0 Introduction

Climate change is becoming an important issue in all infrastructure development fields[1-2].The European Green Deal and relevant decarbonization policies in the Middle East and North Africa(MENA)have urged a profound transition in the energy exploitation,allocation,and consumption landscape[3-5].In this sense,the scaling up of renewable energy resource(RES)deployment and the broader espousal of regional backbone grid integration are of paramount importance[6-7].In a feasible scenario in 2030,integrated with the master plan of the European Network of Transmission System Operators for Electricity(ENTSO-E)and the Pan-Arabic Electricity Market,the Mediterranean Transmission System Operators(Med-TSO)grid(Fig.1)would be based on a wide range of wind and solar portfolios to meet the regional carbon dioxide(CO2)emission reduction targets as well as the significantly greater energy demand mainly from MENA countries[8-16].Although the use of local storage systems is a practical solution to RES intermittency and unpredictability[17],high-level interconnection is indispensable for increasing RES shares and regional balancing.

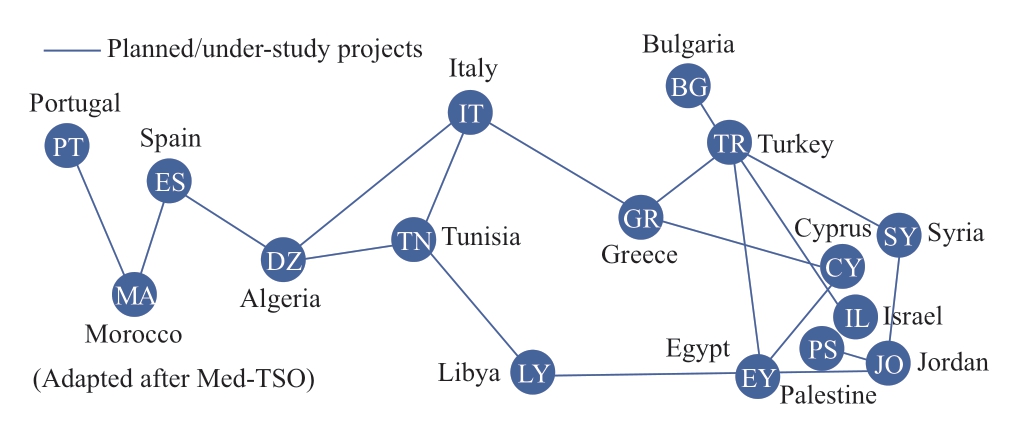

Fig.1 Topology of planned/under-study interconnectors among Med-TSO countries

The 19 Med-TSO countries include the following:north shore(Portugal,Spain,France,Italy,Slovenia,Croatia,Montenegro,Albania,Greece,and Cyprus),east shore(Turkey,Jordan,Israel,and Palestine),and south shore(Egypt,Libya,Tunisia,Algeria,and Morocco).To date,although Turkey and the Maghreb countries Morocco,Algeria,and Tunisia are connected with the Continental European Synchronous Area(CESA),other south and east bank countries have insufficient interconnections and synchronization difficulties that have proven to be major hurdles to the implementation of large-scale solar and wind development and the attainment of climate goals[2].

Technically,over 50 cross-sea power transmission submarine cables(mainly DC lines)have been commissioned,particularly in Europe[18].Owing to restrictions of mass and insulation requirements of power wires,±525 kV DC lines were more common until the end of 2021.However,European and African countries have a pattern of reversed distribution of renewable resources and loads,and a set of alternating current(AC)synchronous grids and DC grids have been applied[19].AC lines at a voltage level of 1,100 kV and ±800 kV DC lines have proven to be technically and economically feasible in China,India,and Brazil,enabling large-scale renewable development and allocation over long distances between resources and load centers[20].To date,monopole and bipole HVDC links have been commissioned in Europe,and voltage source converters or line-commutated converter HVDC technology has proven to be more efficient in connecting offshore wind farms and other RESs[21].

In 2009,Dii Desert Energy created a masterplan ‘Desert Power 2050’ to increase RES deployment in MENA and deliver green power to the CESA[22-24].Since 2012,the Med-TSO has analyzed trans-boundary grid interconnectors to enhance power market integration and the potential benefits that overcome costs according to a cost-benefit analysis[25].However,new climate targets such as the ‘Fit for 55’ program(55% emissions reduction by 2030 compared to 1990 level),the emerging hydrogen industry,and the accelerated development of large-scale renewables and better performance of submarine cables require a holistic review of the aforementioned market and technical status to create feasible projects for the coming decade[26].The remainder of this paper is structured as follows.Section 1 describes the Med-TSO generation mix and carbon emission portfolios.Section 2 outlines the grid interconnection of the region.Feasible new transmission projects are examined in Section 3.Section 4 summarizes the major sectors that facilitate grid interconnections.Inferences and recommendations for a holistic regional decarbonization roadmap are discussed in Section 5.

1 Trans-Mediterranean electricity mix and carbon emission

1.1 Power generation portfolios

The Med-TSO countries have a diversified generation pattern,as listed in Table 1[27-29].Coal-fired fleets and gas-fired power plants continue to have an important share in Turkey,Israel,Italy,and in all south- and east-shore countries.

Typical electricity generation patterns using the latest data from the International Energy Agency are illustrated in Fig.2[30].With a 66% contribution from nuclear fleets,France has the lowest carbon intensity in the power sector with approximately 10% generation from thermal power plants.However,owing to security problems,the French government is attempting to reduce its 66% nuclear share to 50% in the coming decades,resulting in an urgent need to ramp up its offshore wind development.Spain pioneered utility-scale solar photovoltaic(PV)and concentrating solar power(CSP)development in the north-shore region.In Turkey,coal and natural gas have contributed to over 50% of the generation mix,making the energy sector a significant burden for social and economic decarbonization[31].Egypt presents a typical south-shore power generation pattern with approximately 80% natural gas and 10%oil.The World Bank has shown significant demographic growth and enhanced energy demands for south- and eastshore countries,requiring a dramatic transformation of their generation sector[32].By 2030,the Mediterranean area expects an increased generation capacity of 400 GW from approximately 60% of RESs(Table 2);the corresponding electricity demand is approximately 2.53 PWh,from which MENA countries have a demand of approximately 1.40 PWh[33].

Fig.2 Power generation mix of major carbon emitters:(a)Spain,(b)France,(c)Egypt,and(d)Turkey(2020)

Table 1 Electricity portfolios of trans-Mediterranean countries(2020)and demand projections(2030)[27-29]

1.2 Carbon emission portfolios

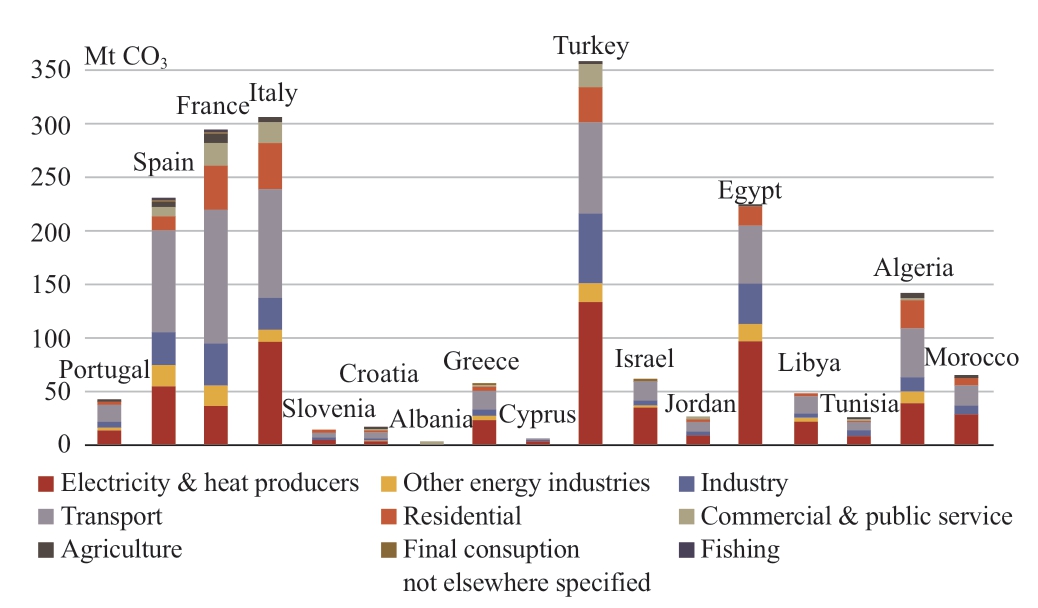

Turkey(367 Mt CO2),Italy(308 Mt CO2),France(295 Mt CO2),Spain(231 Mt CO2),Egypt(225 Mt CO2),and Algeria(143 Mt CO2)are primary emitters in the region(Fig.3).In most Mediterranean countries,electricity/heat and transport account for more than 60% of carbon emissions,whereas in particularly low carbon intensity power-sector countries such as France,transport is the sole dominating emission source.To date,the European Commission and relevant governments are leading the campaign towards energy sector decarbonization of the north-shore countries.However,clear and sound nationally determined contributions of carbon emissions as well as proper technical,market,and policy frameworks are generally missing in south- and east-shore countries.Aligned with the European Union’s pledge towards carbon neutrality in 2050,whereby 80% of greenhouse gas emissions would be reduced compared to the 1990 level(Germany and France are phasing out coal and nuclear fleets,respectively),significant amounts of complementary renewables and/or electricity imports are indispensable in the CESA[34].

Fig.3 Energy sector carbon emission portfolios in Mediterranean countries(2020)

2 Trans-Mediterranean grid interconnection status quo

Owing to(i)upgraded European decarbonization pledges,(ii)the search for a higher quality of service and a more reliable energy supply,particularly after the emerging tense situation in Ukraine,and(iii)the prevention of RES curtailment and improvement of system stability and security,Dii Desert Energy,Med-TSO,ENTSO-E and relevant peer institutions have endeavored to extend the CESA to the south- and east-shore countries[35-37].Currently,in addition to Italy,France,Spain,and Greece,power trade among other Med-TSO countries is restricted(Table 2)[33].

Table 2 Power trade of trans-Mediterranean countries(GWh)in 2019 and projected generation capacity(GW)in 2030

2.1 North-shore interconnections

The European power grid is composed of five major synchronous networks encompassing the continental synchronous(CESA),Nordic,Baltic,British,and Irish grids[3],among which CESA is the pivotal market in terms of realizing Europe-Asia-Africa interconnection in the coming decades[19].To date,except for Iceland and Cyprus,all ENTSO-E countries have exchanged electricity with their neighbors.In general,220 225/275 kV and 380 400 kV lines are utilized in north-shore countries such as France,Spain,and Italy,whereas low-voltage lines are commissioned in Cyprus.

In 1951,Italy joined the Union for the Coordination of the Production and Transport of Electric Power,and since then,the expansion of the CESA began,allowing synergies of resource allocation optimization in a wider area.However,the north-south shore interconnections of Spain-Morocco and Turkey-Syria have limited capacity and topology[39].

The European Union(EU)set an interconnection target of at least 10% by 2020 to encourage EU countries to further connect their installed electricity production capacity.This means that each country should have electricity cables that allow at least 10% of the electricity produced by its power plants to be transported across borders to neighboring countries[40].

2.2 South- and east-shore interconnections

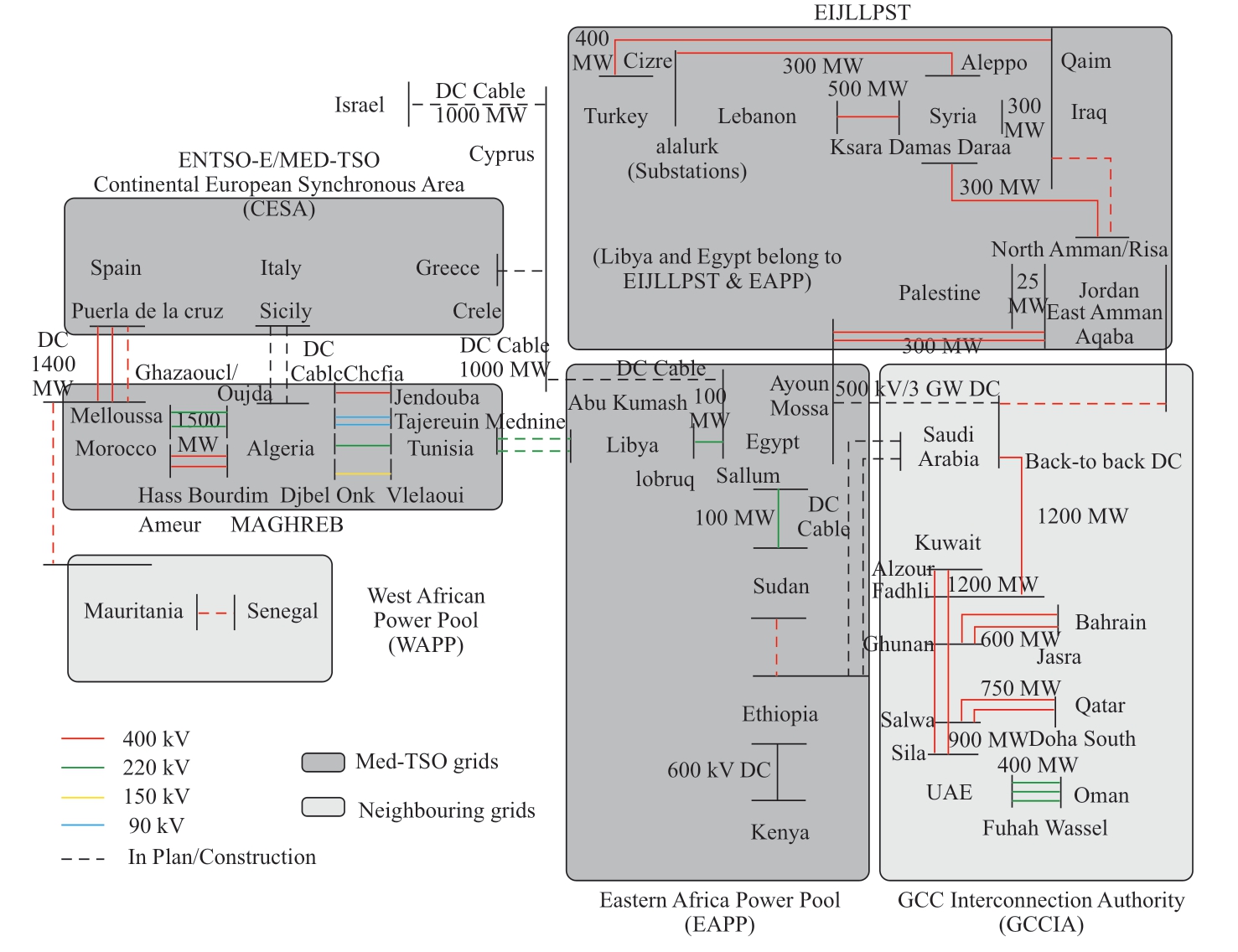

For the south- and east-shore countries,the two primary sub-regional electricity markets are the Maghreb grid interconnection[41-44]and those of the Libya,Egypt,Jordan,Palestine,Syria,Lebanon,Iraq,and Turkey(EIJLLPST)grid interconnection(Fig.4)[7].The lack of physical connection with the Gulf Cooperation Council(GCC)grids has hindered greater power trade among MENA countries[45-47].In addition to the Comité Maghrébin de L’Electricité(COMELEC)countries Morocco,Algeria,and Tunisia,the quasi-regional power pool Arab Union of Electricity also envisages integration with the CESA(mainly via Turkey).Although the power trade among COMELEC countries is mainly limited to mutual aid and several annual trade contracts,a liberalized and competitive market is still absent[11].Regarding the EIJLLPST market,only Libya,Egypt,and Jordan are synchronized.

Aligned with ENTSO-E’s Ten-Year Network Development Plan(TYNDP),Med-TSO and relevant national utilities have strengthened their planning to further interconnect the CESA with south- and east-shore countries.In 1997,the CESA achieved synchronous status with Morocco,Algeria,and Tunisia across the Gibraltar Strait via a 400 kV AC line.In 2006,a second 400 kV AC line was in operation.The Moroccan grid was then linked to Spain via two 400 kV connections with a 1.4 GW thermal capacity(Fig.4).In 2015,the Turkish grid was connected to the CESA.To date,the Turkey grid has been interconnected with Southeast Europe’s synchronous 400 kV grid via one line to Greece and two lines to Bulgaria,with a total nominal capacity of 1.9 GW[2].

Fig.4 Scheme of the MENA grids and neighboring interconnections(adapted after[7])

3 Major trans-Mediterranean power grid interconnections in the coming decade

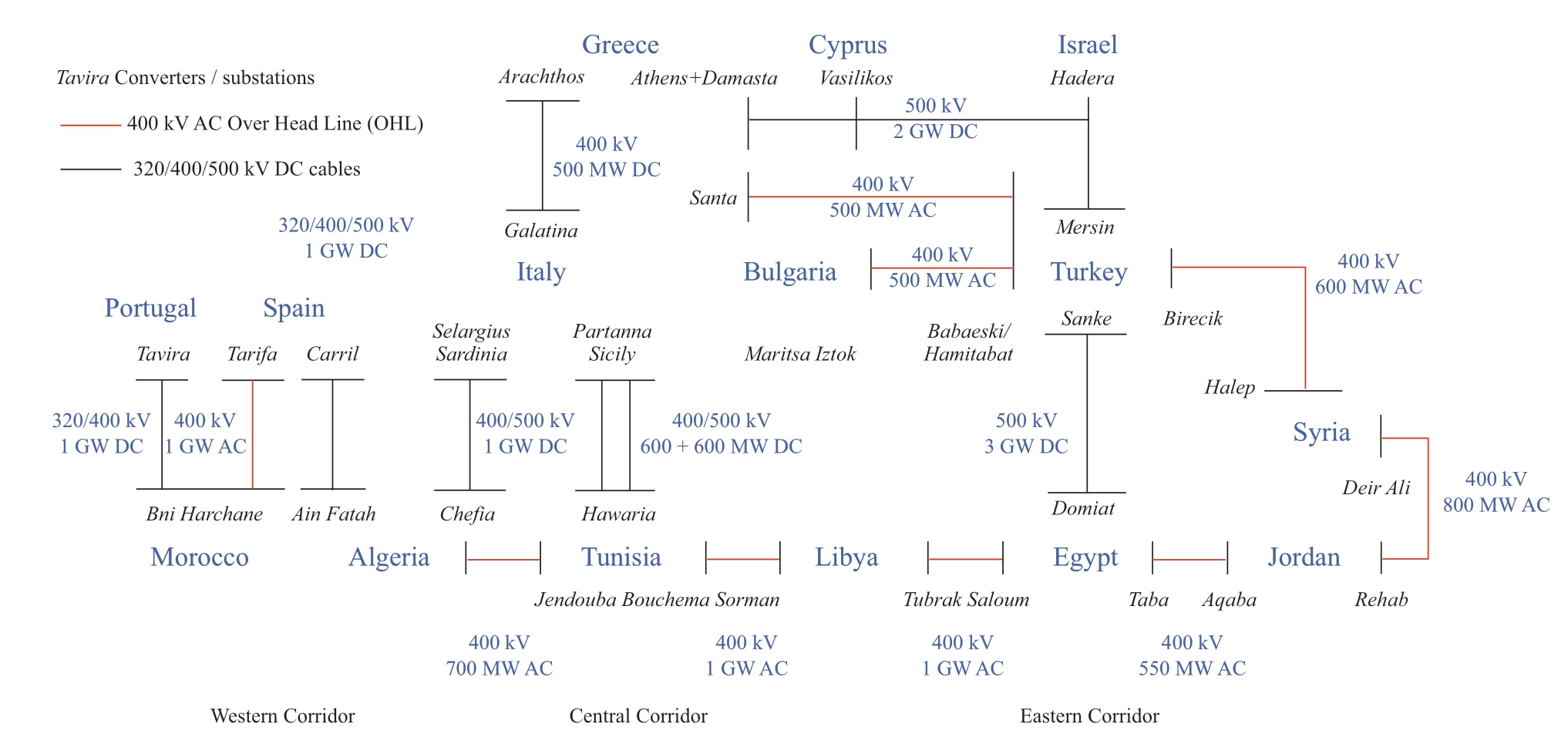

Van Son and Ruderer(2012)envisaged synergies among Mediterranean utilities,whereby Dii Desert Energy,along with Instituto de Investigación Tecnológica,Centro Elettrotecnico Sperimentale Italiano,and TERNA,are jointly applying TEPES,PowerACE,and Green-X models to investigate electricity exchange among Mediterranean countries for the years 2030 and 2050[24,38].The Global Energy Interconnection Development and Cooperation Organization conducted an array of analyses concerning solar- and wind-based development and proposed a set of trans-Mediterranean HVDC lines and a cost analysis[48].Working together with member utilities,the Med-TSO launched Master Plan 2030(MP 2030),which is coherent with the analogous ENTSO-E TYNDP,aiming to develop a Trans-Mediterranean Electricity Market[25].Evaluated by the Mediterranean Regulators for Energy,MP 2030 analyzed the feasibility of 15 cross-border grid interconnections and relevant new substations and submarine lines among member states.MP 2030 reveals that 18 GW of new interconnection capacity is needed,approximately 2,200 km of new lines and 40 new converts/substations need to be reinforced,and the total amount of corresponding investment is approximately EUR 16 billion.To provide a holistic view of the above projects,all sets of clusters were segregated into western,central,and eastern corridors as shown in Fig.5.

Fig.5 Proposed transmission lines for western,central,and eastern corridors(adapted after[25])

Currently,the only active trans-Mediterranean line in Morocco-Spain sees limited flows from north to south.In 2030,with remarkably improved transmission infrastructure and higher RES capacity,the annual trade among Mediterranean countries is estimated to be 120 TWh,with a focus on the south to north direction,where power flows represent 70% of the total exchange[24].Accordingly,the ENTSO-E’s TYNDP envisages a total capacity of 50 GW on approximately 40 European and neighboring borders for European system needs that will avoid 110 TWh of RES curtailment and 53-Mt/a CO2 emissions by 2030[13].In 2050,in light of the Dii Desert Energy’s analysis,the wellintegrated trans-Mediterranean interconnections will see a total of 1,110 TWh of electricity exchanged(1,087 TWh from the MENA to the CESA and 23 TWh from Europe to the MENA)[24].The abbreviations of the whole set of country codes see as in Fig.1.

3.1 Western corridor

Morocco-Portugal line(MAPT).The utilities Office National de l’Electricité et de l’Eau Potable(ONEE,Morocco),Redes Energéticas Nacionais(REN,Portugal),and Med-TSO jointly proposed a 265-km(222-km cable)Tavira(PT)-Bni Harchane(MA)400 kV/1 GW HVDC line.

Morocco-Spain line(MAES).The utilities ONEE,Red Eléctrica de España(REE,Spain),and Med-TSO jointly proposed a 60-km(30-km cable)Tarifa(ES)-Bni Harchane(MA)400 kV/1 GW HVDC line.

Algeria-Spain line(DZES).The utilities Société Nationale de L’electricité et du Gaz(Sonelgaz,Algeria),REE,and Med-TSO jointly proposed a 240-km(maximum depth 2000 m)Carril(ES)-Ain Fatah(DZ)400 kV/1 GW HVDC line.

3.2 Central corridor

Algeria-Italy line(DZIT).The utilities Sonelgaz,TERNA(Italy),and Med-TSO jointly proposed a 350-km Cagliari(Sardinia,IT)-Cheffia(DZ)400 kV(500 kV)/1 GW HVDC line.

Tunisia-Italy lines(TNIT 1 and 2).The utilities Société Tunisienne de l’Électricité et du Gaz(STEG,Tunisia),TERNA,and Med-TSO jointly proposed a 200-km Partanna(Sicily,IT)-Hawaria(TN)400 kV(500 kV)/600-MW +600-MW HVDC line.The project was included in the Italian Plan for Energy and Environment.

Algeria-Tunisia line(DZTN).The utilities Sonelgaz,STEG,and Med-TSO jointly proposed a 40-km Chefia(DZ)- Jendouba(TN)400 kV/700-MW overhead line(OHL).

Tunisia-Libya-Egypt(TNLYEY)line.The utilities Sonelgaz,General Electricity Company of Libya,Egyptian Electricity Transmission Company(EETC),and Med-TSO jointly proposed a 300-km Bouchema(TN)-Sorman(LY)and a 350-km Tubrak(LY)-Saloum(EY)400 kV/1 GW HVAC OHL.

3.3 Eastern corridor

Greece-Turkey line.The utilities Independent Power Transmission Operator(IPTO/ADMIE,Greece),Türkiye Elektrik İletim A.Ş.(TEİAŞ,Turkey),Electricity System Operator EAD(Bulgaria),and Med-TSO jointly proposed a 130-km Santa(GR)-Babaeski(TR)400 kV/1 GW AC OHL and a 140-km Hamitabat(TR)-Maritsa Izok(BG)400 kV/1 GW AC OHL.

Greece-Cyprus-Israel line.The utilities IPTO,Cyprus transmission system operator,Israel Electric Company(IEC),and Med-TSO jointly proposed a 335-km + 896-km Athens(GR)-Damasta(GR)-Vassilikos(CY)500 kV/1 GW HVDC cable and a 310-km Vassilikos(CY)-Hadera(IL)500 kV/2 GW HVDC cable.The Athens-Damasta line was tendered at the end of 2021.

Turkey-Egypt line(TREY).The utilities TEİAŞ,EETC,and Med-TSO jointly proposed a 700-km Bezci(TR)-EY 500 kV/3 GW HVDC line.

Turkey-Israel line(TRIS).The utilities TEİAŞ,IEC,and Med-TSO jointly proposed a 600-km Mersin(TR)-IS 500 kV/2 GW HVDC line.

Egypt-Jordan line(EYJO).The utilities EETC,National Electric Power Company(NEPCO,Jordan),and Med-TSO jointly proposed a second 12-km Taba(EY)-Aqaba(JO)400 kV/550-MW HVAC cable with a total capacity of 1.1 GW accompanied by 18-km and 9-km 400 kV AC OHLs to be built in Egypt and Jordan,respectively.

Jordan-Syria-Turkey line(JOSYTR).The utilities NEPCO,TEİAŞ,Syrian Ministry of Electricity,and Med-TSO jointly proposed a 102-km Hasheimya(JO)-Deir Ali(SY)400 kV/800-MW AC OHL,and a 61-km Suriye(SY)-Birecik(TR)400 kV/600-MW AC OHL.

4 Facilitating grid interconnection development

As mentioned above,the further integration of southand east-shore grids with the CESA can significantly profit by raising renewables share and decarbonizing the MENA energy sector,and key projects outlined by the Med-TSO and relevant utilities will be commissioned smoothly in the coming decade.However,market,technical,and financial hurdles must first be settled to facilitate project implementation.

4.1 Market,legal,and regulation barriers

The CESA has,in general,a mature and packaged protocol;namely,(i)key supranational projects studied and raised by national utilities and submitted to ENTSO-E regional offices,(ii)proposal evaluation by the Technical Committee of the European Agency for the Cooperation of Energy Regulators(ACER),(iii)financing of proposals entering the Projects of Common Interest by multilateral and/or international funding instruments,and(iv)dayahead trading of products from commissioned plants or spot mechanisms via the European Power Exchange.These mechanisms include EPEX SPOT,Nord Pool,and Mercado Ibérico de Electricidade.

For south- and east-shore countries,major legal and regulatory barriers such as non-liberalized market structures,regulation gaps of taxation and transmission tariffs,and private(third-party)sector access rights need to be examined and removed[49,50].

Mature power trading,regulating,and dispute settlement mechanisms under an independent supranational entity such as ACER and ENTSO-E are necessary to harmonize the synergies among different utilities,sectors,and stakeholders[51].In addition,the residential and industrial retail tariffs in the Maghreb and Mashreq countries are generally far below the generation cost because of a significant amount of conventional fuel subsidies.Subsidies have been a major barrier to the use of alternative RESs.A heavily subsidized tariff distorts consumption decisions and makes the renewables of Arab countries less competitive.However,the subsidized power price of domestic producers undermines their incentive to export electricity to foreign consumers.

4.2 Technologies and standards

Spain’s link to Morocco is the CESA’s only operational interconnection with the African continent and is mainly utilized in a north to south direction with a net export of over 5.2 TWh,which accounts for approximately 14%of Morocco’s total electrical supply.To ensure system operations during periods of oversupply,grid operators such as REE have chosen to curtail solar PV and CSP outputs.Enhanced third interconnections have been proven to significantly reduce the curtailment.In recent years,the Spanish utility REE has revealed an average export utilization rate from Spain to Morocco of 75%-77%.Given that Spain and other north-shore countries foresee 100% renewable electricity by 2050 as part of their rigorous climate strategy,the status of European utilities as energy exporters may be reversed to receive MENA solar resources[43].

According to the European Resources Adequacy Assessment introduced by ENTSO-E[29]and analyses by Dii Desert Energy and the Fraunhofer Institute for Systems and Innovation Research using PowerACE and Green-X models[24],Spain(import 151 TWh)would be a major ‘Balancer’ in 2050.The assessment reported that if Spain imported MENA power during summer evenings and managed power flows to Morocco mainly in winter months in relatively few hours but with high loads,it would play a crucial role in balancing the Maghreb and entire MENA system.In 2050,the major regional exporters will be Morocco(505 TWh),Algeria(188 TWh),and Libya(227 TWh)[24].In addition,as defined by ENTSO-E,after the aforementioned new MAES line is commissioned,the Spanish 220 kV and 400 kV systems would require domestic grid reinforcements to solve overloads greater than 15%[28].According to a security analysis,Spain’s RES capacity exceeding a threshold of 20-25 GW would cause overloads in large areas of the Spanish grid[28].In light of studies from Dii Desert Energy,CESA foresees a curtailment of 230 TWh in 2050 with 145 TWh in winter and 85 TWh in summer months if no further measures such as grid expansion or demand-side management are conducted[24].Therefore,a holistic evaluation and implementation of grid interconnections,storage systems,and demand-side management schemes must be considered for all Mediterranean utilities.

Among the south- and east-shore countries,only Algeria and Jordan have grid codes that allow the minimum technical,design,and operational criteria for supranational interconnections and number of end-users connecting to the grid system.Other MENA countries need to implement connection codes and prerequisites for further regional grid integration[52].Enhancement of domestic grids,substations,and harmonized grid codes and frequency,voltage,and communication technology standards among all trans-Mediterranean countries are prerequisites for implementing regional grid interconnections.In addition,pumped storage,electric batteries,and power-to-X(hydrogen and its derivatives)are important flexible sources for integrated systems that maximize RES penetration[53-56].

In the next decade,the current ±500-600 kV/1.5-2.5 GW HVDC submarine cables are expected to be upgraded to ±800 kV/5 GW HVDC cables to provide greater capacity at longer transmission distances and deeper water depths for new trans-Mediterranean lines[18,57].

4.3 Financing instruments

In general,south- and east-shore countries are confronted with ‘bankability issues’ in terms of implementing power sector masterplans,particularly regarding transmission projects[58].Multilateral and commercial banks are more likely to finance low-risk infrastructure projects,whereas mobilizing capital instruments are indispensable for realizing supranational transmission projects[59].These instruments include the Connecting Europe Facility,European Fund for Strategic Investment,European Bank for Reconstruction and Development,European Investment Bank,Kreditanstalt für Wiederaufbau,Agence Française de Développement,and Arab Fund for Economic and Social Development.In addition,private/international investments such as guaranteed foreign capital brought by engineering procurement,and construction/EPC contractors also provide financial assistance.In general,new business instruments and schemes encompassing concession-based models,power purchase agreements,public-private partnership arrangements,and relevant host country-issued long-term guarantees would profoundly reduce merchant investors’revenue uncertainty.In addition,national monopolized utilities need to raise their creditworthiness and reduce their use of conventional gas turbine fuels for North African countries to reduce financing risks,secure sustainable returns on investments,and attract private and foreign capital for trans-boundary project development.

5 Trans-Mediterranean energy decarbonization roadmap

Economic and demographic growth in south- and eastshore countries would lead to continuously greater power demand in the region(Tables 1 and 2).Electricity plays a core role in the decarbonized energy system on the path to an in-time regional zero-emission pattern.A well-built trans-Mediterranean backbone grid system will hedge the profound evolution of regional generation,transmission,and consumption sectors.

5.1 Generation sector

As analyzed by Med-TSO,regional countries had a total power demand of approximately 2 PWh in 2019 and this is projected to increase by approximately 27% to 2.53 PWh by 2030,mainly because of south- and east-bank countries[60].Lead by Spain,Jordan,Egypt,and Morocco,the Med-TSO economies show an ambitious RES deployment target,although flexible storage sources as well as physical grid interconnection capability in south- and east-shore countries are generally limited.Specifically,the lack of freshwater in the MENA has caused an energy-water nexus making desalinization an electricity-intensive sector[61].Although only initiated in the last decade,fiscal incentives and public/private financing,as well as loans and grants,have been introduced to promote renewable desalinization in the MENA[62].Common fiscal incentives include capital subsidies,tax reductions,and investment credit.Public competitive bidding for a certain quantity of RESs has already been implemented in the region.

5.2 Transmission sector

The EU has set a 10% European interconnection target by 2020(measured as the electricity import capacity over the installed generation capacity).For example,France is well interconnected with 17.4 GW of export and 12.5 GW of import capacity(interconnection rate of 11.4%);other north-shore countries,however,still need to increase their interconnection rate[63].

The greater pace of economic and demographic increase in the coming decades will trigger greater power demand(Tables 1 and 2).An integrated trans-Mediterranean grid will improve system reliability,take advantage of diurnal,seasonal,and cross-longitudinal demand diversity,and disparage marginal production costs for European and MENA countries[64,65].After commissioning the above projects,the surplus of the CESA could easily match the increased demand in the Maghreb and Mashreq countries.In addition,Maghreb solar energy imports are pivotal for a decarbonized CESA system.Along with physical interconnections based on HVAC and HVDC lines,a general agreement such as the power exchange trading agreement signed by the GCC countries is a good example to facilitate regional power trade in the MENA region and then trans-Mediterranean wide[45].

5.3 Consumption sector

Owing to the high emissions in the consumption sector(Fig.3),the development of higher-efficiency electrical appliances,equipment,and vehicles is inevitable in future building,transportation,and industry sectors[66].In 2020,except for Israel,the total final energy consumption rates of the Med-TSO countries was less than 25%(Fig.6).Moreover,hard-to-abate heavy industry and long-haul freight,shipping,and aviation will promote the powerto-X(hydrogen,methane,ethanol,and biofuel)industry[57],heading to a ‘Desertec 3.0’ version symbolized by an integration of green electrons and molecules through the entire Mediterranean energy value chain[24].

Fig.6 Electricity consumption and share of electricity in total final consumption(2020)

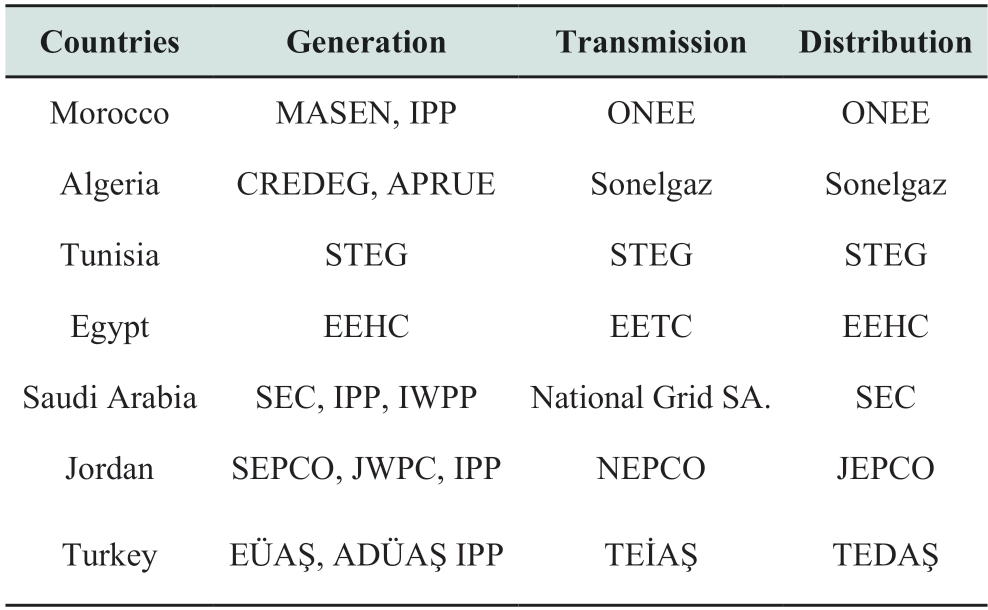

To avoid the discretion of state-owned utilities and achieve competitive,cost-saving,and reliable services for all consumers,policymakers in north-shore countries are obliged to unbundle incumbent utilities.However,their counterparts in south- and east-shore countries now entail only a preliminary unbundling status with a single buyer model and limited bilateral agreements(Table 3).Until now,past practices have revealed that interconnectors among countries without a liquid and transparent wholesale market are usually poorly utilized.In light of the standard phases of power market restructuring,a vertically integrated monopoly would lead to the following phases:(1)a single buyer model to commercialize/privatize the generation sector and introduce independent power/waterpower producers(IPPs/IWPPs)into the value chain,(2)a wholesale competition model to unbundle the distribution sector,and(3)a wholesale + retail competition model now commonly applied as a spot market in the CESA.Morocco,Algeria,and Egypt have approached Phase 1,while being able to handle a day-ahead and intraday market under the platform of Enerji Piyasaları İşletme(EPİAŞ),Turkey is now in a transit period between Phases 2 and 3.Technically,further unbundling procedures for MENA utilities require holistic preparation and implementation of account,functional,legal,and ownership unbundlings and could be pivotal prerequisites for further integration with the CESA.

Table 3 Power sector regulation frameworks in relevant MENA countries

6 Conclusion

Climate change is becoming an important issue in all infrastructure development fields.To date,coal-fired fleets and gas-fired power plants continue to be heavily used in Turkey,Israel,Italy,and in all south- and east-shore countries.

Currently,only Turkey and the Maghreb countries,namely Morocco,Algeria,and Tunisia,are connected with the CESA.Other south- and east-shore countries have insufficient interconnections and synchronization difficulties that have been major obstacles to the implementation of large-scale solar and wind development and the attainment of climate goals.In recent decades,over 50 cross-sea power transmission submarine cables(mainly DC lines)have been commissioned,particularly in Europe.

South- and east-shore grids further integrated into the CESA can significantly profit from the share of renewables and decarbonize the MENA energy sector.For south- and east-shore countries,major legal and regulatory barriers such as non-liberalized market structures,regulation gaps of taxation and transmission tariffs,and private sector access rights,need to be examined and removed.Enhancement of domestic grids,substations,and harmonized grid codes and frequency,voltage,and communication technology standards among all trans-Mediterranean countries are prerequisites for implementing regional grid interconnection.In addition,mobilizing capital instruments along with private and international investments is indispensable to realizing supranational transmission projects.

Electricity plays a core role in the decarbonized energy system on the path to a regional neutral emission pattern.A well-built trans-Mediterranean backbone grid system will hedge the profound evolution of regional generation,transmission,and consumption sectors.Along with RES development and supranational grid integration,the development of more-efficient electrical appliances,equipment,and vehicles is inevitable in the decarbonized building,transportation,and industrial sectors.

Acknowledgement

This study was supported by the National Science Foundation of China(Grant No.41701232).

Declaration of Competing Interest

We declare that we have no conflict of interest.

References

[1]Yu KF,Huang L,Yan T,et al.(2021)Synergies of renewables development and grid interconnection in the Middle East.In:CIGRE CGG Power Proceedings 2021,25 October 2021

[2]Yu KF,Werkmeister CB(2019)Trans-boundary energy and electricity markets.In:CIGRE GCC Power Proceedings 2019,Muscat,Oman,27 October 2019

[3]Liu ZX,Zhang Y,Wang Y,et al.(2020)Development of the interconnected power grid in Europe and suggestions for the energy internet in China.Global Energy Interconnection 3(2):111-119

[4]Zhang XP(2019)Development of European energy internet and the role of Energy Union.In:Su WC,Huang AQ(eds)The Energy Internet.Amsterdam:Elsevier,347-367

[5]Zappa W,Junginger M,van den Broek M(2019)Is a 100%renewable European power system feasible by 2050? Appl Energy,233-234:1027-1050

[6]Timmerberg S,Sanna A,Kaltschmitt M,et al.(2019)Renewable electricity targets in selected MENA countries - Assessment of available resources,generation costs and GHG emissions.Energy Rep 5:1470-1487

[7]Yu KF,Huang L,Yan T,et al.(2022)Grid interconnection and sustainable development in Middle East and North Africa(MENA).J Global Energy Interconnec 5(1):71-84(in Chinese)

[8]World Bank(2013)Middle East and North Africa - integration of electricity networks in the Arab world:regional market structure and design.https://documents.worldbank.org/en/publication/documents-reports/documentdetail/415281468059650302/middle-east-and-north-africa-integration-of-electricity-networksin-the-arab-world-regional-market-structure-and-design.Accessed 26 April 2021

[9]Hasan S(2018)Electricity market integration in the GCC and MENA:imperatives and challenges.King Abdullah Petroleum Studies and Research Center

[10]Zhang XP,Ou MY,Song YM,et al.(2017)Review of Middle East energy interconnection development.J Mod Power Syst Cle 5(6):917-935

[11]Arab Union of Electricity(2020)29th Arab Electricity Magazine 2020.https://auptde.org/en/latest-releases.Accessed 26 April 2021

[12]Hirth L,Mühlenpfordt J,Bulkeley M(2018)The ENTSO-E transparency platform - a review of Europe’s most ambitious electricity data platform.Appl Energy 225:1054-1067

[13]European Network of Transmission System Operators for Electricity(2020).Ten-year network development plan(TYNDP)2020 main report version for ACER opinion.https://eepublicdownloads.blob.core.windows.net/public-cdn-container/tyndp-documents/TYNDP2020/Foropinion/TYNDP2020_Main_Report.pdf.Accessed 26 April 2021

[14]van Son P,Ruderer D(2012).Capturing synergies among the power markets around the Mediterranean.Robert Schuman Centre for Advanced Studies Research Paper No.RSCAS 2015/42 https://ssrn.com/abstract=2631088 or http://dx.doi.org/10.2139/ssrn.2631088

[15]Ferrante A,Sabelli C,Bué E,et al.(2018)The Mediterranean Mater Plan - Consolidating a secure and sustainable electricity infrastructure in the Mediterranean region.AEIT International Annual Conference 10.23919/AEIT.2018.8577419

[16]Dittmann F(2012)Frank Shuman und die frühe nutzung der solarenergie.In:Fraunholz U,Wölfel S(Eds)Ingenieure in der technokratischen Hochmoderne.Münster:Waxmann,p 181-193

[17]Tian Y,Zhao CY(2013)A review of solar collectors and thermal energy storage in solar thermal applications.Appl Energy 104:538-553

[18]Global Energy Interconnection Development and Cooperation Organization(2020).The development roadmap of high voltage and large capacity DC submarine cable technology.China Electric Power Press,Beijing,p 1-38

[19]Global Energy Interconnection Development and Cooperation Organization(2019).Research and outlook on global energy interconnection.China Electric Power Press,Beijing,p 49-86

[20]Global Energy Interconnection Development and Cooperation Organization(2020).The development and outlook of UHV transmission technology.China Electric Power Press,Beijing,p 1-149

[21]Benasla M,Allaoui T,Brahami M,et al.(2018)HVDC links between North Africa and Europe:Impacts and benefits on the dynamic performance of the European system.Renew Sustain Energy Rev 82(3):3981-3991

[22]Dii GmbH(2012)Desert Power 2050:Perspectives on a sustainable power system for EUMENA.München Germany

[23]Dii GmbH(2013)Desert Power 2050:Getting started - The manual for renewable electricity in MENA.München Germany

[24]Dii GmbH(2014)Desert Power:Getting connected.Starting the debate for the grid infrastructure for a sustainable power supply in EUMENA.München Germany.https://dii-desertenergy.org/wp-content/uploads/2016/12/2014-08-07_DPGC_Full-Report.pdf

[25]Mediterranean Transmission System Operators(2020)The Mediterranean project booklet - Consolidating secure and sustainable electricity infrastructure in the Mediterranean region.Med-TSO,Rome

[26]European Commission(2014)Communication:A policy framework for climate and energy in the period from 2020 to 2030.European Commission,Brussels,Belgium

[27]International Renewable Energy Agency(2021).Renewable capacity statistics 2021.https://www.irena.org/publications/2021/March/Renewable-Capacity-Statistics-2021.Accessed 26 April 2021

[28]Mediterranean Transmission System Operators(2018)Mediterranean Master Plan of interconnections objective 2030-Outlook of the task and deliverables:Task 2 Planning and development of the Euro-Mediterranean Electricity Reference Grid.Med-TSO,Rome

[29]European Network of Transmission System Operators for Electricity(2021)European Resource Adequacy Assessment(2021 Edition).https://www.entsoe.eu/outlooks/eraa/2021.Accessed 1 June 2022

[30]International Energy Agency(2021).Renewables 2021-Analysis and forecast to 2026.IEA,Paris

[31]Kilickaplan A,Bogdanov D,Peker O,et al.(2017)An energy transition pathway for Turkey to achieve 100% renewable energy powered electricity,desalination and non-energetic industrial gas demand sectors by 2050.Solar Energy 158:218-235

[32]Leal-Arcas R,Akondo N,Alemany R,et al.(2017)Energy trade in the MENA region:looking beyond the Pan-Arab electricity market.J World Energy Law Bus,10(6):520-549

[33]Mediterranean Transmission System Operators(2021)Statistical report - Mediterranean project 2(2018-2020).Med-TSO,Rome

[34]Tagliapietra S(2016)Renewable in the southern and eastern Mediterranean:Current trends and future developments.In:Rubino A,Campi MTC,Lenzi V,Ozturk I(eds)Regulation and Investments in Energy Markets.Academic Press,41-71

[35]Khalfallah H(2015)Connecting Mediterranean countries through electricity corridors:New institutional economic and regulatory analysis.Util Policy,32:45-54

[36]Brinkerink M,Gallachóir B,Deane P(2019)A comprehensive review on the benefits and challenges of global power grids and intercontinental interconnectors.Renew Sustain Energy Rev,107:274-287

[37]International Energy Agency(2019)Integrating power system across borders.Organization for Economic Cooperation and Development,Paris,France

[38]Böttcher PC,Gorjão LR,Beck C,et al.(2022)Initial analysis of the impact of the Ukrainian power grid synchronization with continental Europe.Phys Soc https://doi.org/10.48550/arXiv.2204.07508

[39]Bouzid MA,Flazi S,Stambouli AB(2019)A cost comparison of metallic and earth return path for HVDC transmission System case study:connection Algeria-Europe.Electr Power Syst Res 171:15-25

[40]Poudineh R,Rubino A(2017)Business model for cross-border interconnections in the Mediterranean basin.Energy Policy,107:96-108

[41]Brand B,Zingerle J(2011)The renewable energy targets of the Maghreb countries:impact on electricity supply and conventional power markets.Energy Policy 39(8):4411-4419

[42]Cavana M,Leone P(2021)Solar hydrogen from North Africa to Europe through greenstream:A simulation-based analysis of blending scenarios and production plant sizing.Inter J Hydrog Energy 46(43):22618-22637

[43]Shen H,Dai Q,Wu Q,et al.(2018)The state-of-the-arts of the study on grid interconnection between Iberian Peninsula and West Maghreb region.Global Energy Interconnection,1(1):20-28

[44]Zhang Y,Xiao JY,Zhou Z(2021)Research on the implementation of West Africa-North Africa grid interconnection using new electricity-water composite transmission technology.Global Energy Interconnection,4(5):485-492

[45]Gulf Cooperation Council Interconnection Authority(2019).Annual report.https://www.gccia.com.sa/Data/Downloads/Reports/FILE_25.pdf.Accessed 26 April 2021

[46]Trieb F,Müller-Steinhagen H(2008)Concentrating solar power for seawater desalination in the Middle East and North Africa.Desalination 220(1-3):165-183

[47]Cavana M,Leone P(2021)Solar hydrogen from North Africa to Europe through greenstream:A simulation-based analysis of blending scenarios and production plant sizing.Inter J Hydrog Energy 46(43)22618-22637

[48]Global Energy Interconnection Development and Cooperation Organization(2020).The development and outlook of clean energy power generation technology.China Electric Power Press,Beijing,p 71-101

[49]Fischhendler I,Herman L,Anderman J(2016)The geopolitics of cross-border electricity grids:The Israeli-Arab case.Energy Policy 98:533-543

[50]Griffiths S(2017)A review and assessment of energy policy in the Middle East and North Africa region.Energy Policy 102:249-269

[51]Carafa L,Frisari G,Vidican G(2016)Electricity transition in the Middle East and North Africa:a de-risking governance approach.J Clean Prod 128:34-47

[52]Trieb F,Schillings C,Pregger T,et al.(2012)Solar electricity imports from the Middle East and North Africa to Europe.Energy Policy 42:341-353

[53]van Wijk A,Chatzimarkakis J(2020)Green hydrogen for a European green deal a 2*40 GW initiative.https://static1.squarespace.com/static/5d3f0387728026000121b2a2/t/5e85aa53 179bb450f86a4efb/1585818266517/2020-04-01_Dii_Hydrogen_Studie2020_v13_SP.pdf.Accessed 26 April 2021

[54]International Renewable Energy Agency(2021)World energy transitions outlook:1.5℃ pathway.https://www.irena.org/publications/2021/March/World-Energy-Transitions-Outlook.Accessed 26 April 2021

[55]International Renewable Energy Agency(2019).Renewable energy market analysis:GCC 2019.https://www.irena.org/publications/2019/Jan/Renewable-Energy-Market-Analysis-GCC-2019.Accessed 26 April 2021

[56]Gandía LM,Arzamendi G,Diéguez PM(2013)Renewable hydrogen technologies.production,purification,storage,applications and safety.https://www.sciencedirect.com/book/9780444563521/renewable-hydrogen-technologies.Accessed 26 April 2021

[57]van der Zwaan B,Lamboo S,Longa FD(2021)Timmermans’dream:An electricity and hydrogen partnership between Europe and North Africa.Energy Policy 159 https://doi.org/10.1016/j.enpol.2021.112613

[58]Allal HBJ,Urbani M(2016)Financing Mediterranean electricity infrastructure:Challenges and opportunities for an interconnected Mediterranean grid.In:Rubino A,Campi MTC,Lenzi V,Ozturk I(eds)Regulation and Investments in Energy Markets.Academic Press,pp 275-291

[59]Krupa J,Poudineh R,Harvey LD(2019)Renewable electricity finance in the resource-rich countries of the Middle East and North Africa:A case study on the Gulf Cooperation Council.Energy 166:1047-1062

[60]Moretti A,Pitas C,Christofi G,et al.(2020)Grid integration as a strategy of Med-TSO in the Mediterranean area in the framework of climate change and energy transition.Energies 13(20):5307

[61]Negewo BD(2012)Renewable energy desalination:an emerging solution to close the water gap in the middle east and north Africa.World Bank,Washington DC,p 87-109

[62]Olaofe ZO(2018)Review of energy systems deployment and development of offshore wind energy resource map at the coastal regions of Africa.Energy 161:1096-1114

[63]Maltby T(2013)European Union energy policy integration:a case of European Commission policy entrepreneurship and increasing supranationalism.Energy Policy 55(100):435-444

[64]Cambini C,Franzi D(2013)Independent regulatory agencies and rules harmonization for the electricity sector and renewables in the Mediterranean region.Energy Policy 60:179-191

[65]Martínez-Anido CB,L’Abbate A,Migliavacca G,et al.(2013)Effects of North-African electricity import on the European and the Italian power systems:a techno-economic analysis.Electr Power Syst Res 96:119-132

[66]Belaïd F,Zrelli MH(2019)Renewable and non-renewable electricity consumption,environmental degradation and economic development:Evidence from Mediterranean countries.Energy Policy 133 https://doi.org/10.1016/j.enpol.2019.110929

[67]USAID(2022)Strengthening utilities and promoting energy reform utility unbundling &electricity market reform.https://pdf.usaid.gov/pdf_docs/PA00Z748.pdf

Received:12 Feburary 2022/Accepted:4 July 2022/Published:25 Feburary 2023

Kaifeng Yu

Kaifeng Yu

kaifeng-yu@geidco.org

Paul van Son

paul@dii-desertenergy.org

2096-5117/© 2023 Global Energy Interconnection Development and Cooperation Organization.Production and hosting by Elsevier B.V.on behalf of KeAi Communications Co.,Ltd.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

Biographies

Kaifeng Yu received Doctor Degree of Natural Science(Dr.rer.nat.)at RWTH Aachen,Germany(2017).He is now Senior Environmental Engineer at the Middle East and North Africa(MENA)Office,Global Energy Interconnection Development and Cooperation Organization(GEIDCO).His research interests includes arid realm climate &environmental change,energy modelling,remote sensing and geographic information system(GIS)techniques.

Paul van Son received Master of Science at Technical University of Delft,Netherlands,and Master of Corporate Governance at Nyenrode University,Netherlands.He is the president of Dii Desert Energy,and the founder and honorary President of the European Federation of Energy Traders.He was the Chairman for innogy SE(former RWE)’s MENA branch.He has been active for 40 years in various supervisory board,executive and operations management positions in the international(renewable)energy,grid infrastructure and gas business.

(Editor Yanbo Wang)