0 Introduction

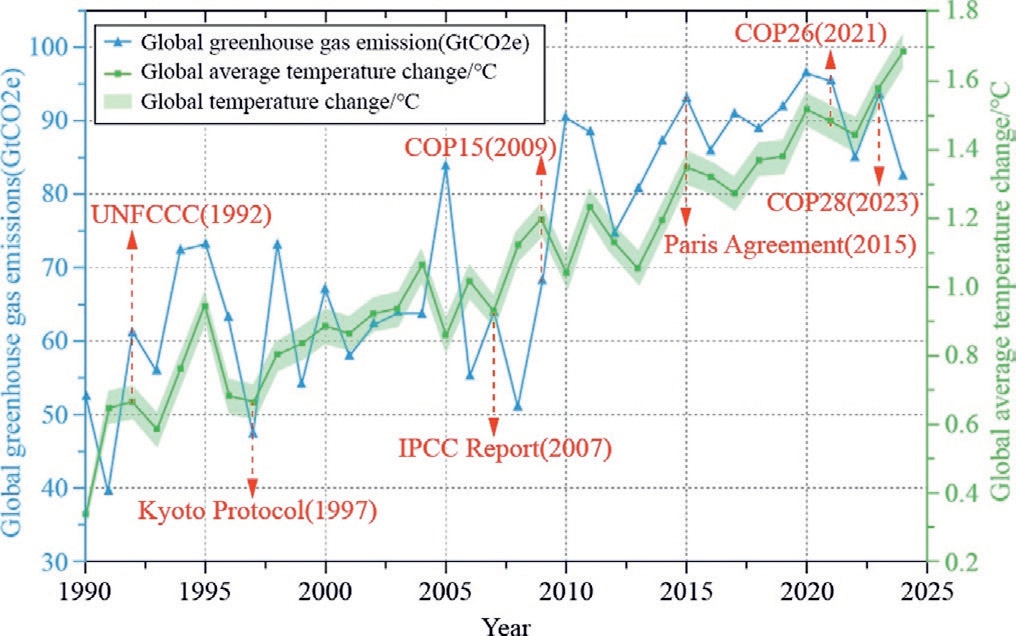

Currently, the steady increase in global greenhouse gas emissions has had a profound impact on Earth’s climate.According to data from the International Energy Agency(IEA), the average annual growth rate of global carbon dioxide emissions from 1990 to 2024 is approximately 0.9%, and the annual growth rate of temperature is approximately 3.6% [1,2], as shown in Fig.1.Compared to pre-industrial levels, the Earth’s average temperature has risen by about 1.1°C.If the current intensive development model remains unchanged, it is projected that the global average temperature will increase by over 3 °C by the end of this century.To address the increasingly grave challenges of climate change,the international community has jointly signed the United Nations Framework Convention on Climate Change(UNFCCC),establishing emission reduction targets and action frameworks for various countries[3].In addition,the implementation of the Kyoto Protocol and the Paris Agreement further promoted the establishment and development of international carbon markets [4].These international community initiatives clearly demonstrate the broad recognition of the lowcarbon paradigm and underscore the crucial role of carbon markets in global greenhouse gas emissions management.

Fig.1.Global greenhouse gas emissions and temperature change curve[1,2].

To address global climate change challenges, the international community is expanding the construction and development of a global carbon market.Among these,the European Union Carbon Market(EU CM),the largest carbon market globally, accounts for approximately 45%of the EU’s greenhouse gas emissions.As of 2023, the EU CM had a trading volume of 11.9 billion tonnes of CO2 equivalent, with a transaction value exceeding 98 billion euros.It includes vital industrial sectors such as power generation, steel, aluminum smelting, paper manufacturing, and aviation, facilitating cross-border and crosssector carbon emissions trading among the 27 EU member states [5,6].In North America, the California Carbon Market (CCM) and Northeast Regional Greenhouse Gas Initiative (NRGGI) hold leading positions in global trading volume.Since its establishment in 2013, California’s carbon market has encompassed sectors such as electricity,industry, natural gas, and transportation, with a trading volume of 258 million tons of CO2 in 2023.The NRGGI,which was initiated in 2009, currently covers the power sector in 11 states, with a trading volume of 208 million tons of CO2 equivalent by 2023.Meanwhile, countries in the Asia-Pacific region, such as Japan [7], South Korea[8,9],and New Zealand[10],have also established national or regional carbon markets covering major emitting industries.These countries continue to optimize their operational mechanisms and enhance market liquidity to partially integrate with the more mature carbon markets in Europe and North America.In summary,the construction of a global carbon market is in an accelerated development phase, and the interconnection between carbon markets in various countries is expected to intensify further in the future.

Inspired by the successful cases of global carbon markets, the Chinese government has identified the construction of a unified national carbon market as a critical strategic decision to achieve the ‘‘dual carbon” goals and promote the low-carbon transition of the energy economy[11-13].However, since the launch of the carbon market pilots in China in 2013, several significant issues have remained.These include the narrow scope of the covered sectors, inadequate allocation of allowances, incomplete monitoring mechanisms, and weak carbon price signals.Sustained efforts in communication and collaboration between the government and various stakeholders are required to optimize the carbon market system.The goal is to establish an efficient carbon market that aligns with China’s national conditions and meets international standards as soon as possible.This is of significant strategic importance for achieving China’s ‘‘30-60” dual carbon goals and advancing global climate governance.

Therefore, this study examines the construction and development of global carbon markets, emphasizing the pivotal role of carbon trading mechanisms in addressing climate change and environmental governance.Specifically:

· This study comprehensively examined the importance and necessity of establishing carbon markets from the perspective of energy system transformation and sustainable economic development.

· Thisstudysystematicallyreviewstheconstructionprogress and practical experiences of international mainstream carbon markets through a detailed comparative analysis of the operational mechanisms, trading scales, and emission-reduction effects of major carbon markets in the European Union,the United States,and New Zealand.

· This study analyzes the issues and challenges in constructing China’s carbon market and offers strategic recommendations based on the successful experiences of international carbon markets in institutional design and operations with the aim of developing a market aligned with national conditions and international standards.

1 The necessity of accelerating the construction and development of global carbon markets

1.1 The severe challenges of global climate change

Since the Industrial Revolution, greenhouse gas emissions from human activities have increased significantly,destabilizing the global climate and ecosystems.If highcarbon emissions persist, global temperatures could rise by approximately 3  C above pre-industrial levels by the end of this century,leading to frequent extreme weather events,accelerated sea level rise, biodiversity loss, and threats to ecological security and sustainable development [14,15].

C above pre-industrial levels by the end of this century,leading to frequent extreme weather events,accelerated sea level rise, biodiversity loss, and threats to ecological security and sustainable development [14,15].

The international community has broadly acknowledged the severity of this issue and is actively taking measures to expeditiously control greenhouse gas emissions to achieve global carbon neutrality.

1.2 The urgent need for energy system transformation and sustainable economic development

To combat climate change and promote sustainable economic development,the global energy system is transitioning from traditional fossil fuels to a model with high integration of renewable energy, increasing the urgency for low-carbon and environmentally friendly energy solutions [16-18].

Among the various transition measures, the carbon market,as a market-based emission reduction mechanism,plays a crucial role in facilitating the economical,efficient,and environmentally sustainable achievement of carbon reduction targets.Specifically:

a) The carbon pricing mechanism in carbon markets increases the cost of using fossil fuels through the marketization of carbon emissions costs, thereby enhancing the cost competitiveness of renewable energy sources such as wind and solar power.

b) The carbon pricing mechanism incentivizes enterprises to invest in the research,development,and application of clean technologies,thereby promoting the transition to a more efficient and lower-carbon energy structure.

c) The carbon market compels businesses and consumers to consider the economic impact of carbon emissions,optimize resource allocation in decision-making, and advance the development of a low-carbon economy.

d) The carbon market’s driving mechanism effectively reduces global carbon emissions and fosters innovation in carbon and green finance,providing sustained momentum and financial support for global green economic transition.

1.3 The emission reduction effects of the carbon market have begun to emerge

Since its inception,the international carbon market has undergone years of robust development and has achieved significant results in the global carbon reduction process.This further confirms that the construction and development of carbon markets play a pivotal role in mitigating global climate change, as detailed below:

a) Direct Emission Reduction Effects: Since its launch in 2005, the EU Carbon Market (EU CM) has reduced greenhouse gas emissions from key industries such as power generation, steel, and chemicals by over 35% [19].Using the initial emission cap as a baseline,reductions are projected to surpass 2.5 billion tonnes of CO2 equivalent by 2024, directly contributing to the EU’s carbon reduction targets.

b) Proportionate Emission Reduction Effects: According to reports from the EU and New Zealand [20],the implementation of carbon market mechanisms has directly contributed to more than 15% of the progress towards emission reduction targets, underscoring the critical role of carbon markets in national emission reduction systems.

c) AbsoluteEmissionReductionEffects:TheEUCMhas cumulativelyreducedemissionsbyover2.5billiontonnes of CO2,equivalent to the total annual emissions of a medium-sized European country.In the United States,California and the Northeast carbon markets havecollectively reducedemissionsbyover150million tons of CO2 over more than ten years of operation.

2 Development history and operational mechanisms of major international carbon markets

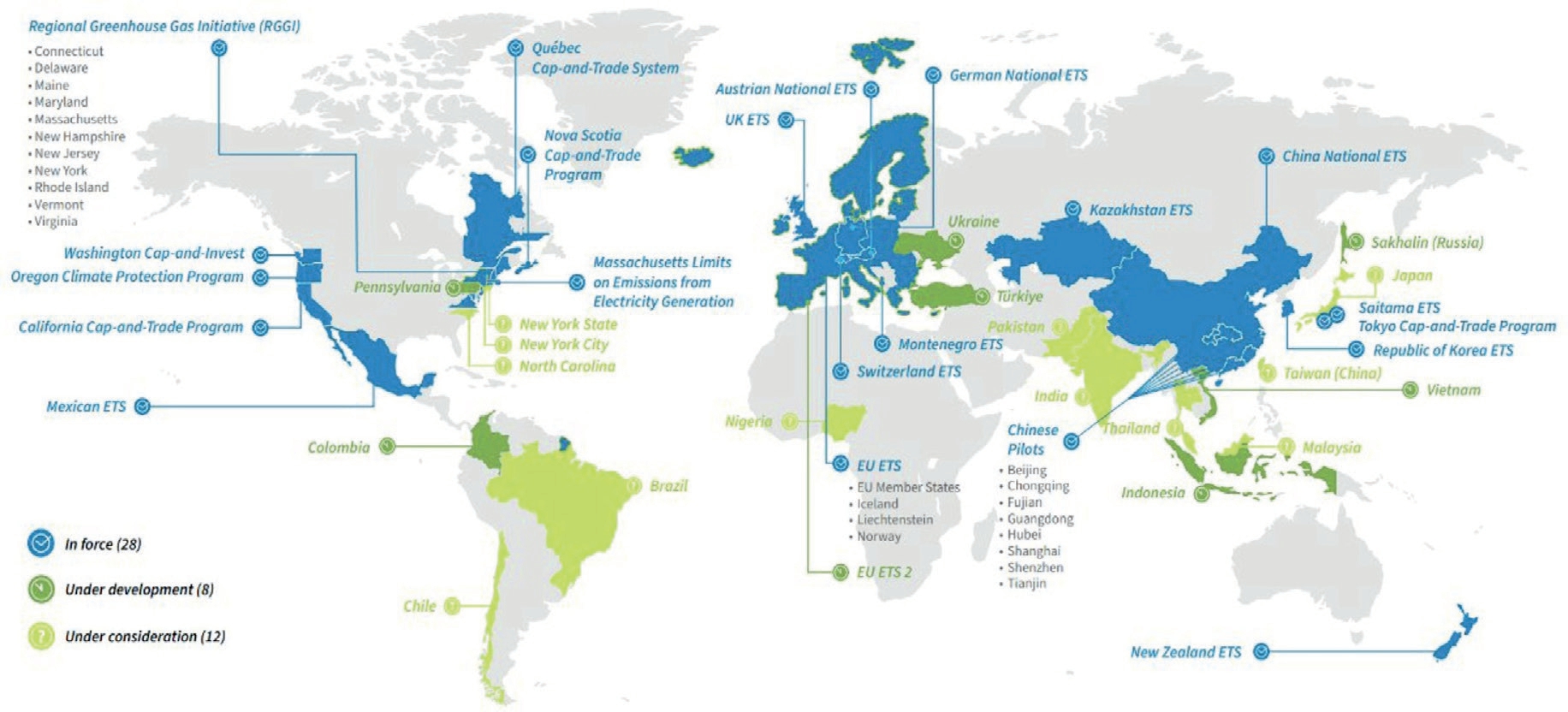

According to the International Carbon Action Partnership(ICAP)‘‘Emissions Trading Worldwide 2024′′ annual report [21], as of January 2024, there are 28 operational carbon markets worldwide, covering 17% of global greenhouse gas emissions and involving nearly one-third of the world’s population,as illustrated in Fig.2.With the establishment of carbon neutrality goals and the refinement of emission reduction pathways, the operational rules of these markets have been adjusted.This subsection compares the carbon markets in the EU, the United States,and the Asia-Pacific region to summarize their similarities and differences.

2.1 EU carbon market

To date, the EU CM is the world’s most extensive greenhouse gas emissions trading system, covering most countries and industries.This exemplifies a model for promoting low-carbon transitions and the development of the global economy and society.

2.1.1 Market development history

To fulfill its emission-reduction commitments under the Kyoto Protocol,the EU CM was launched in 2005.Since its inception,the EU CM has established clear long-term emission reduction goals and has progressed in four phases[22].

First Phase (2005-2007): This phase was a trial period to explore the feasibility of the carbon trading mechanism within the EU.The initial emissions cap was lenient, with free carbon allowances for energy-intensive industries and power production sectors, laying the foundation for the subsequent EU carbon trading system.

Fig.2.Construction of global carbon market [21].

Second Phase(2008-2012):Corresponding to the first commitment period of the Kyoto Protocol,this phase tightened the emissioncaptomeetstricterreductiontargetsandincreasedthe proportion of emission permits allocated through auctions,thereby improving market efficiency and fairness.

Third Phase(2013-2020):This phase marked significant improvements and expansion in the carbon trading system.The EU CM covers the aviation sector.Additionally,the proportion of permits allocated through auctions increased, and new regulatory measures were introduced to ensure the fairness and transparency of trading.

Fourth Phase (2021-2030): The EU is currently in this phase, aiming to reduce carbon emissions by at least 55%compared to 2005 levels.Mechanisms, such as the Market Stability Reserve (MSR), were introduced to maintain carbon price stability and prevent allowance oversupply,thereby enhancing the effectiveness of the EU carbon market.In April 2023, the European Parliament further approved key legislation under the ‘‘Fit for 55′′ package,including new laws on the EU CM and the Carbon Border Adjustment Mechanism.This legislation significantly adjusts overall market targets,allowance allocation,market stability reserve mechanisms, coverage, and auction revenues.

2.1.2 EU CM operational mechanism

a) Carbon market coverage

At its inception, the EU CM primarily covered highemission sectors, such as energy and heavy industries,including power generation and steel production.As the system matured, its coverage expanded to include other high-emission industries, such as chemicals and aviation,ensuring broader emission control.

Currently, the EU CM covers 27 member states and accounts for approximately 45% of the EU’s total emissions.The main greenhouse gases include CO2, N2O,and perfluorocarbons.However, indirect emissions have not yet been included, highlighting coverage limitations.

By the end of 2026,the EU plans to assess the inclusion of municipal waste incineration in the carbon market to expand its influence and coverage.By 2027, independent emission trading systems for the building and transportation sectors are expected to be introduced to effectively reduce emissions.Further measures should be developed based on the emission characteristics of each industry for precise management, broader market coverage, and more efficient emission reduction.

b) Carbon allowance cap setting

The EU CM first established a stringent cap on the total carbon allowances.It then employs a linear reduction factor to ensure that the total number of allowances decreases automatically each year in support of the EU climate targets.These measures aim to reduce the EU’s greenhouse gas emissions by at least 55% by 2030 compared with 1990 levels.The EU approach emphasizes a gradual and predictable reduction pathway.Compared with other countries, its notable feature is the precise specification of the rate of allowance reduction and long-term reduction plans.As of 2023, the total allowance cap for the EU CM is set at 1.486 billion tons of CO2 equivalent [23].

c) Carbon allowance allocation method

The EU CM allocates carbon allowances through auctions and free allocations.This dual-track system effectively balanced market incentives by protecting industrial competitiveness [24].

The EU allocates 100% of its carbon allowances to the power sector through auctions,as this sector can pass costs to consumers and has a high emission reduction potential.Industrial sectors at risk of carbon leakage receive free allocations based on benchmarks set according to the average emission intensity of the most efficient 10% of the installations.This prevents industry relocation to regions without carbon pricing and protects the competitiveness of EU industries.In the aviation sector, 15% of the allowances are auctioned,with the remaining distributed for free,based on operational data, to support gradual carbon reduction.

The EU’s carbon allowance allocation mechanism is undergoing dynamic adjustment.According to recent reform proposals,the EU plans to gradually reduce free allowances,linked to the phased implementation of the Carbon Border Adjustment Mechanism (CBAM).The CBAM aims to enhance market incentives and protect the EU market from unfair competition owing to lower carbon costs in other countries,thus ensuring fairness and efficiency in policy applications.These adjustments reflect the EU’s strategy of balancing emission reductions with economic competitiveness.

2.1.3 EU CM trading mechanisms and effects

a) Carbon market trading mechanisms

The EU’s carbon market trading mechanisms include auctions and secondary markets.Both regulated and nonregulated entities can participate in transactions, thereby enhancing market inclusiveness and liquidity.Auctions are organized centrally by the European Energy Exchange to ensure transparency and fairness.The secondary market offers diverse financial products, including spot, futures,options, and forward contracts, supports on-exchange and over-the-counter trading, and increases market flexibility and depth.

b) Carbon market flexibility mechanism

In 2015, the European Commission proposed a Market Stability Reserve(MSR)to enhance market stability.When allowances in circulation exceed 833 million tons,24%of the excess is transferred from auctions into the reserve.If the allowance volume drops below 400 million tons,100 million allowances are released from the reserve to maintain the supply and demand balance.Since 2020, the EU CM has suspended certain carbon credit offset mechanisms, such as the Clean Development Mechanism and Joint Implementation,to better align with the EU’s specific circumstances and strengthen local carbon market incentives.

c) Carbon market prices and revenue

In 2023, the average auction price in EU CM was€78.91,whereas the average price in the secondary market was €80.82.Since the establishment of the EU CM, its total revenue has amounted to €139.5 billion [25,26].

To optimize fund utilization, the EU established the Innovation Fund and Modernization Fund in 2021 using EU CM auction revenues to support innovative lowcarbon technologies and industrial solutions for decarbonizing energy-intensive industries.According to recent reform proposals, the second phase of EU CM revenues will be managed by the Social Climate Fund to alleviate the economic burden on citizens from rising energy and carbon prices, particularly in the heating and transportation sectors [27].

2.2 U.S.carbon market

In contrast to the unified EU carbon market, U.S.carbon market development reflects distinct regional characteristics.Despite the absence of a national carbon trading system, several states and regions have actively engaged in carbon reduction through various mechanisms.Notable examples include the California Carbon Market and the Northeast Regional Greenhouse Gas Initiative(NRGGI).These cases demonstrate effective carbon management and trading strategies at local and regional levels.

2.2.1 Market development history

Examining the establishment and development of the California carbon market as an example:

First Phase(2007-2011):As an active participant in the Western Climate Initiative (WCI), California began to focus on the preparation and legislative framework for the carbon market in 2007 [28].This phase represented an initial exploration of the establishment of an effective carbon market, and cooperation with regional partners laid the foundation for the official launch of the market.

Second Phase (2012-2014): California’s carbon market began operations in 2012, marking its active participation in the global carbon market[29].By 2014,it was linked to the Quebec carbon market in Canada [30], demonstrating the feasibility and mutual benefits of cross-national regional carbon market cooperation and significantly enhancing market liquidity and stability.

Third Phase(2015-2017):The operational scope of California’s carbon market expanded further, and market mechanisms were refined to better address the challenges encountered in the initial stages of operation.Key improvements include the refinement of allowance allocation methods and the strengthening of market regulations.

Fourth Phase (2018-2025): Beginning in 2018, the California carbon market entered a critical phase, adopting a strategy of reducing allowances by 4%annually to achieve a 40% reduction in greenhouse gas emissions below 1990 levels by 2030.California aims for carbon neutrality by 2045, with an 85% reduction in emissions compared with 1990 levels.These strategic adjustments and policy updates highlight California’s leadership and innovation in global climate governance, driving the carbon market towards more efficient and extensive emission reductions.

2.2.2 U.S.CM operational mechanism

a) Carbon market coverage

The California carbon market accounts for approximately 75% of the state’s greenhouse gas emissions.Compared with the EU carbon market, the California market has unique and expanded coverage in terms of gas types.In addition to the six leading greenhouse gases specified by the Kyoto Protocol(CO2,CH4,N2O,SF6,hydrofluorocarbons,and perfluorocarbons),it includes NF3 and other fluorinated gases [31].

The California carbon market covers a wide range of industries, including industrial facilities with annual emissions exceeding 25,000 tons of CO2 equivalents, such as cement; cogeneration; glass; hydrogen production; and steel, lime, and nitric acid manufacturing.These also include petroleum, natural gas, refineries, paper manufacturing, on-site electricity generation, fixed-fuel facilities,power plants, and electricity importers.

This comprehensive industry coverage and the inclusion of additional gas types make the California carbon market more nuanced and tailored in its approach to addressing climate change than the EU.

b) Carbon allowance cap setting

U.S.CM is primarily established independently by individual states or regions, resulting in a lack of a unified national standard.For example, the California carbon market adopted a strategy of annually reducing total carbon allowances to accelerate the carbon reduction process.This setting and the adjustment of allowance caps demonstrate the regional flexibility of the U.S.CM.As of 2023,the cap for the California carbon market is set at 294.1 million tonnes of CO2 equivalents.

c) Carbon allowance allocation method

California’s carbon market allocates allowances through a combination of auctions and free allocations.For industrial facilities, free allowances are calculated based on total production and energy consumption.For example, free allowances for the paper, oil refining, and steel industries are determined by emissions per unit of production,whereas other industries use energy consumption benchmarks.Since 2020, California has adjusted the proportion of free allowances to 42% [32].

Compared to the EU carbon market, California’s carbon market demonstrates greater flexibility and industryspecific adaptability in its free allocation mechanisms.While the EU also provides free allowances for industries at a high risk of carbon leakage, California uses more detailed industry-specific methods to assess risks and determine free allocation benchmarks.The adjustment of free allowance proportions in California reflects a quicker response to market changes and industry needs, whereas the EU prefers long-term stable strategy adjustments in the allowance distribution.

2.2.3 U.S.CM trading mechanisms and effects

a) Carbon market trading mechanisms

Similar to the EU carbon market, California’s carbon market operates on two levels: auctions and secondary markets.Auctions were administered quarterly by the Western Climate Initiative Inc.(WCI).The secondary market operates on platforms such as the Intercontinental Exchange (ICE), CME Group, and Nodal Exchange,involving the trading of allowances, carbon credits, and financial derivatives.In 2023, the average auction price is$28.08 per tonne and $4.03 billion in total revenue for 2023.

b) Carbon market flexibility mechanism

The California carbon market’s flexibility mechanisms include two key aspects: offset and price stability mechanisms.First,the offset mechanism allows regulated entities to use carbon credits to offset their emissions,thus providing companies with diverse emissions-reduction strategy options.These carbon credits must originate from projects in the United States and cover the following six areas:forestry, urban forestry, livestock methane, ozone-depleting substance destruction,mine methane capture,and rice cultivation.From 2021 to 2025, companies can use carbon credits to offset up to 4% of their emissions.From 2026 to 2030,this proportion will increase to 6%annually,with more than half of the offset projects required to be located within California.Second, the price-stability mechanism ensures stable market operation by establishing an auction floor price and an Allowance Price Containment Reserve(APCR).In 2023, the auction floor price in the California carbon market was set at$22.21 per tonne,with price ceilings set at $51.92, $66.71, and $81.50 per tonne, respectively.When market prices reach these ceilings, the APCR releases a certain amount of allowances into the market to return the prices.

The differences between California’s and the EU’s carbon markets reflect their varied management strategies and priorities.California’s offset mechanism emphasizes local projects, ensuring the geographical concentration of emission reduction activities, whereas the EU allows broader international carbon credit trading, fostering international cooperation.California’s price-stability mechanism uses direct market price intervention with explicit price-control tiers and floor prices.In contrast,the EU employs indirect measures such as the Market Stability Reserve (MSR) to adjust market supply and influence carbon prices [33].

c) Carbon market prices and revenue

In 2023,the average auction price in the California carbon market is $28.08 per tonne.Since its inception, the market has generated total revenue of $22.25 billion, with$4.03 billion in total revenue for 2023.Most of the auction proceeds from the California carbon market go into the Greenhouse Gas Reduction Fund,which supports projects across the state that bring significant environmental, economic, and public health benefits.Notably, at least 35%of the funds must benefit disadvantaged and low-income communities.As of May 2023,$11.4 billion has been allocated to over 560,000 projects,with an estimated reduction of 79 million tons of CO2 equivalent.Disadvantaged and low-income communities have received more than$5.4 billion in assistance.

2.3 New Zealand carbon market

The development of carbon markets in the Asia-Pacific region, including New Zealand, South Korea, Japan, and China,is shaped by each country’s unique industrial structure and policy environment [34-36].This section focuses on New Zealand’s carbon market and explores how its distinctive industrial structure influenced the formation and development of its carbon-trading mechanisms.

2.3.1 Market development history

Since its launch in 2008,the New Zealand Carbon Market (NZCM) has become the only operating carbon market in Oceania [37].The development of NZ-CM can be divided into three distinct phases.

First Phase (2008-2012): In the initial phase, the NZ CM did not set a cap on the total number of allowances,which is a unique feature of its market mechanism.This phase focused primarily on the establishment and initial operation of the market and explored how market mechanisms could effectively control greenhouse gas emissions.

Second Phase (2013-2020): During this period, New Zealand began to evaluate and adjust the structure of NZ’s CM in response to market and environmental changes.Governments and other relevant institutions have sought ways to enhance market efficiency and fairness.

Third Phase (2021-2050): Starting in 2021, this phase marks the fundamental reform of New Zealand’s carbon market policies.The Climate Change Response(Zero Carbon)Amendment Act,passed in 2020,stipulates the implementation of an emissions cap starting in 2021.This change aims to make NZ’s CM more stringent and align it with the country’s long-term emission reduction goals.To adapt to this policy shift,the New Zealand government updated its annual cap plan for 2023-2027 in December 2022 and established stricter annual reduction targets.

2.3.2 NZ CM operational mechanism

a) Carbon market coverage

The New Zealand carbon market (NZ CM) has broad coverage, including multiple greenhouse gases, such as CO2, CH4, and N2O, as well as forestry and agriculture,which are significant to New Zealand’s economy.This contrasts with the EU and U.S.carbon markets, which typically exclude forestry and agriculture.The NZ CM follows the principle of ‘‘those who emit, pay; those who absorb,benefit”,distinguishing between net negative emitters like forestry and net positive emitters like electricity and industry.This comprehensive coverage makes NZ’s CM unique to the global carbon market, showcasing its innovative design and commitment to environmental stewardship.

b) Carbon allowance cap setting

The NZ CM initially did not set an overall cap on allowances, which is a significant difference between the EU and U.S.markets.However, with the passage of the Climate Change Response (Zero Carbon) Amendment Act in 2020, New Zealand formally introduced an emissions cap in 2021.This move marked the maturity of its market mechanism and reflected an adaptation to international emission-reduction trends.This strategy of introducing an emissions cap at a later stage demonstrates New Zealand’s flexible response to market dynamics and emission reduction needs, in contrast to the EU’s strict reduction targets from the outset and the decentralized management approach of the U.S.carbon markets.In 2023,the emissions cap for NZ CM was set at 32.3 million tonnes of CO2 equivalent.

c) Carbon allowance allocation method

NZ CM uses auctions and free allocation for carbon allowances.Forestry receives free allowances, whereas other industries use emissions intensity benchmarks.Highly emissions-intensive industries receive 90% free allowances,whereas moderately emissions-intensive industries receive 60%.By 2023, free allowances have been adjusted to 19.8%.

Compared to the EU and U.S.carbon markets,the NZ CM provides free allowances to negative emissions sectors and offers a high proportion of free allowances to emission-intensive industries.Although the EU CM also provides free allowances to industries vulnerable to carbon leakage,its standards and methods are more complex and are gradually reducing the free allowances.The U.S.CCM’s approach to combining auctions with free allocations focuses more on market efficiency and fairness, aiming to cover a broader range of industries.Conversely,New Zealand’s carbon allowance allocation strategy focuses on meeting the economic and environmental needs of particular industries.

2.3.3 NZ CM trading mechanisms and effects

a) Carbon market trading mechanisms

Similar to other major carbon markets, NZ CM includes two trading tiers: auctions and secondary markets.All account holders can participate in auctions that are jointly operated by the New Zealand and European Energy Exchanges.Most allowances are traded in the secondary market through spot and forward contracts,allowing participants to flexibly trade options for different riskmanagement and financial strategies.

b) Carbon market flexibility mechanism

The flexibility mechanisms of NZ CM include offset and price stability mechanisms.The unrestricted use of Kyoto Protocol-related carbon credits was allowed until June 2015, after which new carbon credits were prohibited for offsets.For price stability,the NZ CM implements an auction floor price and a Cost Containment Reserve (CCR).In 2023, the auction floor price is NZD 33.06 per tonne,which is expected to increase to NZD 44.35 by 2027.The CCR releases allowances when prices reach the TPs,with the 2023 trigger price set at NZD 80.64, increasing to NZD 129.97 in 2027.The CCR allowance volume was 7 million tons in 2022, increasing to 8 million tons in 2023, and is planned to reduce to 5.9 million tonnes by 2027.

Compared to the EU and U.S.carbon markets,the NZ CM is more stringent with offset mechanisms, banning new international carbon credits for offsets entirely after 2015.This is in contrast to the EU market, which allows for the partial use of international carbon credits.New Zealand controls market fluctuations by setting auction floor prices and price trigger mechanisms similar to California’s price containment reserve.However, New Zealand’s triggered price adjustments and allowance release strategies demonstrate strict control over market details and adaptive adjustments.

c) Carbon market prices and revenue

In 2023, the average auction price in NZ CM is NZD 75.88 per tonne, whereas the secondary market price is NZD 78.97 per tonne.The total revenue for the year reached NZD 2 billion, with cumulative revenue since its inception of NZD 5.1 billion.In May 2022,the New Zealand government established the Carbon Emissions Reduction Foundation to manage the carbon market revenue by funding emission reduction projects and climate change adaptation activities.

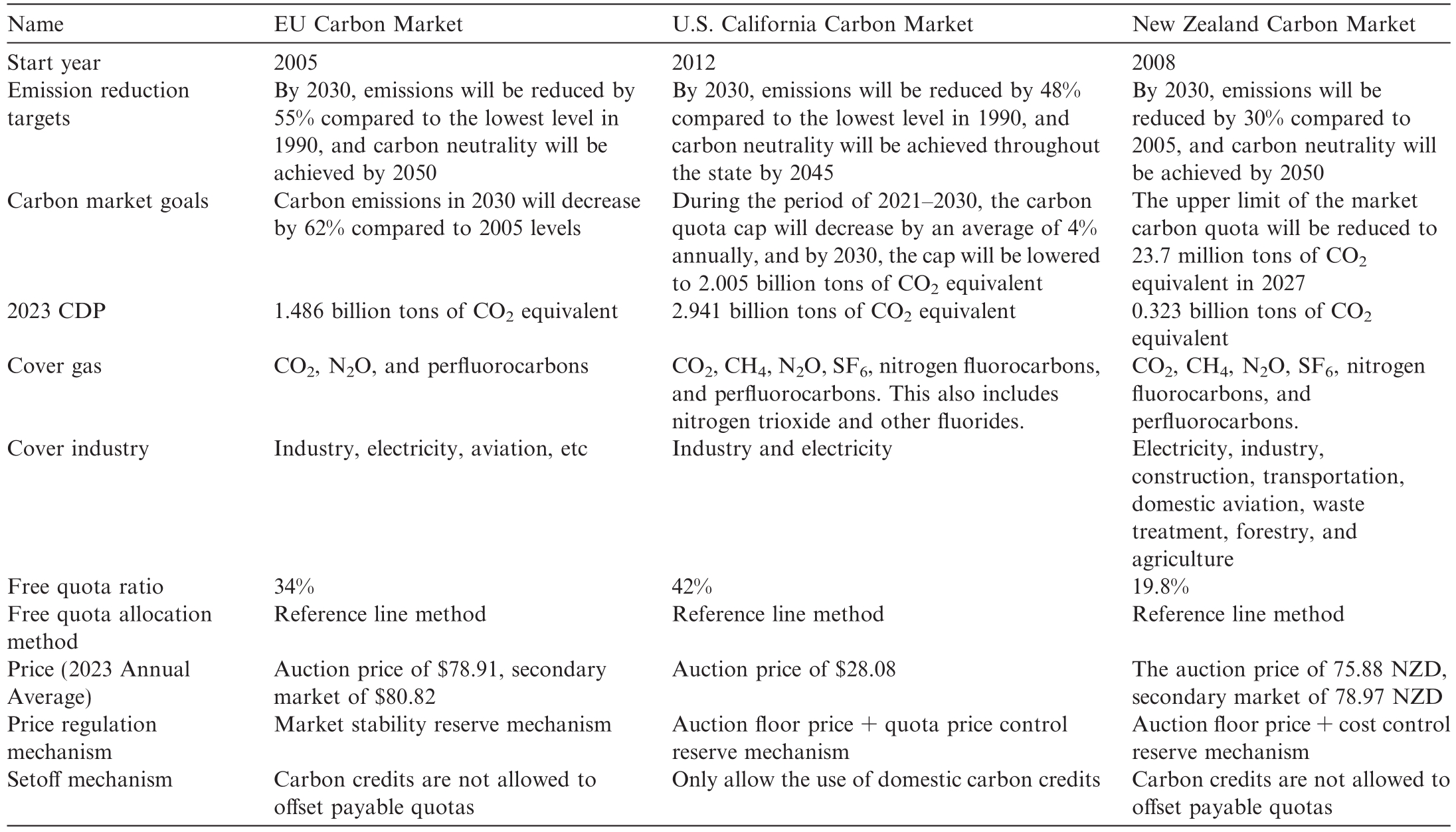

2.4 Comparison of technical elements in major international carbon markets

Through a detailed analysis of the development history and operational mechanisms of the major international carbon markets,this subsection systematically summarizes the critical technical elements of each market.The elements are listed in Table 1.

3 Development status and operational mechanisms of the carbon market with Chinese characteristics

3.1 Development status of the Chinese carbon market

3.1.1 Key milestones in the development of the Chinese carbon market

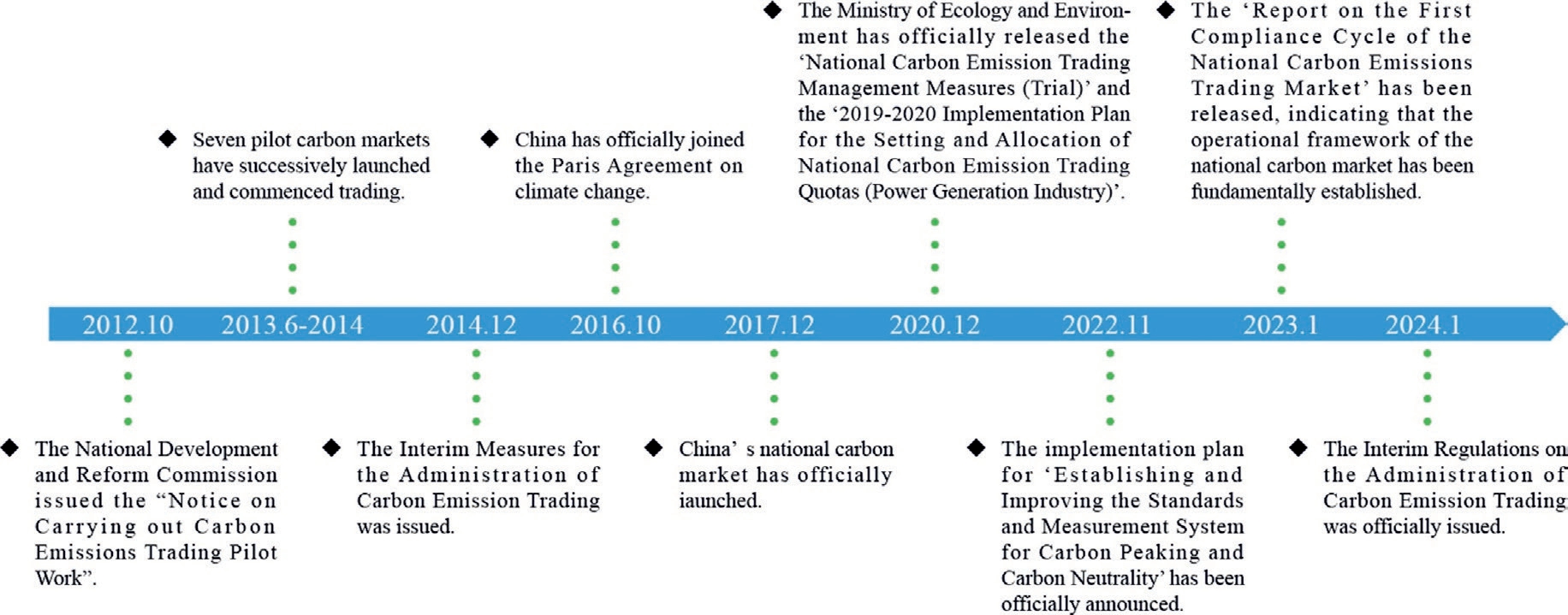

Considering that China’s energy structure is predominantly coal-based, the strong dependence of economic growth on energy demand, and regional development imbalances,the construction and operation of the Chinese carbon market have followed a unique development path.This not only reflects China’s active efforts in the field of climate change but also demonstrates its firm commitment to global emissions reduction actions.Fig.3 illustrates the development of the Chinese carbon market through key milestones.

3.1.2 Construction and operation of the unified national carbon market

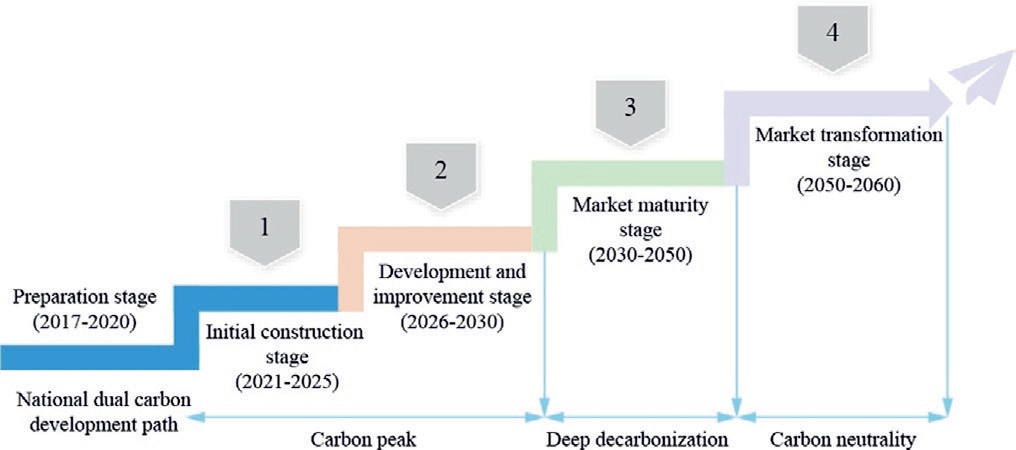

The construction of China’s national carbon market can be divided into four stages: Initial Construction,Development and Improvement, Maturity, and Transformation [38], as shown in Fig.4.During the Initial Construction and Development stages, the focus was on achieving the carbon peaking target.The Maturity stage concentrates on deeper decarbonization.Finally, the Transformation stage aims at achieving carbon neutrality.

China’s unified national carbon market is currently in its initial stage [39].Launched in July 2021, it primarily covers the power generation industry, with 2,384 companies participating, accounting for approximately 40% of the national power sector’s emissions.By March 2024,the market’s cumulative transaction value had reached 5.826 billion yuan, with a trading volume of 176.8 million tonnes and 2,821 participants.In the first trading window of 2024, Huadian Corporation led with a trading volume of approximately 2.64 million tonnes.The second batch of allowances for 2024 was auctioned at 60-65 yuan per ton, totaling approximately 437 million tons.

Table 1

Comparison of technical elements in the international mainstream carbon market.

Despite this progress, the construction of a national carbon market still faces several challenges.For instance,industry coverage is limited, with only the power generation industry included, and the market size needs to be expanded, as the trading volume in the first quarter of 2024 accounted for only approximately 14% of the allowances, indicating weak liquidity.In addition, support systems need to be further improved, such as carbon verification systems, which are insufficiently rigorous.The training of professional carbon market personnel is also urgently required.

3.1.3 Construction and operation of regional carbon markets

In addition to a national unified carbon market,several provinces and cities in China are actively advancing the construction of regional carbon markets.For example,since its launch in 2013, the Shanghai carbon market has achieved a cumulative trading volume of over 180 million tons of CO2, which is equivalent to more than 600 participants.Since its launch in 2014, the Chongqing carbon market has reached a cumulative transaction value of over 1.4 billion yuan,whereas the Shenzhen carbon market has also surpassed 4.6 billion yuan in cumulative transaction value.Beijing, Guangdong, Hubei, and other regions promoted the construction of significant regional carbon markets [40].However, non-uniform regulations across regional carbon markets urgently need to be addressed.Recently, the carbon markets in Guangdong, Hubei, and Chongqing have announced their integration into the national carbon market, marking significant progress in promoting the unification of carbon markets.

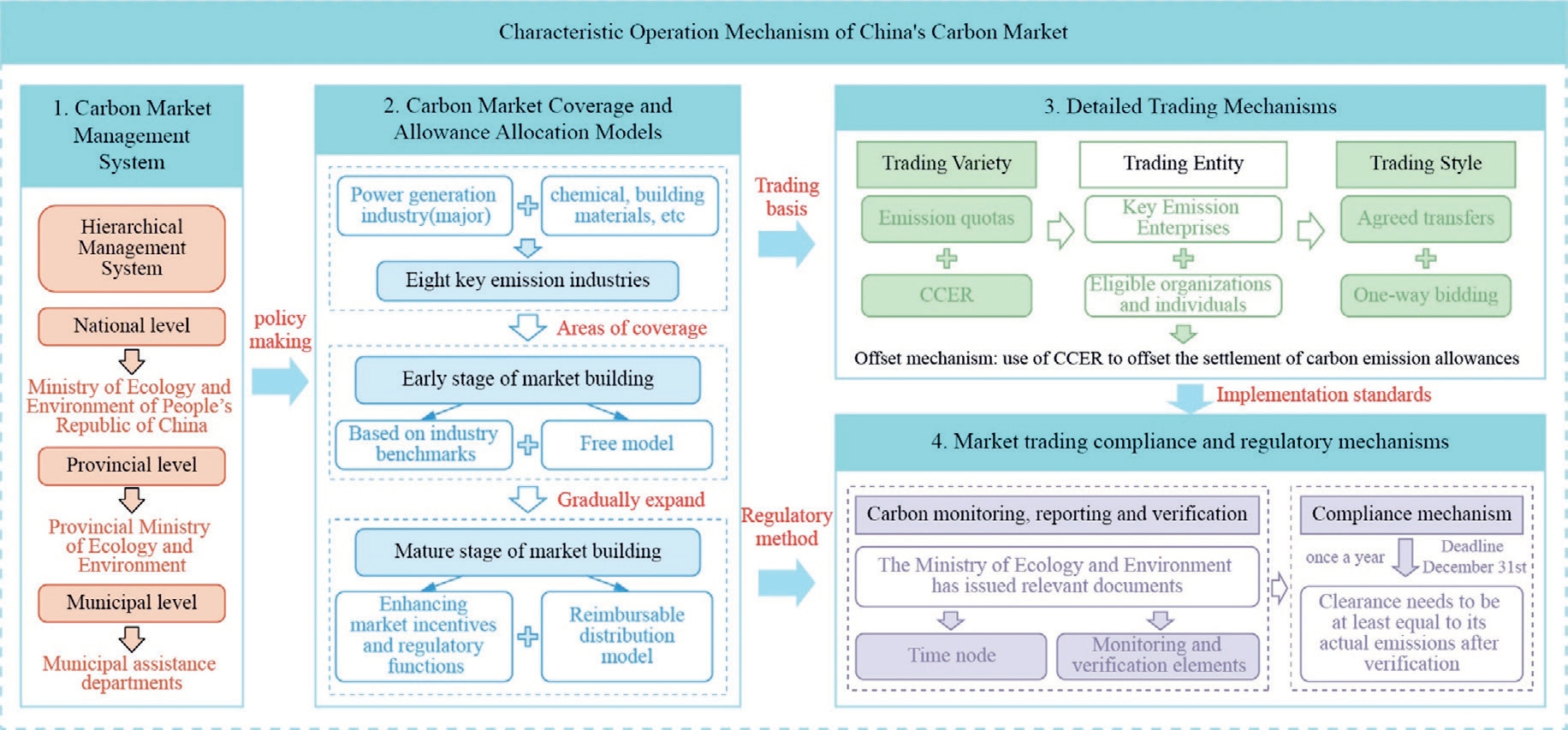

3.2 Operational mechanisms of the carbon market with Chinese characteristics

The construction and operation of the Chinese carbon market differ from those of major international carbon markets, showing distinctive Chinese development characteristics.Its core mechanisms involve multiple aspects,including regulatory authorities, coverage, allowance allocation,monitoring,reporting,verification,trading mechanisms, compliance mechanisms, and offset mechanisms[41].The specific logical relationships are shown in Fig.5.

3.2.1 Regulatory authorities

In China, the national carbon market is managed by a hierarchical system encompassing three levels: national,provincial, and municipal [42].

Fig.3.Development timeline of China’s carbon market.

Fig.4.The development path of China’s carbon market.

At the national level, China’s Ministry of Ecology and Environment has the highest regulatory authority.It determines the greenhouse gases and industry sectors covered by the carbon market,sets total carbon emission allowances and allocation plans, and organizes the establishment of a national carbon emissions registry and trading institutions.Additionally, it formulates technical standards for national carbon emissions trading and related activities and strengthens the supervision and management of provincial carbon emission allowance allocations, greenhouse gas emissions reporting, and verification.

At the provincial and municipal levels, provincial environmental departments manage the issuance and clearance of carbon emission allowances within the province and supervise the verification and reporting of greenhouse gas emissions.Municipal departments assist provincial departments in implementing policies effectively at the local level.

This three-tier management structure not only ensures the uniformity and efficiency of national carbon market policies but also offers flexibility for local policy implementation to adapt to the specific needs of different regions.

Fig.5.Characteristic operation mechanism of China’s carbon market.

3.2.2 Market coverage

The coverage of China’s national carbon market has expanded from the initial power generation industry to include eight key emission sectors: petrochemicals, chemicals, building materials, steel, non-ferrous metals, paper,and aviation.However, it does not yet include the power grid [43].The market primarily controls CO2 emissions.The entry standard stipulates that any enterprise with an annual emission of 26,000 tons of CO2 equivalent or more between 2013 and 2019 must participate.Currently, 2,167 power generation enterprises are included in the market,with their total emissions exceeding 4.5 billion tonnes,accounting for approximately 40% of the national total carbon emissions.Relevant notices from the Ministry of Ecology and Environment further clarify that the coverage ensures that the national carbon market includes all major high-emission industries and that any enterprise or organization with greenhouse gas emissions meeting the above standard from 2013 to 2020 is classified as a critical emission unit and included in the management.

3.2.3 Allowance allocation method

China’s carbon market is currently in its initial construction phase,with allowance allocation based on industry benchmarks and a free allocation model [44,45].It primarily targets the power generation sector, which includes conventional coal-fired units above and below 300 MW, unconventional coal-fired units, and gas-fired units.These units receive allowances based on the actual electricity or heat output and establish carbon emission benchmarks.To enhance market incentives and regulatory functions, China plans to gradually transition to a paidallocation model in the future.

3.2.4 Carbon emissions monitoring, reporting, and verification

In China, key emission units must prepare annual greenhouse gas emission reports in accordance with the technical specifications for greenhouse-gas emissions accounting and reporting formulated by the Ministry of Ecology and Environment.These reports had to be submitted to the provincial ecological environment authorities by March 31 each year.Provincial departments are responsible for verifying these reports and for using the verification results as the basis for allowance settlements.The Ministry of Ecology and Environment’s ‘‘Guidelines for the Accounting and Reporting of Greenhouse Gas Emissions by Enterprises - Power Generation Facilities”and ‘‘Guidelines for the Verification of Enterprise Greenhouse Gas Emissions Reports (Trial)” [46] provide detailed requirements for the accounting, reporting, and verification of carbon emissions.

3.2.5 Market-based trading mechanism

China has implemented a unified national market-based carbon trading mechanism with a carbon emissions registration system in Wuhan and a carbon emissions trading system in Shanghai.The registration authority records the holding,transfer,settlement,and cancellation of allowances and provides settlement services.The trading authority organizes the nationwide trading of carbon emissions allowances.

In the initial stage, the market primarily trades carbon emissions allowances supplemented by China Certified Emission Reductions (CCER).The CCER involves emissions reduction from projects such as renewable energy,forestry carbon sequestration, and methane utilization.Companies can use CCER to offset up to 5%of their total annual allowances.

In terms of trading participants, the mechanism is mainly aimed at key-emitting enterprises, other entities,and individuals that meet national regulations.Currently,the primary participants are power-generation enterprises,which are included in the first batch of trading entities owing to their significant carbon emissions.In the future,the market plans to expand gradually to include a broader range of participants, such as investment institutions and individuals, to promote broader social participation and investment.

The market offers various trading mechanisms, including negotiated transfers and single-directional bids, to meet the needs of different participants.As the market matures, it is expected to become open to non-regulated enterprises and individual investors.These diverse trading methods allow participants to operate flexibly, according to their risk preferences and trading strategies,thereby significantly increasing their market liquidity and activity.

3.2.6 Compliance mechanism

The compliance cycle for the Chinese carbon market is set annually with a deadline of December 31 each year.Critical emission units must surrender the required amount of carbon emission allowances from the previous year to provincial ecological environment authorities within the timeframe set by the Ministry of Ecology and Environment.The surrendered amount must be at least equal to actual emissions.

To alleviate the compliance pressure on enterprises with significant allowance shortages, market rules set a compliance allowance gap limit of no more than 20% of the verified emissions.If an enterprise fails to surrender the required allowance over time.In this case,the local municipal or higher-level ecological environment department orders it to make corrections within a specified period and may impose a fine of 20,000-30,000 yuan.If an enterprise fails to correct an issue within a specified period, In this case, the provincial ecological environment department reduces the enterprise’s carbon emission allowances for the following year by an amount equal to the shortfall.

In January 2023,the Ministry of Ecology and Environment of China released ‘‘The First Compliance Cycle Report of the National Carbon Emission Trading Market” [47,48].

3.2.7 Offset mechanism

The key emission units can use the CCER to offset their carbon emission allowance compliance each year,with the offset proportion not exceeding 5% of the required allowances.The CCER used for offsetting must not originate from the emission reduction projects included in the allowance management of the national carbon emissions trading market.

4 Challenges and lessons for China’s carbon market from successful experiences in international carbon markets

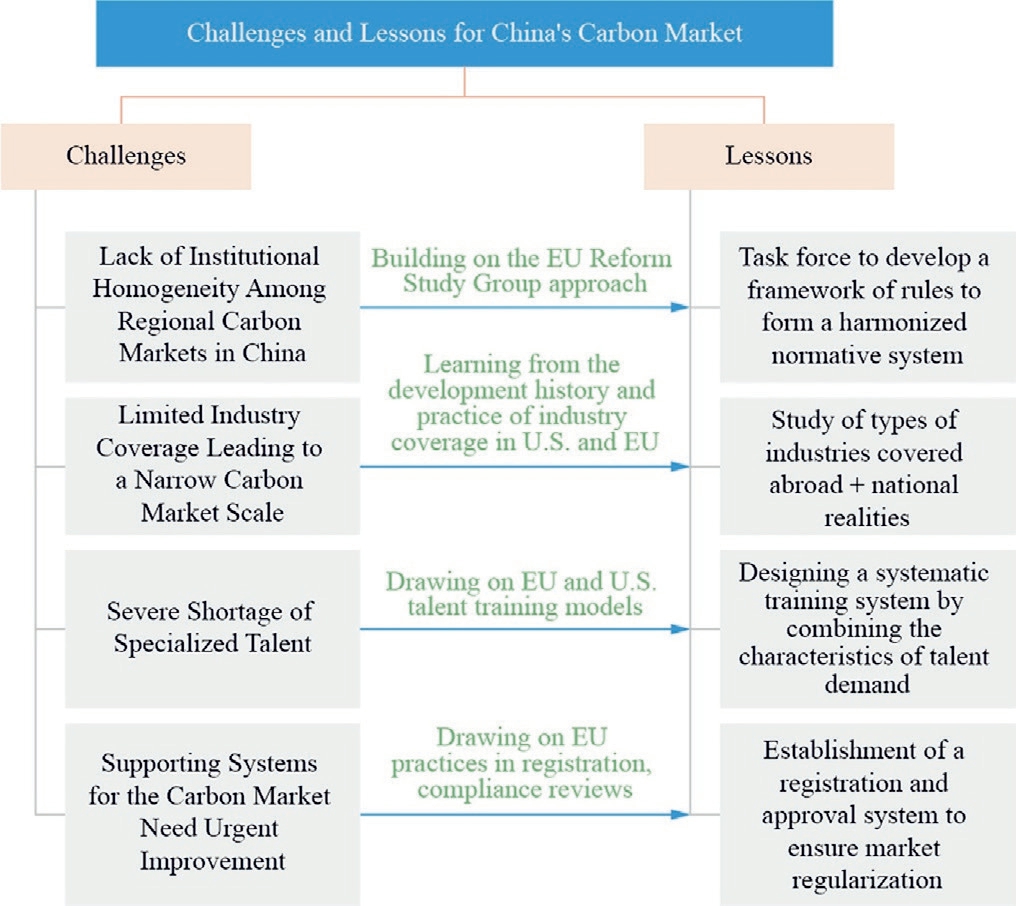

Currently, China’s carbon market is in its early stages of development and faces numerous challenges.To optimize this system,the Chinese government and various sectors are actively learning from successful international carbon markets.They are committed to establishing an efficient carbon market that aligns with China’s national conditions and meets international standards as soon as possible.Fig.6 illustrates the problems with China’s carbon market construction process.At the same time, how should China learn from advanced international experience, and what are the specific improvement measures for these problems?

4.1 Challenges faced by the development of China’s carbon market

As a developing country, China must maintain continuous economic growth while also addressing the pressure to reduce greenhouse gas emissions.Therefore, China decided to establish a nationwide carbon market trading system to promote the low-carbon transition of the energy system through market-based means.However, the process presents numerous challenges.

Fig.6.Challenges and lessons for China’s carbon market.

4.1.1 Lack of institutional homogeneity among regional carbon markets in China

Specifically,existing carbon trading pilots exhibit significant differences in critical institutional designs, such as allowance allocation mechanisms, verification standards,monitoring and reporting requirements, and registration and settlement processes [49,50].These differences prevent effective integration between the pilot carbon markets,thereby affecting the construction of a unified national carbon market.For example, Beijing and Shanghai have different qualification standards for carbon verification agencies;Beijing requires the verification agency’s revenue to be at least 50 million yuan, whereas Shanghai requires 30 million yuan.This disparity increases the difficulty verification agencies face in conducting cross-market business.In addition, Shenzhen and Hubei have different interface standards for their registration systems, with each developing its own technical specifications,which significantly increases the cost of interfacing with the carbon registration systems.Moreover, the legal and regulatory system that directly supports the development of the carbon market is still incomplete,lacking strong legal guarantees and posing obstacles to its institutional construction of the carbon market.

4.1.2 Limited industry coverage leading to a narrow carbon market scale

Currently, China’s seven carbon markets cover only the power generation industry, accounting for approximately 3%of the national carbon emissions.They lack full coverage of key emitting sectors, such as heavy industry, building materials, and chemicals, which is significantly lower than the EU’s 45% coverage rate.In addition, overly homogeneous participation in the Chinese carbon market directly results in low trading volumes and insufficient liquidity.To address this issue,it is necessary to expand industry coverage and optimize the allowance allocation mechanism to broaden the market scale and enhance trading activity.

4.1.3 Severe shortage of specialized talent restricting the effective operation of the carbon market

Carbon accounting, trading, and market regulation require specialized carbon asset management and carbon market regulation personnel,but China is currently noticeably lacking such talent.For example, China’s five major power generation groups have only approximately 12 carbon accountants, compared with an average of 20-30 per European power company.Regulatory agencies also face significant staffing gaps, with Shandong Province alone requiring more than 300 additional carbon market regulators.Most companies do not have dedicated carbon asset management departments and the professional levels of regulatory personnel require improvement.The shortage of specialized talent directly leads to the inefficient operation of China’s carbon market [51].

4.1.4 Supporting systems for the carbon market need urgent improvement

China needs to establish and improve mechanisms covering trade monitoring,registration,and settlement as well as formulate resilient carbon pricing and regulation mechanisms.In addition, it is necessary to develop contingency plans to address potential legal and credit risks.The inadequacy of these support systems restricts the safe, standardized, and efficient operation of China’s carbon market [52].

4.2 Insights from successful international carbon market examples for the development of China’s carbon market

Faced with various challenges in the process of establishing a unified national carbon market,the Chinese government recognizes the importance of healthy and sustainable development of the carbon market.However,relying solely on spontaneous exploration of regional carbon markets is insufficient.Therefore, it is necessary to learn actively and extensively from the construction experiences of advanced international carbon markets and form a systematic and standardized carbon market construction guidance plan[53].Influenced by successful international carbon market examples, this study proposes the following improvement measures.

a) First, in promoting the unification of carbon market regulations, it is essential to learn from the EU’s mechanism for formulating carbon market regulations.In the EU,the Reform Working Group drafts regulatory proposals, which are revised based on feedback from member states, to form unified rules.China can emulate this mechanism by having a specialized task force draft a unified regulatory framework, and then gather feedback and revision suggestions from representatives of regional carbon markets.A systematic and unified regulatory system can be established through multiple rounds of feedback and consensus-building.

b) Second, when expanding the coverage of industries,it is essential not only to study the types of industries covered in other countries but also to recognize that each country has gradually expanded its coverage based on its circumstances.For instance, the EU began with the energy sector and included only the aviation sector in the third phase.The United States also began in the energy sector, adding steel and chemicals to the third phase.New Zealand includes negative-emission sectors, such as forestry.China should also develop a phased plan for expanding coverage based on emission characteristics and preparedness of accounting methods for each industry.

c) Third,in terms of talent development,it is necessary not only to learn from the training models of the EU and the United States but also to design a systematic training system based on the development stage of the Chinese carbon market and the characteristics of talent demand.For instance, the training of carbon verification personnel can be divided into two stages: training the faculty team of training institutions, and training the practitioners of verification.Layered training should be organized to address different needs.

d) Fourth, when improving support systems, it is crucial to study the detailed practices of the EU in registration, such as requiring multiple documents,including bank reference letters,to be submitted during account opening, and conducting review and approval processes to ensure account reliability.China also needs to establish a similar registration and approval system to ensure compliance with the carbon market participants.

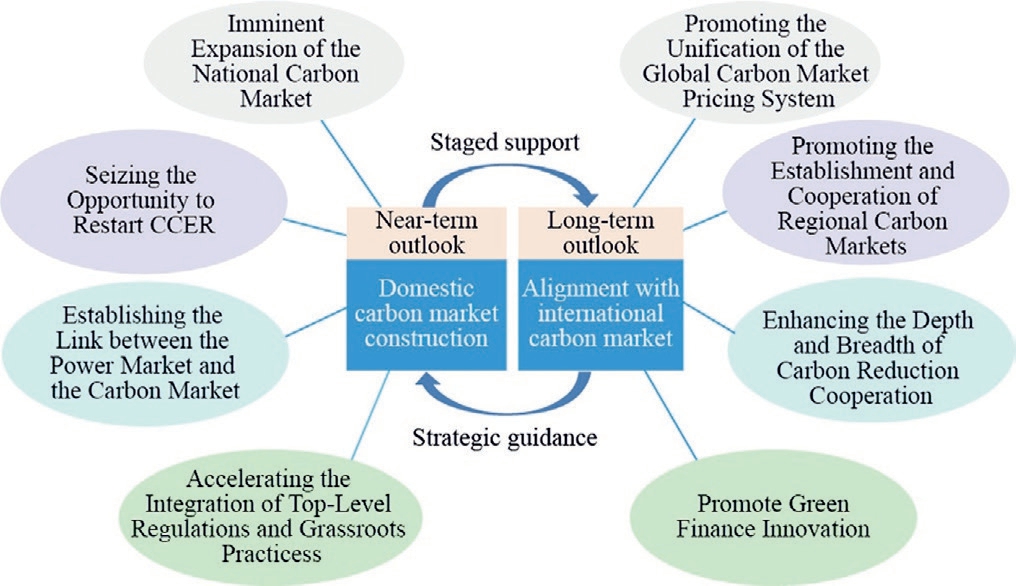

5 Future prospects for the development of China’s carbon market

The future development of China’s carbon market can be divided into two stages: construction of the domestic carbon market and integration with international carbon markets.The construction of a domestic carbon market provides a short-term outlook and phased support for future integration with international carbon markets.Conversely, integrating international carbon markets for a long-term outlook offers strategic guidance for the current construction of the domestic carbon market.This relationship is illustrated in Fig.7.

5.1 Domestic development planning and exploration of the carbon market

5.1.1 Imminent expansion of the national carbon market

Fig.7.Outlook for the future development of China’s carbon market.

Since its launch, China’s national carbon market has included only the power generation industry.With economic transition and increasing environmental requirements, it is urgent to include seven high-emission industries—petro chemicals, chemicals, building materials, steel, non-ferrous metals,paper,and aviation—following the principle of‘‘maturing one industry and then incorporating it”.In May 2023, the Ministry of Ecology and Environment initiated a special study to expand industrial coverage.In-depth studies of the steel,petrochemical,and building materials industries were conducted in June, with initial meetings held on June 16th, 17th, and 27th, respectively.These activities mark a solid step forward for the national carbon market in addressing climate change and promoting green and lowcarbon development.

5.1.2 Seizing the opportunity to restart CCER

With the continuous development of China’s national carbon market and the end of the first compliance period,there has been a noticeable shortage in CCER supply,failing to meet the growing demand for carbon offsets.In response,restarting the CCER has become a focal point of market attention.On June 29, 2023, the Ministry of Ecology and Environment announced plans to restart the national voluntary greenhouse gas emissions trading market within the year to address the urgent carbon offset demand.

This initiative by the Chinese government will incentivize enterprises to adopt more environmentally friendly and low-carbon production methods, promote clean technologies and green industries,and advance the green transformation of the economy.It is also expected to create specialized carbon market services and intermediary institutions that provide carbon asset management, carbon trading facilitation, and carbon market consulting.These institutions support smooth market operations and enhance liquidity and transparency.

5.1.3 Establishing the link between the power market and the carbon market

The coordinated development of power and carbon markets is at the core of China’s future energy and environmental policies [54-56].In the carbon market pilots in Beijing, Tianjin, and Shanghai, green electricity was excluded from carbon emission calculations.This measure encourages enterprises to increase their use of green electricity and reduce their carbon emissions effectively.

By 2023, green electricity transactions in China will account for only 1.2%of the total electricity volume,indicating that the potential demand for green electricity has not been fully realized.As China intensifies its carbon reduction efforts and promotes green development, the government is expected to enhance green electricity certification and market incentives to increase its attractiveness.This will include integrating green electricity as a positive factor in the carbon market while raising public environmental awareness and policy support to stimulate green electricity consumption.This linkage between the power and carbon markets will not only help optimize the energy structure and promote China’s green and low-carbon transition but also showcase China’s leadership and contribution to global climate governance.

5.1.4 Accelerating the integration of top-level regulations and grassroots practices

To accelerate the effective integration of top-level regulations and grassroots practices in the carbon market, the formulation and implementation of the ‘‘Interim Regulations on the Management of Carbon Emission Trading”has become a key measure in the development of China’s carbon market.Since its inclusion in the State Council’s legislative work plan, this regulation has highlighted its central role in national environmental protection policies.The ‘‘Interim Regulations on the Management of Carbon Emission Trading” were officially released in February 2024, detailing key content such as the total quota amount, allocation methods, payment procedures, obligations of key emission units, supervision and management,and accountability mechanisms[57].These provisions provide a clear legal framework for market operations and ensure a solid basis for transitioning from policy formulation to market implementation.

The formulation of this regulation guides current market behavior and provides standards for grassroots practices, ensuring the standardization and effectiveness of carbon market construction and operations.Issues and challenges identified in practice can be continuously monitored and evaluated, thus providing feedback to policymakers to refine and adjust top-level regulations.This interactive mechanism ensures a dynamic balance between policy and practice,thereby enhancing the practical adaptability and operability of regulations.This drives the Chinese carbon market towards greater maturity and efficiency, advances national green and low-carbon development strategies, and achieves China’s long-term environmental and sustainable development goals.

5.2 International cooperation and expansion of the carbon market

As one of the world’s major carbon emitters, China’s innovative attempts and practical measures to build a carbon market have undoubtedly had a far-ranging and profoundly positive impact on the global carbon trading system.

5.2.1 Promoting the unification and improvement of the global carbon market pricing system

Sharing China’s experiences and practices in carbon pricing and trading mechanisms can help break down existing price barriers,promote standardization of the global carbon pricing system, and provide clear emission reduction incentives for governments and enterprises worldwide [58].

5.2.2 Promoting the establishment and cooperation of regional carbon markets

China can prioritize establishing regional carbon markets with neighboring countries such as Japan and South Korea based on regional political and trade systems [59].Experimentally linking key elements, such as allowance allocation, offset handling, and quality standards, can improve the compatibility and synergy of various national carbon market mechanisms.In the long term, such regional cooperation can lay the foundation for a more liquid global carbon market, promoting deeper integration of international carbon trading.

5.2.3 Enhancing the depth and breadth of carbon reduction cooperation

Building on China’s extensive experience in international clean project trading, it can leverage multilateral cooperation frameworks such as the ‘‘Belt and Road Initiative” and ‘‘South-South Cooperation” to engage in bilateral or multilateral carbon credit trading with countries along these routes [43,60,61].This will not only help expand the scope and depth of global carbon reduction cooperation but also bring both economic and environmental benefits to China and other participating countries.

5.2.4 Promote green finance innovation

The development of China’s carbon market has fostered innovation in green financial products and services,such as carbon credits and funds [62].These financial instruments not only support China’s domestic green transition and sustainable development but also provide new investment channels and financial products for the international carbon market.This further enhances capital flow and the vitality of the global carbon market.

6 Conclusion

Given China’s regional differences, rapid new energy development, and complex market structure, its carbon market construction differs significantly from that of Europe and the United States.Mainstream international carbon market theories and models are difficult to apply directly to China.Therefore, it is important to explore a carbon market development strategy that suits China’s national conditions and reflects its characteristics.

Currently, the construction of China’s carbon market faces multiple challenges, and there is an urgent need to learn from the advanced experiences of mainstream international carbon markets.It is expected that China’s carbon market will gradually reach maturity, aim to integrate with the international carbon market system and strive to contribute Chinese wisdom and solutions to the global carbon market trading system.

CRediT authorship contribution statement

Qingkai Sun: Methodology, Investigation, Funding acquisition, Formal analysis, Data curation, Conceptualization.Li Ma:Writing-review&editing,Writing-original draft,Visualization.Menghua Fan:Writing-review&editing, Writing - original draft, Visualization, Conceptualization. Xiaojun Wang: Resources, Project administration, Methodology, Investigation. Zheng Zhao:Visualization,Validation,Supervision,Project administration. Yiru Shi: Methodology, Investigation, Funding acquisition, Formal analysis.

Declaration of competing interest

The authors declare the following financial interests/personal relationships which may be considered as potential competing interests:Qingkai Sun reports financial support was provided by State Grid Energy Research Institute Co., Ltd.If there are other authors,they declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Acknowledgments

Thanks for the funding support of the SGCC Science and Technology Project ‘‘Cost Analysis, Market Bidding Mechanism Research and Validation of New Power System Transformation under a Diversified Value System”(1400-202357380A-2-3-XG) for this article.

References

[1]International Energy Agency (IEA).IEA Energy and Carbon Tracker, 2024.https://www.iea.org/ name="ref2" style="font-size: 1em; text-align: justify; text-indent: 2em; line-height: 1.8em; margin: 0.5em 0em;">[2]International Energy Agency (IEA).Global Energy Review: CO2 Emissions in 2021, 2022.https://www.iea.org/ name="ref3" style="font-size: 1em; text-align: justify; text-indent: 2em; line-height: 1.8em; margin: 0.5em 0em;">[3]C.Odeyemi, The UNFCCC, the EU, and the UNSC: a research agenda proposal for the climate security question, Adv.Clim.Chang.Res.11 (4) (2020) 442-452.

[4]Y.Gao,X.Gao,X.Zhang,The 2 ℃global temperature target and the evolution of the long-term goal of addressing climate changefrom the United Nations framework convention on climate change to the Paris agreement, Engineering 3 (2) (2017) 272-278.

[5]A.Dechezlepreˆtre,D.Nachtigall,F.Venmans,The joint impact of the European Union emissions trading system on carbon emissions and economic performance, J.Environ.Econ.Manag.118 (2023)102758.

[6]W.Zhang, L.Tian, Y.i.Yao, Z.Tian, et al., Dynamic evolution characteristics of European union emissions trade system price from high price period to low price period, J.Clean.Prod.224(2019) 188-197.

[7]A.J.Chapman,K.Itaoka,Energy transition to a future low-carbon energy society in Japan’s liberalizing electricity market:precedents,policies and factors of successful transition, Renew.Sustain.Energy Rev.81 (2) (2018) 2019-2027.

[8] Xu.Guangyue, Y.Wang, H.Rehman, G.Xu, Y.Wang, H.Rehman, J.Environ.Manag.345 (1) (2023) 118588.

[9]S.Cho, Y.-S.Jeong, J.-H.Huh, Is South Korea’s 2050 Carbon-Neutral scenario sufficient for meeting greenhouse gas emissions reduction goal?, Energy Sustain.Dev.80 (2024) 101447.

[10]I.P.Pincelli, J.Hinkley, A.Brent, Carbon, materials and energy footprint of a utility-scale solar plant in Aotearoa New Zealand,Solar Energy 273 (1) (2024) 112535.

[11]Z.Ren, J.Zheng, M.He, et al., The effect of the multi-target energy and climate policy on carbon emissions: county-level evidence from China, Energy 291 (15) (2024) 130436.

[12]Y.Jiang,H.Ni,Y.Ni,et al., Assessing environmental,social,and governance performance and natural resource management policies in China’s dual carbon era for a green economy,Resour.Policy 85(2023) 104050.

[13]B.Jiang, M.Y.Raza, Research on China’s renewable energy policies under the dual carbon goals:a political discourse analysis,Energ.Strat.Rev.48 (2023) 101118.

[14]I.Vinoth Kanna, S.Roseline, K.Balamurugan, S.Jeeva, I.Augastin Santhiyagu, et al., The Effects of Greenhouse Gas Emissions on Global Warming, Reference Module in Earth Systems and Environmental Sciences, 2024.

[15]A.K.Priya, M.Muruganandam, S.Rajamanickam, et al., Impact of climate change and anthropogenic activities on aquatic ecosystem-A review, Environ.Res.238 (2) (2023) 117233.

[16]Q.Hassan,P.Viktor,T.J.Al-Musawi,et al.,The renewable energy role in the global energy Transformations, Renewable Energy Focus 48 (2024) 100545.

[17]A.B.M.Asif Raihan,M.Bari,Energy-economy-environment nexus in China: the role of renewable energies toward carbon neutrality,Innovation Green Dev.3 (3) (2024) 100139.

[18]M.Khalid,Smart grids and renewable energy systems:perspectives and grid integration challenges, Energ.Strat.Rev.51 (2024)101299.

[19]X.Pan, S.Liu, The development, changes and responses of the European Union carbon border adjustment mechanism in the context of global energy transition, World Dev.Sustain.4 (2024)100148.

[20]M.Tao,S.Poletti,M.S.Sheng,Nexus between carbon,stock,and energy markets in New Zealand: an analysis of causal domains,Energy 299 (2024) 131409.

[21]The International Carbon Action Partnership (ICAP).Emissions Trading Worldwide annual report, 2024.https://www.eu-chinaets.org/en/information/212.

[22]European Commission.EU emissions trading system.http://ec.europa.eu/clima/eu-action/euemissions-trading-system-eu-ets_en.

[23]P.Bayer,M.Aklin,The European Union emissions trading system reduced CO2 emissions despite low prices, Proc.Natl.Acad.Sci.117 (16) (2020) 8804-8812.

[24]F.Zhang, H.Fang, W.Song, Carbon market maturity analysis with an integrated multi-criteria decision making method: a case study of EU and China, J.Clean.Prod.241 (20) (2019) 118296.

[25]C.Lyu,H.X.Do,R.Nepal,et al.,Volatility spillovers and carbon price in the Nordic wholesale electricity markets,Energy Econ.134(2024) 107559.

[26]H.Yu,H.Wang,C.Liang,et al.,Carbon market volatility analysis based on structural breaks: evidence from EU-ETS and China,Front.Environ.Sci.10 (2022) 973855.

[27]C.-P.Anke, H.Hobbie, S.Schreiber, et al., Coal phase-outs and carbon prices: interactions between EU emission trading and national carbon mitigation policies, Energy Policy 144 (9) (2020)111647.

[28]Global Warming Solutions Act of 2006 (AB 32), California Air Resources Board, 2006.Available: https://ww2.arb.ca.gov/resources/fact-sheets/ab-32-global-warming-solutions-act-2006.

[29]Cap-and-Trade Program, California Air Resources Board, 2012.Available: https://ww2.arb.ca.gov/our-work/programs/cap-andtrade-program/about.

[30]California Cap-and-Trade Program and Que´bec Cap-and-Trade System: November 2014 Joint Auction #1, California Air Resources Board, 2014.Available: https://ww2.arb.ca.gov/news/california-and-quebec-announce-results-joint-cap-and-tradeauction.

[31]California’s Cap-and-Trade Program, Center for Climate and Energy Solutions (C2ES), 2018.Available: https://www.c2es.org/document/californias-cap-and-trade-program/.

[32]Cap-and-Trade Program: Overview of Allocation to Industrial Entities, California Air Resources Board, 2020.Available: https://ww2.arb.ca.gov/resources/documents/cap-and-trade-programoverview-allocation-industrial-entities.

[33]R.Sousa, L.Aguiar-Conraria, Energy and carbon prices: a comparison of interactions in the European Union Emissions Trading Scheme and the Western Climate Initiative market,Carbon Manag.6 (3-4) (2015) 129-140.

[34]I.Diaz-Rainey, D.J.Tulloch, Carbon pricing and system linking:lessons from the New Zealand emissions trading scheme, Energy Econ.73 (2018) 66-79.

[35]L.Liao, I.Diaz-Rainey, D.Kuruppuarachchi, et al., The role of fundamentals and policy in New Zealand’s carbon prices, Energy Econ.124 (2023) 106737.

[36]S.Kerr, J.Ormsby, D.White, Delinking the New Zealand emissions trading scheme from the Kyoto Protocol: comparing theory with practice, Clim.Pol.21 (6) (2021) 792-803.

[37]New Zealand Emissions Trading Scheme, New Zealand Ministry for the Environment, 2021.Available: https://environment.govt.nz/what-government-is-doing/key-initiatives/emissions-tradingscheme/.

[38]Q.Jiang,L.-C.Chen,W.Wei,The development of China’s carbon market: a state-of-the-art review, IEEE Int.Conf.Appl.Syst.Invention (ICASI) 2018 (2018) 13-17.

[39]H.Liang, Y.Zeng, X.Jiang, et al., Dynamic evaluation of lowcarbon development in China’s power industry and the impact of carbon market policies, Heliyon 9 (2) (2023) 13467.

[40]J.Cui, F.Song, Z.Jiang, Efficiency vs.equity as China’s national carbon market meets provincial electricity markets, China Econ.Rev.78 (2023) 101915.

[41]Y.Zheng, B.Zhang, Does China’s national carbon market function well? A perspective on effective market design, J.Chin.Governance 8 (4) (2023) 563-592.

[42]Y.H.Jialin Li, Y.Chi, D.Liu, et al., Analysis on the synergy between markets of electricity, carbon, and tradable green certificates in China, Energy 26 (2024) 131808.

[43]Y.Song, T.Liu, Y.Li, et al., Paths and policy adjustments for improving carbon-market liquidity in China, Energy Econ.115(2022) 106379.

[44]Implementation Plan for Setting and Allocation of Total Carbon Emission Trading Quota in China from 2019 to 2020 (Power Generation Industry),Ministry of Ecology and Environment of the People’s Republic of China, 2020.https://www.mee.gov.cn/xxgk2018/xxgk/xxgk03/202012/t20201230_815546.html.

[45]L.H.Goulder, X.Long, J.Lu, R.D.Morgenstern, China’s unconventional Nationwide CO2 emissions trading system: costeffectiveness and distributional impacts,J.Environ.Econ.Manag.111 (2022) 102561.

[46]Guidelines for the Verification of Enterprise Greenhouse Gas Emissions Reports (Trial), Ministry of Ecology and Environment of the People’s Republic of China, 2021.https://www.mee.gov.cn/xxgk2018/xxgk/xxgk06/202103/t20210329_826480.html.

[47]Management Measures for Voluntary Greenhouse Gas Emission Reduction Trading (Trial), Ministry of Ecology and Environment of the People’s Republic of China, 2023.https://www.mee.gov.cn/xxgk2018/xxgk/xxgk02/202310/t20231020_1043694.html.

[48]The first compliance cycle report of the national carbon emission trading market, Ministry of Ecology and Environment of the People’s Republic of China, 2023.https://www.mee.gov.cn/ywgz/ydqhbh/wsqtkz/202301/t20230101_1009228.shtml.

[49]X.Q.Wang, C.W.Su, O.R.Lobont¸, et al., Is China’s carbon trading market efficient? Evidence from emissions trading scheme pilots, Energy 245 (15) (2022) 123240.

[50]Z.Chen, P.Song, B.Wang, Carbon emissions trading scheme,energy efficiency and rebound effect-evidence from China’s provincial data, Energy Policy 157 (2021) 112507.

[51]W.Shen, Chinese business at the dawn of its domestic emissions trading scheme: incentives and barriers to participation in carbon trading, Clim.Pol.15 (3) (2015) 339-354.

[52]China’s emissions trading scheme,IEA,2020.https://www.iea.org/reports/chinas-emissionstrading-scheme.

[53]Yu.Anqi, S.Peng, Y.Li, Analysis of the effectiveness of carbon emission trading market in China, Procedia Comput.Sci.221(2023) 1440-1447.

[54]Y.Wang, S.Liu, M.Z.Abedin, Volatility spillover and hedging strategies among Chinese carbon,energy,and electricity markets,J.Int.Finan.Markets.Inst.Money 91 (2024) 101938.

[55]Y.Li, T.Feng, L.Liu, et al., How do the electricity market and carbon market interact and achieve integrated development?-A bibliometric-based review, Energy 265 (15) (2023) 126308.

[56]X.Song, P.Wang, Effectiveness of carbon emissions trading and renewable energy portfolio standards in the Chinese provincial and coupled electricity markets, Util.Policy 84 (2023) 101622.

[57]Interim Regulations on the Management of Carbon Emission Trading, Ministry of Ecology and Environment of the People’s Republic of China, 2024.https://www.mee.gov.cn/zcwj/gwywj/202402/t20240205_1065850.shtml.

[58]Ru.Sha,J.Qian,C.Li,et al.,A win-win opportunity for economic growth and carbon emissions reduction in China: the perspective from correcting energy price distortions, Energ.Strat.Rev.53(2024) 101406.

[59]B.Xiao, Y.Fan, X.Guo, S.Voigt, Effects of linking national carbon markets on international macroeconomics: an openeconomy E-DSGE model, Comput.Ind.Eng.169 (2022) 108166.

[60]A.F.Li, C.-F.Qu, X.-L.Zhang, Exploring U.S.-China climate cooperation through linked carbon markets, Adv.Clim.Chang.Res.14 (1) (2023) 145-155.

[61]H.Jiang,J.Wang,Yu.Sha,et al.,Exploring global carbon market link mechanism: efficiency evaluation in the context of carbon neutrality, J.Clean.Prod.420 (25) (2023) 138474.

[62]K.Zhou, Y.Li, Carbon finance and carbon market in China:progress and challenges, J.Clean.Prod.214 (20) (2019) 536-549.

Received 9 September 2024;revised 26 November 2024; accepted 23 December 2024

Peer review under the responsibility of Global Energy Interconnection Group Co.Ltd.

* Corresponding author.

E-mail addresses: sunqingkai_123@163.com (Q.Sun), mali@sgeri.sgcc.com.cn (L.Ma), dqqsqk1234@gmail.com (M.Fan), xjwang1@bjtu.edu.cn(X.Wang), zhaozheng@sgeri.sgcc.com.cn (Z.Zhao), shiyiru0114@163.com (Y.Shi).

https://doi.org/10.1016/j.gloei.2024.12.002

2096-5117/© 2025 Global Energy Interconnection Group Co.Ltd.Publishing services by Elsevier B.V.on behalf of KeAi Communications Co.Ltd.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

Qingkai Sun received a Ph.D.in electrical engineering from Beijing Jiaotong University,China, in 2023.He is currently an Intermediate Researcher at the State Grid Energy Research Institute Co.,Ltd.,Beijing,China.His research interests include energy policy, the power market, the carbon market, and game theory.

Li Ma received a Ph.D.degree in Electrical Engineering from Zhejiang University, China,in 2003.She is currently a professor-level senior engineer at the State Grid Corporation of China in Beijing,China.Her research interests include power and carbon markets, power system stability analyses, and energy policy.

Menghua Fan received a Ph.D.in Electrical Engineering from Tianjin University, China, in 2011.She is currently a Professor-Level Senior Engineer at the State Grid Energy Research Institute Co.,Ltd.,Beijing,China.Her research interests include power and carbon markets,power system stability analyses, and energy policy.

Xiaojun Wang received a Ph.D.degree in Electrical Engineering from North China Electric Power University, China, in 2008.He currently serves as the Vice Dean of the School of Electrical Engineering at Beijing Jiaotong University.His research interests include power markets, power system stability analyses, and energy policies.

Zheng Zhao received a Ph.D.in Electrical Engineering from Clemson University, USA in 2012.He is currently a Professor-Level Senior Engineer at the State Grid Energy Research Institute Co.,Ltd., Beijing,China.His research interests include carbon market and energy policy.

Yiru Shi received a M.S.degree in Electrical Engineering from Beijing Jiaotong University,China, in 2024.She is currently a Junior Researcher at the State Grid Energy Research Institute Co.,Ltd.,Beijing,China.Her research interests include power markets, carbon markets, and energy policy.

(Editor Yajun Zou)