation and consumption entities adjusted the time-of-use deviation service electricity prices based on the pricing strategy of the BRP,determined their optimal purchasing strategies for deviation regulation services according to their positive or negative deviations,and implemented adjustments tailored to their specific conditions.The deviations before and after adjustment are shown in Figs.8 and 9,respectively.

Fig.8.Pre-adjustment deviation status.

Fig.9.Post-adjustment deviation status.

It can be observed from the figures that positive and negative deviations of varying magnitudes occurred throughout the day,with most deviations successfully regulated by the BRP.Negative deviations primarily arose when the predicted load values exceeded the actual values,whereas positive deviations resulted from renewable energy output exceeding the predictions.At 1:00,2:00,7:00,20:00,and 23:00,unregulated positive and negative deviations remained.Notably,significant positive deviations occurred at 2:00 and 23:00,and a large negative deviation occurred at 7:00.At 23:00,the high output of wind power led to a substantial positive deviation.The BRP incentivized renewable energy entities to purchase downward deviation services by setting a lower negative electricity price,but this resulted in higher deviation penalties.During this period,the allocated downward regulation power for generation entities was insufficient and the market electricity price reached its peak.The BRP prioritized selling electricity from adjustable resources to capture price differentials.

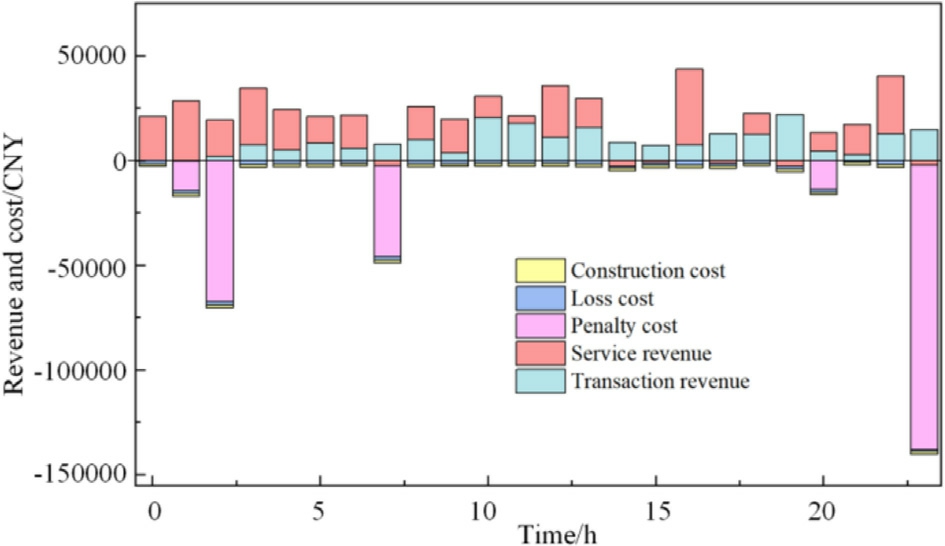

The revenue and cost breakdown for the VPP acting as the BRP across different time periods is illustrated in Fig.10.Significant service revenue and trading profits were generated when internal adjustable resources successfully regulated positive or negative deviations.Conversely,unresolved deviations led to notable penalty costs.During certain periods,such as 7:00 and 14:00,the deviation service price was negative,resulting in negative service revenue.The market electricity price was at mid or peak levels most of the time,and deviations were generally within the adjustable capacity range.The BRP could profit from selling electricity in the market while earning substantial service revenue.Overall,the revenue obtained by the BRP significantly outweighed the costs incurred.

Fig.10.Revenue and cost overview.

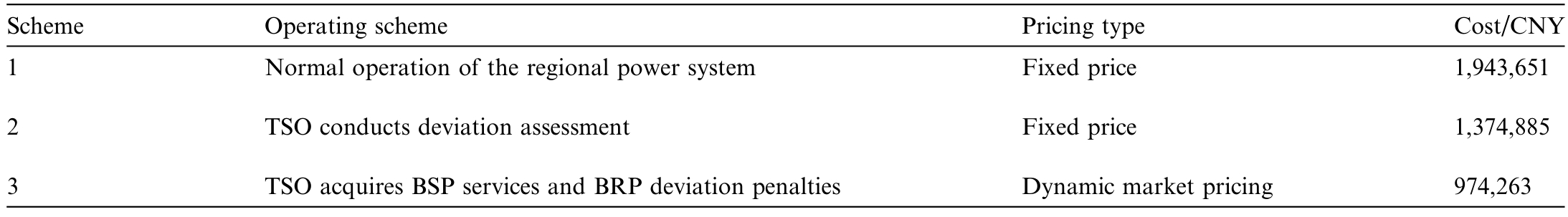

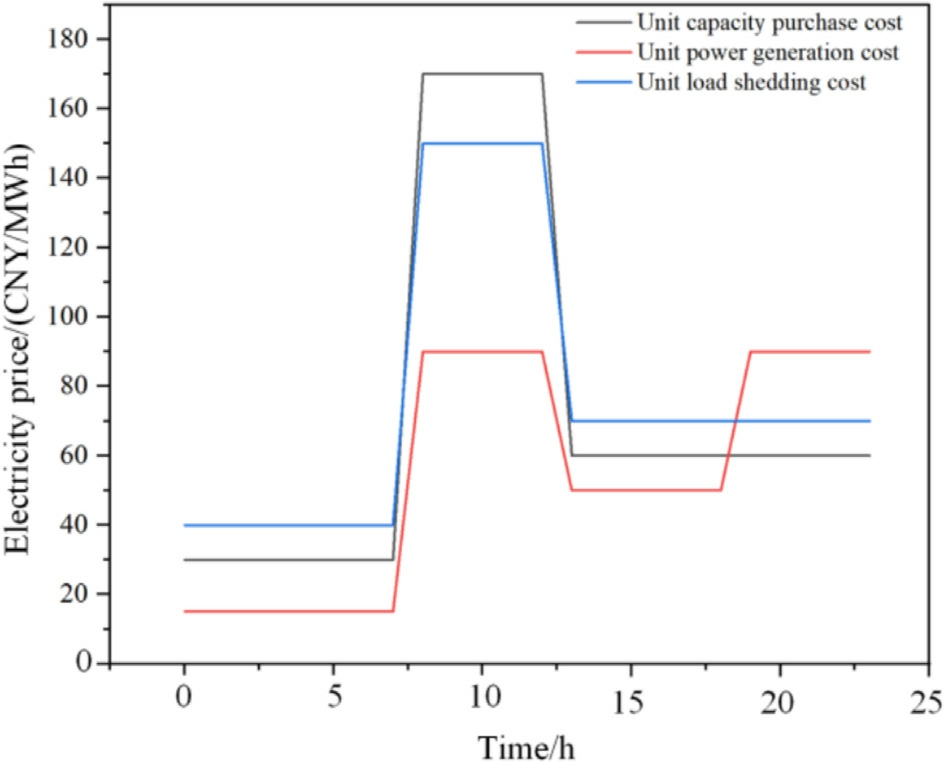

Finally,from the perspectives of regional system operating costs and the VPP as a BRP,the new model was compared with various existing mechanisms to evaluate its economic benefits and cost expenditures comprehensively.To analyze the regional power operating costs,with the market entity application scenarios and key parameters set earlier unchanged,the comparison results under different schemes are detailed in Table 5.

Table 5 Deviation regulation costs of different solutions.

Option 1: The baseline reference group adopted a passive operation mode,with its results directly reflecting the supply–demand imbalance in traditional power systems owing to a lack of flexible regulation mechanisms.The high operational costs under this mode essentially represent efficiency losses stemming from insufficient system flexibility.

Option 2: Operational improvements were introduced by implementing a TSO deviation penalty mechanism.Under this scheme,generation entities were required to reserve a certain level of regulation capacity based on installed capacity or peak load,while energy storage operators had to bear the full life cycle costs of supporting storage infrastructure,subject to TSO deviation penalties.Although this achieved a 29.3% cost reduction compared with Option 1,it still exhibited significant drawbacks:

1) high initial investment barriers for market participants,particularly the substantial fixed-as set cost burden on energy storage operators;and

2) a rigid pricing mechanism that failed to reflect the true economic value of flexibility resources.

Option 3: The proposed innovative scheme established a dual-regulation framework combining BSP specialization and VPP-enabled BRP deviation management.This model:

1) introduces a professional BSP market to provide high-qua lity real-time balancing services;

2) integrates VPPs and other new market entities into the BRP framework,incentivizing improved generation/load forecasting accuracy through deviation penalties;and

3) employs dynamic price signals to reflect the spatiotemporal value of regulation resources accurately.

This “market-driven incentives+specialized regulation” coordination mechanism not only achieved significant system-wide cost reductions but also enhanced clean energy integration and demand-side resource participation,offering a market-oriented operational paradigm for future power systems.

Fig.11 presents a breakdown of the unit cost components in the upper-tier operational expenditures.Fig.12 provides a comparative analysis of the entity-specific power outputs under each proposed scheme.

Fig.11.Unit costs in regional power system operations.

Fig.12.Comparative analysis of entity-specific power outputs across different schemes.

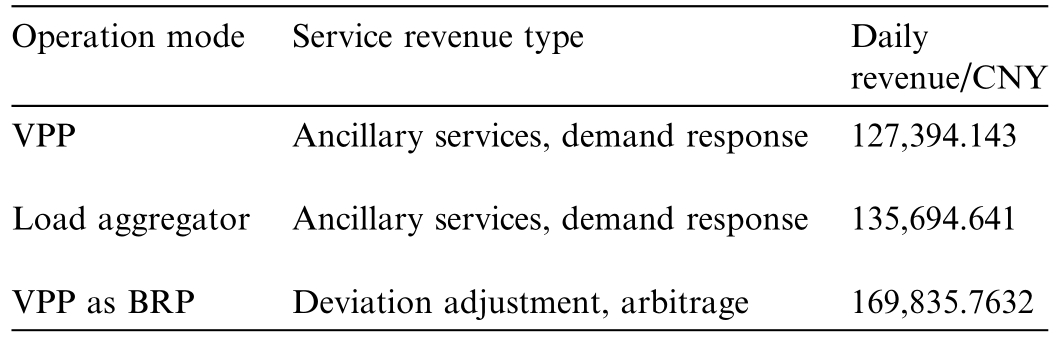

Finally,by setting identical or similar parameters to those of the BRP,as shown in the comparative results in Table 6,the BRP was compared with the aggregated operation model of existing VPPs operated by load aggregators.

Table 6 Revenues of different operation models.

Compared with the revenue models of VPPs and load aggregators,which generated income by providing peakshaving ancillary services and implementing demand response,VPPs acting as BRPs achieved higher revenue through more flexible,market-oriented active resource allocation.This included offering deviation adjustment services and engaging in price arbitrage.

5 Conclusions

Based on the core functions and operational characteristics of VPPs as multi-resource aggregated market entities,as well as the increasing demand for power balance regulation in China’s electricity market and the global exploration of power balancing mechanisms,this study has proposed a novel balancing mechanism in which VPPs serve as BRPs to provide services for regional multi-type power generation and consumption entities.A bi-level optimization model was constructed with the objectives of minimizing regional power system operating costs and maximizing VPP revenue.The feasibility and effectiveness of the proposed model were validated through case studies using 24 h typical deviation data from a specific region.The main conclusions are summarized as follows:

1) The operational model of VPPs as independent BRPs demonstrates dual benefits,effectively reducing regional power system operating costs while ensuring their own economic returns.

2)As BRPs,VPPs need to consider factors such as their regulation capacity limits and dispatch effectiveness comprehensively.When regional deviation demands exceed the preset thresh olds or market electricity prices reach peak levels,they should pursue revenue maximization while avoiding high penalty costs caused by improper resource allocation.

Future research could focus on optimizing capacity allocation based on regional balancing service demands in scenarios involving multiple VPPs as BRPs.This will help BRPs to enhance their resource aggregation and flexible regulation capabilities,and overall efficiency in balancing deviation adjustment services through marketorient ed mechanisms.In this manner,innovative practices in China’s power market balancing mechanisms can be further promoted,and the cultivation and development of new retail trading models can be fostered.

CRediT authorship contribution statement

Changwei Wu: Writing– original draft,Validation,Methodology,Data curation,Conceptualization.Heping Jia: Writing– review &editing,Supervision,Resources,Project administration.Lianjun Shi: Writing– review &editing,Supervision,Project administration. Dunnan Liu: Supervision,Resources,Project administration,Investigation,Funding acquisition. Zhenglin Yang: Supervision,Software,Resources.

Declaration of competing interest

The authors declare the following financial interests/personal relationships which may be considered as potential competing interests: Zhenglin Yang is currently employed by China Electric Power Research Institute.The other authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Acknowledgments

This work was partly supported by the National Natural Science Foundation of China (no.72471087),Beijing Nova Program (no.20250484853),Beijing Natural Science Foundation (no.9242015),and National Social Science Foundation of China (no.24&ZD111).

References

[1]Y.Zhang,X.Li,L.Wang,Renewable energy transition strategies for global energy security,Energy Convers.Econ.3 (2) (2021) 45–60.

[2]IRENA,Renewable Power Generation Costs in 2022.International Renewable Energy Agency.(2023).

[3]National Development and Reform Commission,National Energy Administration.The 14th Five-Year Plan for Modern Energy Systems [R].(2022).

[4]Xinhua News Agency,Xi Jinping Delivers a Keynote Speech at the General Debate of the 75th Session of the United Nations General Assembly [EB/OL].[2024-12-30].

[5]X.Zhang et al.,Grid flexibility challenges in China’s energy transition,Nat.Energy 8 (4) (2023) 312–325.

[6]Y.Wang et al.,Machine learning for renewable energy forecasting:a review,Renew.Sustain.Energy Rev.174 (2023) 113122.

[7]D.Han et al.,Hierarchical robust Day-Ahead VPP and DSO coordination based on local market to enhance distribution network voltage stability,Int.J.Electr.Power Energ.Syst.(2024)110076.

[8]C.Peng et al.,Master-slave game-based bidding strategy for virtual power plants in multi-competitive electricity markets,Power Sys.Protect.Contr.52 (7) (2024) 125–137.

[9]M.Xie et al.,Virtual power plant quotation strategy based on information gap decision theory,Electr.Power 57(1)(2024)40–50.

[10]P.Cramton et al.,Market coupling and the integration of European electricity markets,Energy Policy 145 (2020) 111713.

[11]J.Wang et al.,Bi-level stochastic optimization for virtual power plants participating in energy and reserve markets,IEEE Trans.Power Syst.48 (6) (2024) 2502–2510.

[12]Y.Liu et al.,Bidding strategy for virtual power plants considering carbon trading and CVaR,Energy 288 (2024) 127654.

[13]E.Mengelkamp et al.,A blockchain-b ased smart contract for peerto-peer energy trading,Appl.Energ.228 (2018) 1385–1398.

[14]B.Wu et al.,Hierarchical SAC for multi-energy dispatch under demand response uncertainty,Eng.Appl.Artif.Intel.127 (2024)107230.

[15]M.Guo et al.,Market-oriented reform path of China’s power balance mechanism,Energy Policy 169 (2022) 113145.

[16]W.Sun et al.,Demand response transaction mechanism considering response rate difference,Automat.Electr.Power Syst.45 (22) (2021) 83–94.

[17]T.Brown et al.,Price formation without fuel costs: interaction of demand elasticity with storage bidding,Energy Econ.118 (2024)106521.

[18]S.Pee et al.,Blockchain-based smart energy trading platform,Int.Conf.Artif.Intell.2019 (2019) 322–325.

[19]L.Park et al.,Sustainable home energy prosumer methodology,Sustainability 10 (3) (2018) 658.

[20]T.Wu et al.,Multi-stakeholder collaborative optimization in power systems,Energy 263 (2022) 125876.

[21]C.Yikuang,H.Anne,R.K.Einar,et al.,Long-term trends of Nordic power market: a review [J],Wiley Interdiscip.Rev.:Energy Environ.10 (6) (2021).

[22]R.Thompson,L.Chen,Lessons from PJM’s dual-settlement market design for global electricity market reforms,Global Energ.Interconnect.5 (3) (2022) 287–302.

[23]Drax,Iain Staffell.The cost of staying in control [EB/OL].[2024-12-10].

[24]Bundesnetzagentur.Energie in Wandel [EB/OL].[2024-12-10].

[25]M.Khojasteh,P.Faria,F.Lezama,Z.Vale,A hierarchical model for adopting local resources in balancing markets by distribution system operators (DSO) and transmission system operators(TSO),Energy 267 (2023) 126461.

[26]Y.Zhang et al.,Spatial-tem poral heterogeneity of renewable energy resources and its impact on power system balancing,Appl.Energ.303 (2021) 117682.

[27]H.Wang et al.,Cross-regional power exchange mechanisms for carbon neutrality goals,Energy Policy 176 (2023) 113521.

[28]Q.Li et al.,International comparative analysis of power system balancing responsibility allocation mechanisms,IEEE Trans.Power Syst.37 (4) (2022) 3125–3134.

[29]R.Sun et al.,Responsibility-sharing model for renewable energy integration in balancing mechanisms,Renew.Energ.205 (2023)1025–1038.

[30]Y.Zhao et al.,Cost allocation mechanism based on bilateral transaction rights in balancing markets,Energy Econ.104 (2021)105678.

[31]T.Wu et al.,Collaborative optimization of multiple stakeholders in power system balancing,Energy 263 (2022) 125876.

[32]Z.Yang et al.,Optimal scheduling of inter-provincial power transactions under high renewable penetration,IEEE Trans.Sustain.Energ.12 (3) (2021) 1689–1698.

[33]P.Huang et al.,Incentive mechanism design for virtual power plants in balancing markets,Appl.Energ.300 (2021) 117432.

[34]X.Liu et al.,Demand response and ancillary services market design for power system flexibility,Energ.Econ.112 (2022) 106123.

[35]L.Zhou et al.,Subsidy policy gaps and utilization efficiency of energy storage in balancing markets,Energ.Storage 5 (2) (2023)e00256.

[36]Z.Yang,German energy law and policy and their implications for china [J],Wuhan Univ.Int.Law Rev.11 (01) (2010) 217–228.

[37]X.Ren,Y.Cui,X.Ren,Analysis of the German balancing group model and its implications for the development of china’s power grid [C],in: Proceedings of the 2024 Beijing Institute of Electrical Engineering Annual Conference,China Electric Power Research Institute Co.,Ltd.,2024,p.8.

[38]German Federal Ministry for Economic Affairs and Energy.White Paper on the German Electricity Market [R].German Federal Ministry for Economic Affairs and Energy,Germany,2015.

[39]K.Schmidt,L.Müller,Cross-border lessons from Germany’s balance responsibility framework,Global Energ.Int.6 (2) (2023)89–104.

[40]S.Chen,J.Dong,S.Wang,et al.,Germany’s electricity balancing group mechanism and its implications [J/OL],Power Syst.Technol.(2024) 1–11.

[41]P.Zhao,J.Yang,J.Lu,et al.,Study on operation mechanism of balancing market in Germany and its enlightenment for China[C],in: 2023 IEEE/IAS Industrial and Commercial Power System Asia(I&CPS Asia),Chongqing,China,2023,pp.1454–1458.

[42]L.Shan,H.Song,Q.Tang,et al.,Analysis and implications of decentralized decision-making in electricity balancing mechanisms:a case study of Germany’s balancing settlement unit[J/OL],Power Syst.Technol.,1–12.

[43]Hu.Yang,J.Heping,H.Yaxuan,et al.,Research on bi-level optimization of independent balancing service provider operations for regional multi-agent balancing [J],Global Energ.Int.7 (2)(2024) 201–210.

[44]L.Chen et al.,Hybridization of the snake optimizer and particle swarm optimization for continuous optimization problems,Eng.Sci.Technol.Int.J.5 (1) (2025) 102316.

Received 21 April 2025;revised 25 August 2025;accepted 28 August 2025

Peer review under the responsibility of Global Energy Interconnection Group Co.Ltd.

* Corresponding author.

E-mail addresses: wuchangwei_ncepu@163.com (C.Wu),jiaheping@ncepu.edu.cn (H.Jia),shilianjun@ncepu.edu.cn (L.Shi),liudunnan@126.com (D.Liu),yangzhenglin@epri.sgcc.com.cn (Z.Yang).

https://doi.org/10.1016/j.gloei.2025.08.003

2096-5117/© 2025 Global Energy Interconnection Group Co.Ltd.Publishing services by Elsevier B.V.on behalf of KeAi Communications Co.Ltd.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

Changwei Wu is working towards his master’s degree at North China Electric Power University,China.His research interests include the optimal operation of virtual power plants and electricity markets.