0 Introduction

There is a general consensus in the global energy field that a clean,low-carbon,safe,and efficient energy system must be built,promoting the revolution of energy production and consumption.Based on research in recent years,the realization of such an energy revolution in the future will mainly depend on the development of distributed energy[1].Considering this,distributed operation and transaction models,such as peer-to-peer(P2P)[2-5]and community models[6,7],are emerging.With the development of distributed energy trading,its security,reliability,and privacy protection have gained attention.Blockchain technology is decentralized,traceable,and cannot be tampered with.Therefore,it can potentially be used for solving security problems and protecting privacy[8].In a blockchain-based environment,a peer can conduct non-intermediary power transactions with other peers in the system[9].

Various studies have focused on P2P transactions in the field of electric energy[10-12].The focus of existing literature has mostly been concentrated in the following three areas[13]:electric vehicles[14,15],microgrids[16,17],and distribution networks[18].A key challenge in P2P power trading is designing a safe,efficient,and transparent trading mode and operation mechanism.For the P2P trading mechanism of distributed energy,various schemes using different auction mechanisms have been proposed.A P2P energy trading framework based on blockchain was built in[19],integrating bilateral contracts,e-commerce platforms,the Vickrey-Clarke-Groves(VCG)mechanism,and transactions with power grids.In[20],a k-double auction was used for photovoltaic P2P transactions.For P2P energy trading in a community microgrid,[21]proposed a new iterative unified price auction mechanism and designed an adaptive algorithm of the auction market to find the equilibrium point.Among these aforementioned mechanisms,the VCG mechanism is widely used because it ensures that users tell the truth and achieve an efficient consumption distribution.However,the VCG mechanism is budget unbalanced(i.e.,the total expenditure of buyers is not equal to the total income of sellers),resulting in economic deficits for market operators.A budget redistribution method of the VCG mechanism was proposed in[22],but it only addressed the imbalance to some extent.One possible solution to the budget imbalance is the Arrowd’Aspremont-Gerard-Varet(AGV)mechanism.

The AGV mechanism is Bayesian incentive-compatible and budget balanced under weak participation requirements[23].Thus,it has been applied in many fields.In[24],an enhanced AGV mechanism was designed for demand side management in a smart grid.In[25],the AGV mechanism was applied to set the air conditioning temperature in buildings.The AGV mechanism was used for node selection in a wireless relay system in[26].To the best of our knowledge,no study has focused on exploring P2P power trading based on the AGV mechanism.The AGV mechanism requires all agents to have a common belief in the priori distribution of the types of all agents,limiting the practical application of this mechanism.The types of all agents were assumed to follow an exponential distribution in[26],ignoring the differences between agents.We introduce the kernel density estimation(KDE)method to estimate the prior distribution from the historical bid/offer information of the agents and estimate the prior distribution of the agents more accurately.

Mechanism design is an art of game design,in which the Bayesian game plays a central role.There are many ways to find the Bayesian Nash equilibrium,such as payoff matrices[27],sensitivity functions[28],and evolutionary algorithms[29].However,we do not focus on the solution of the equilibrium but on the design of a P2P trading mechanism,through which designers achieve desirable equilibriums.We design an AGV auction mechanism,focusing on transaction matching and price setting in P2P power trading.Prosumers are considered rational,aiming to gain more economic benefits from P2P transactions.Prosumers have private information on reserve prices.Different trading scenarios are simulated and compared to prove the effectiveness of the proposed P2P energy trading mechanism.

The rest of this paper is organized as follows.In Section 1,the system model of distributed energy trading is introduced.In Section 2,the AGV mechanism of P2P power trading is described.Section 3 presents an example analysis,and Section 4 outlines the conclusions.

1 System model

A distributed energy transaction based on blockchain technology is shown in Fig.1.This platform is mainly responsible for designing the transaction mechanism and managing security and fairness.

Fig.1 Distributed energy transaction based on blockchain technology

The transaction subjects in Fig.1 are prosumers.Each prosumer has a photovoltaic system,an energy storage system(ESS),a load,and a smart meter.The excess energy after self-consumption is stored in the ESS or externally traded.Prosumers can purchase electricity from the power grid at a price of pe or sell excess energy to the power grid at a price of pFiT.

After explaining the infrastructure,the main purpose of this paper is to propose an auction-based mechanism of P2P energy trading in a microgrid.Prosumers are assumed rational and independent,capable of selling their excess energy or buying energy in the trading market.

The reserve price refers to the lowest/highest transaction price acceptable to the sellers/buyers,which is widely considered in auction mechanism design.In each trading period,prosumers calculate their current reserve price,which depends on their optimal external choice other than P2P trading.The optimal external choice of the sellers is to charge the ESS or sell electricity to the power grid.For the buyers,it is to discharge energy through the ESS or purchase power from the grid.The reserve price of the i-th prosumer at time slot td is calculated as

where ![]() is the total cost of the optimal external selection for the i-th prosumer at time slot t($)and

is the total cost of the optimal external selection for the i-th prosumer at time slot t($)and ![]() is the energy surplus or shortage of the i-th prosumer at time slot td(kW·h).

is the energy surplus or shortage of the i-th prosumer at time slot td(kW·h).

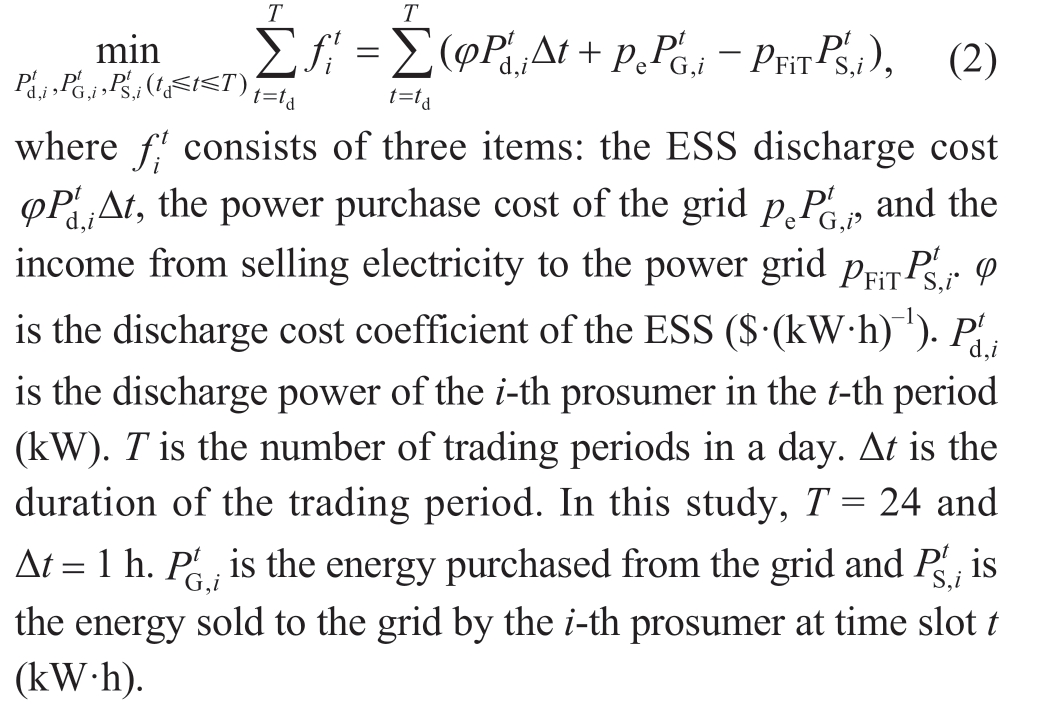

The solution of the optimal external choice is related to the charge and discharge power up to time slot T because of the energy level constraint of the ESS((9)below).At time slot td,each prosumer solves the optimization function of the optimal external choice with the objective of minimizing the total cost from the current period to time slot T:

The above optimization problem is subject to the following constraints:

1)Constraints of energy balance

2 AGV Mechanism for P2P Energy Trading

From the social equity perspective,mechanism designers want to efficiently utilize the electricity provided by prosumers and maximize the social welfare.The basic requirement of fairness in auctions is that all participants disclose real information when bidding for resources[24].In other words,the mechanism designers in the electricity market expect prosumers to disclose their true reserve prices.Aligning personal goals with social goals requires carefully crafted pricing schemes.

One possible way to persuade prosumers to truthfully declare their reserve prices is the VCG mechanism.However,the VCG mechanism is weak budget-balanced,indicating that the mechanism designer must pay some extra fees to the system.It is the main obstacle to the implementation of the bilateral auction VCG mechanism[19].The AGV mechanism is a feasible way of compensating for this loss.

2.1 Key elements of the AGV mechanism

A mechanism can be written as a tuple(φ,t),where φ represents the social choice(i.e.,the P2P transaction power vector)and t ={ti} is the transfer payment vector of the agent under the social choice φ.The key elements of the AGV mechanism are summarized below.

a)There are at least two agents and one social selecting result.

b)The reserve price of each agent is private information.The finite set Θi represents all feasible bids/offers of the i-th agent.During the t-th time slot,the auction agency collects the bids/offers of all agents and selects an effective result to maximize the social welfare.

c)The total payoff or welfare of the i-th agent is denoted by ui,which is expressed as

where ![]() is the utility of the i-th agent,which depends on the real information

is the utility of the i-th agent,which depends on the real information ![]() of the agent and the result of social choice

of the agent and the result of social choice ![]() The transfer payment

The transfer payment ![]() is explained later in Section 2.3.1.

is explained later in Section 2.3.1.

d)The AGV mechanism conforms to the Bayesian settings,in which all agents have a common belief in the priori distribution of all types of agents.However,bids/offers in the current period are private information.Calculating the expectation of the priori distribution is a problem that must be solved and will be explained in Section 2.3.2.

2.2 Economically efficient clearing based on the AGV mechanism

In each P2P trading period,the prosumers with surplus electricity are the energy sellers,and those with insufficient energy are the buyers.Let ![]() be the number of sellers and buyers in the t-th period,which are unchanged in the period.

be the number of sellers and buyers in the t-th period,which are unchanged in the period.![]() refers to the collection of bids/offers of all prosumers.The bids of the buyers are recorded as positive numbers,and the offers of the sellers are negative.Economically efficient clearing in the t-th period can be expressed as the following linear programming problem.Given a set of bids/offers of all prosumers in the t-th period,the trading power of each prosumer

refers to the collection of bids/offers of all prosumers.The bids of the buyers are recorded as positive numbers,and the offers of the sellers are negative.Economically efficient clearing in the t-th period can be expressed as the following linear programming problem.Given a set of bids/offers of all prosumers in the t-th period,the trading power of each prosumer ![]() must be solved to maximize the social welfare.

must be solved to maximize the social welfare.

The inequality presented in(14)indicates that the P2P transaction energy at time slot t cannot exceed the demand or shortage in that period.Eq.(15)shows that the energy sold is equal to the energy bought in each time slot.Energy that cannot be sold or acquired through P2P transactions can be charged or discharged through the ESS or traded with the grid.

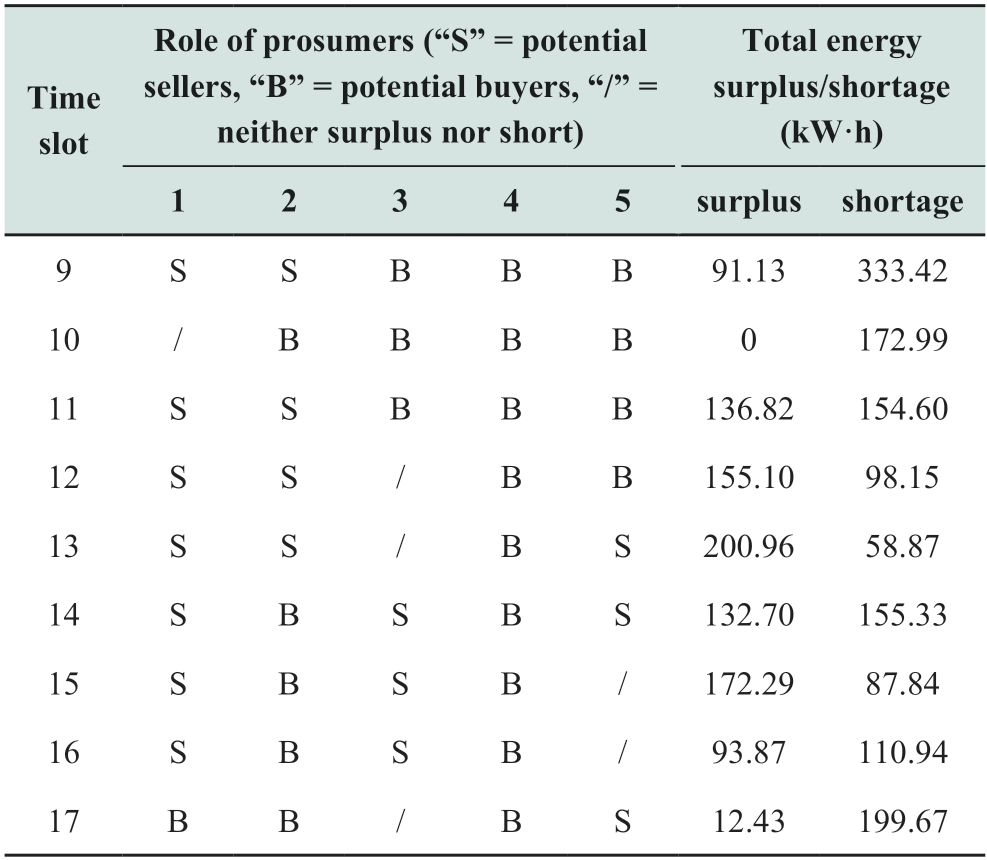

2.3 P2P transaction transfer payment based on the AGV mechanism

After the selection of the current trading period,the payment of the agent must be determined through a reasonable pricing mechanism.

2.3.1 Transfer payment function

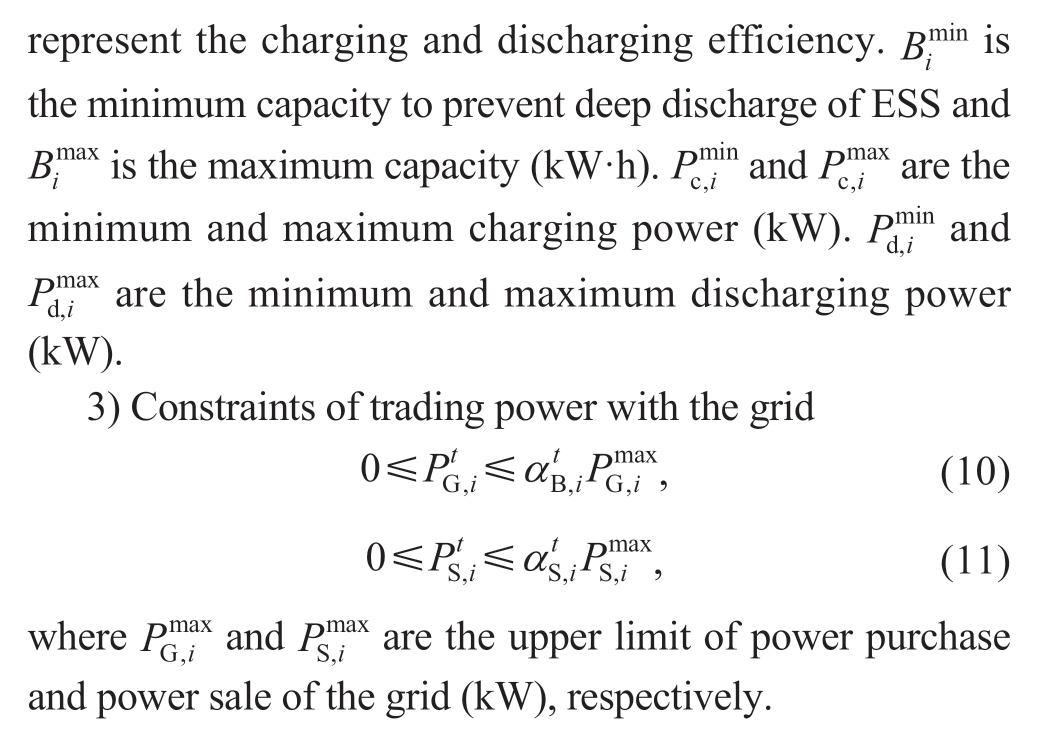

The transfer payment of P2P sellers is the amount received from the auction agency while that of the buyers’is the amount paid to the auction house.It should be noted that the transfer payment of buyers is recorded negative.The transfer payment of prosumers not participating in P2P transactions is 0.Given the bids/offers of all agents,the transfer payment of the i-th agent is given by

where θ-i is the i-th agent’s expectation vector of the prior distribution of other agents’ bids/offers except itself.![]() represents the expectation.

represents the expectation.![]() is the payment redistribution function,which aims to balance the payment distribution among the agents.

is the payment redistribution function,which aims to balance the payment distribution among the agents.

where n is the number of P2P energy traders.

2.3.2 Expectation calculation based on KDE

The AGV mechanism requires all agents to have a common belief in the prior distribution of all agents’ types,limiting the practical application of the AGV mechanism.KDE is one of the typical nonparametric density estimation methods.It does not need a priori knowledge of the data distribution but studies the data characteristics from the sample itself.KDE infers the distribution of the population data from the existing sample set if the appropriate kernel function and window width are selected.The historical bids/offers of agents are public information.We introduce the KDE method to estimate the prior distribution of bids/offers of other agents from the historical information to calculate expectations.

Suppose an agent has nd days of historical bid/offer data X1,X2,…,Xnd in a certain trading period,such as 13:00-14:00 every day.The probability density function obtained by KDE can be expressed as

where K0 is the kernel function selected and h is the window width.

Then,we can get the expectation as

where Xmin and Xmax are the sample maximum and minimum,respectively.

2.4 Budget balance and incentive compatibility of the AGV mechanism

The AGV mechanism in this study has budget balance and Bayesian incentive compatibility,which is proven as follows.

Theorem 1: The proposed AGV mechanism is post budget balanced.

Proof: For convenience of explanation,define

Payment rules(15)and(16)can be rewritten as

where

For any ![]() ,

,

Therefore,the budget balance of the AGV mechanism is proven.

Theorem 2: In the P2P power trading,the best strategy of the i-th agent is to report its real reserve price when agents 1,2,…,i-1,i+1,…,n report the real reserve prices(i.e.,the AGV mechanism is Bayesian incentive-compatible(BIC)).

Proof: The i-th agent can calculate its expected payoff as

2.5 Bilateral transactions on the blockchain

The AGV auction mechanism of the P2P power trading can be implemented in the Ethereum network based on the blockchain technology.The peers initiate the transaction on the client,and the platform completes the execution of the contract and the verification of the transaction.The mechanism designer can publicly release the smart contract to ensure that the transaction mechanism is recognized by all participants.

a)Information releasing:prosumers with power purchase or sale demand submit their information on the multilateral trading platform.They must pay a certain amount of ether as a deposit to prevent false requests.

b)Encryption and decryption of bids/offers:AGV auction is a sealed auction.When the prosumers submit bids/offers,they cannot know the information submitted by others.Therefore,an asymmetric encryption algorithm is used,and the bidding process is divided into two steps:encryption and decryption.Prosumers encrypt their bids/offers with the public key and submit the generated ciphertext to the platform.The platform uses the private key to decrypt the received bids/offers and verify the digital signature.

c)Delivery and settlement:the platform solves the optimization problem to maximize social welfare and ensure the power transferred within the specified time.The platform collects the actual power generation and consumption from the smart meter,calculates the actual transfer payment of each agent based on the AGV pricing mechanism,and returns their remaining deposits.All the deposits of those who fail to be selected will be returned.If any agent exits the transaction for some reason,he/she will not get the deposits back.

Fig.2 Flowchart of distributed multilateral transaction based on Ethereum

3 Case study

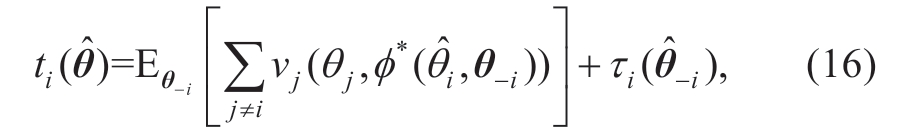

This paper considers a microgrid with five prosumers,each of which is equipped with a photovoltaic system and an ESS.The photovoltaic power generation and energy demand curves of prosumers are taken from[30].Table 1 shows the roles of prosumers in each trading period.pFiT and pe are set to 0.058 and 0.144 $/(kW·h)-1,respectively.The maximum and minimum capacities of ESS are 100 and 0 kW·h,respectively.The charging and discharging efficiency is 90%,and the maximum charging and discharging power is 50 kW.

Table 1 Role of prosumers in different P2P trading periods

3.1 KDE and P2P transaction results

In KDE,the commonly used standard normal distribution function is selected as the kernel function.The window width is 0.5818.Taking Agent 2 as an example,Fig.3 shows the real frequency histogram of the historical bids of Agent 2 att = 15 and the probability distribution curve obtained by KDE.

Fig.3 Frequency histogram and distribution obtained by KDE

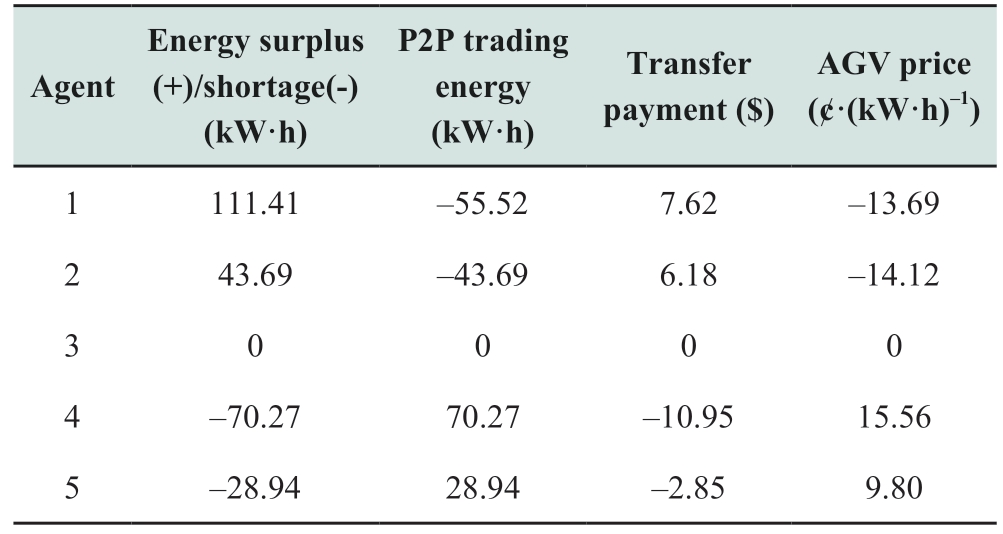

Based on the figure,KDE can estimate the probability density when the distribution type of the agent’s historical bids/offers is unknown.KDE is style="font-size: 1em; text-align: justify; text-indent: 2em; line-height: 1.8em; margin: 0.5em 0em;">Next,the P2P transaction results based on the AGV mechanism are shown.Without losing generality,this paper selects the 12th and 16th period for analysis,as shown in Tables 2 and 3.It should be noted that in the third column of Tables 2 and 3,a negative number indicates energy sold,and a positive one means energy purchased.

Table 2 Transaction results at t=12 under the AGV mechanism

Table 3 Transaction results at t=16 under the AGV mechanism

At time slot 12,the total surplus of energy is 155.10 kW·h,and the total shortage is 98.15 kW·h,which is in a state of oversupply.Prosumer 4 and Prosumer 5 meet all the energy demands in the 12th period through P2P transactions.As sellers,Prosumers 1 and 2 submitted offers of 0.065 and 0.058 $/kW·h,respectively.Prosumer 2 is selected in the social choice because of its lower offer and sells all its 43.69 kW·h surplus energy through P2P transactions.Moreover,an additional energy of 55.52 kW·h is provided by Prosumer 1.Some of the energy of Prosumer 1 that is not traded through P2P trading is sold to the grid.It should be noted that the AGV price for buyers is sometimes slightly higher than its reserve price.In bilateral bidding,the AGV mechanism is not always ex-post individually rational.

At time slot 16,the total energy surplus is 93.87 kW·h,and the shortage is 110.94 kW·h,which is in a state of short supply.Prosumers 1 and 3 sell all the surplus energy in the period through P2P transactions.As buyers,Prosumers 2 and 4 submitted bids of 0.144 and 0.147 $/(kW·h),respectively.Prosumer 4 is preferentially selected because of its higher bid and meets its energy demand through P2P transactions.Prosumer 2 gets 25.14 kW·h of energy in P2P transactions,and the shortfall is purchased from the grid.

3.2 Verification of budget balance and incentive compatibility of the AGV Mechanism

The results regarding the budget balance and incentive compatibility of the AGV mechanism are shown in the following two subsections.

3.2.1 Verification of budget balance of the AGV mechanism

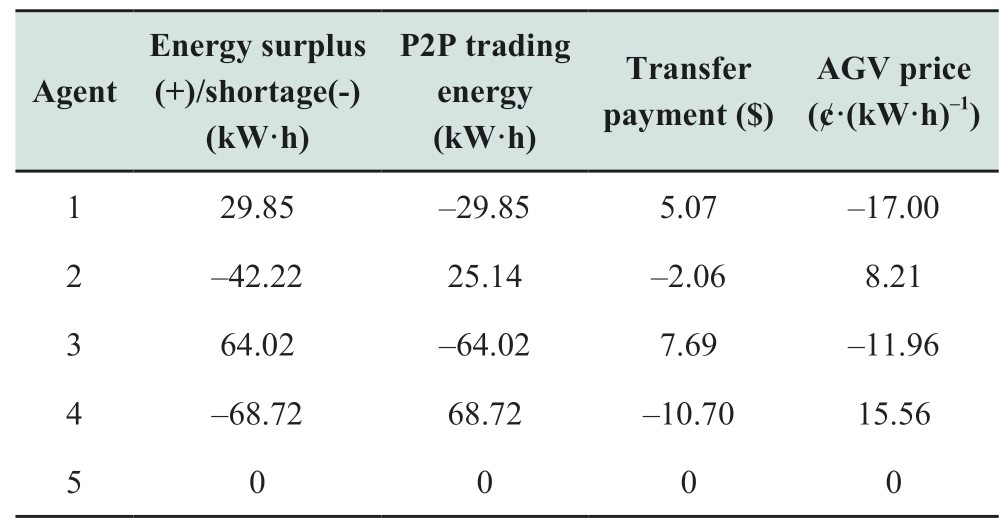

The transfer payments of the agents in each transaction period are shown in Fig.4.

Fig.4 Transfer payments in each transaction period under the AGV mechanism

In Fig.4,negative transfer payment represents the P2P energy cost of buyers.The positive part is the income that P2P sellers receive from the auction institution.If the transfer payment is 0,then the agent is not selected in this period.Fig.6 shows that in each trading period,the sum of the P2P expenditure of the buyers is equal to the sum of the P2P revenue of the sellers.The total transfer payments of all agents participating in the transaction is 0,verifying the balanced budget of the AGV mechanism.Budget balance ensures that auction agencies or mechanism designers do not lose money.The P2P transaction does not need subsidies from a third-party institution,reducing the complex links and is in line with the decentralization of P2P power trading.

3.2.2 Verification of Bayesian incentive compatibility of the AGV Mechanism

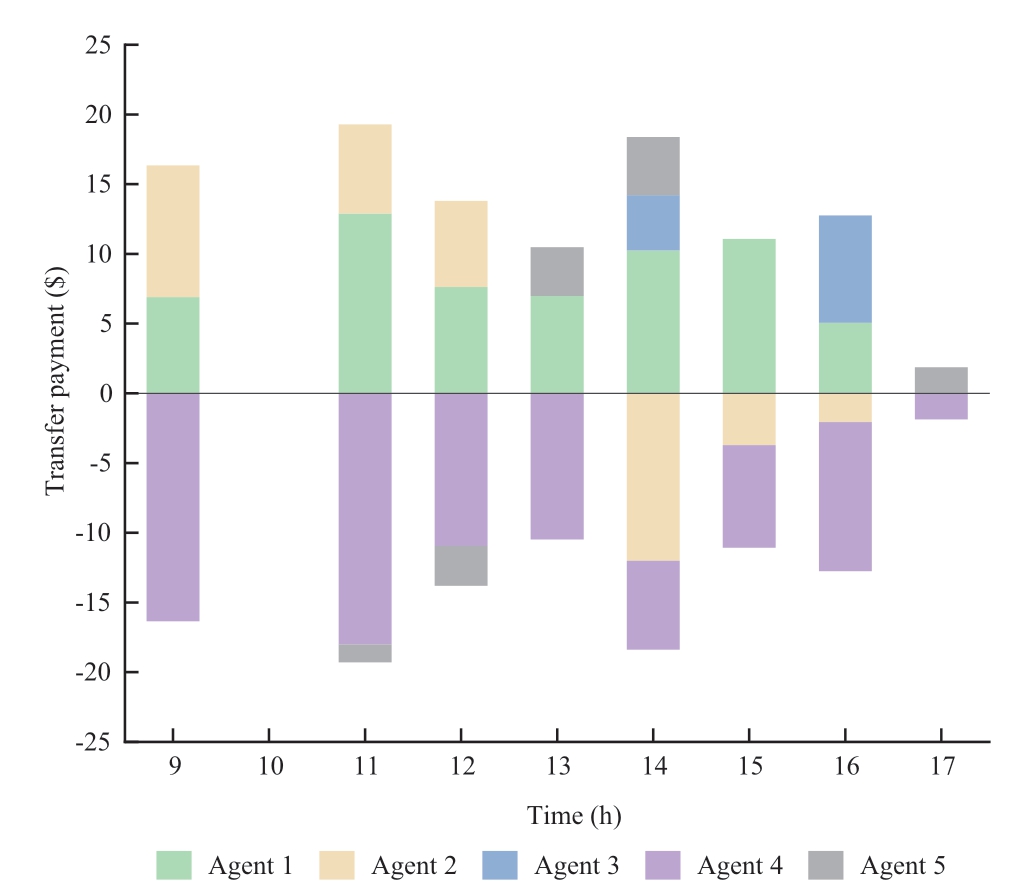

The agents’ expected payoffs under different bids or offers at t=16 are shown in Fig.5(a)and(b).

Fig.5 Expected payoff under different bids/offers

The expected payoff shown in Fig.5 is calculated in the interim stage,where agents know their own reserve price but not others’.Depending on the bids or offers submitted by other agents,the payoff under the AGV mechanism may be varying.If Agent 2 increases its bid,it gains more energy,but must pay more,resulting in a decrease in the expected payoff.During this period,all the power required by Agent 4 comes from P2P transactions.In other words,the P2P transaction power of Agent 4 reaches the maximum value in this period.Even if Agent 4 increases its bid,it cannot obtain a higher expected payoff.If Agent 4 lowers its bid,it will lose its competitive advantage in social choice and get lower P2P trading power and expected payoff.

In Fig.5(b),energy has a supply shortage during this period.Thus,the sellers’ clearing power and their expected payoff remain the same no matter how much they offer.The Bayesian incentive compatibility of the AGV mechanism encourages the real bids/offers of prosumers while meeting the goal of maximizing social welfare.This is what mechanism designers aim to achieve.

3.3 Comparison of AGV mechanism and other mechanisms

We compare the proposed mechanism with Peer to Grid(P2G)and the VCG mechanism,as shown in 3.3.1 and 3.3.2.

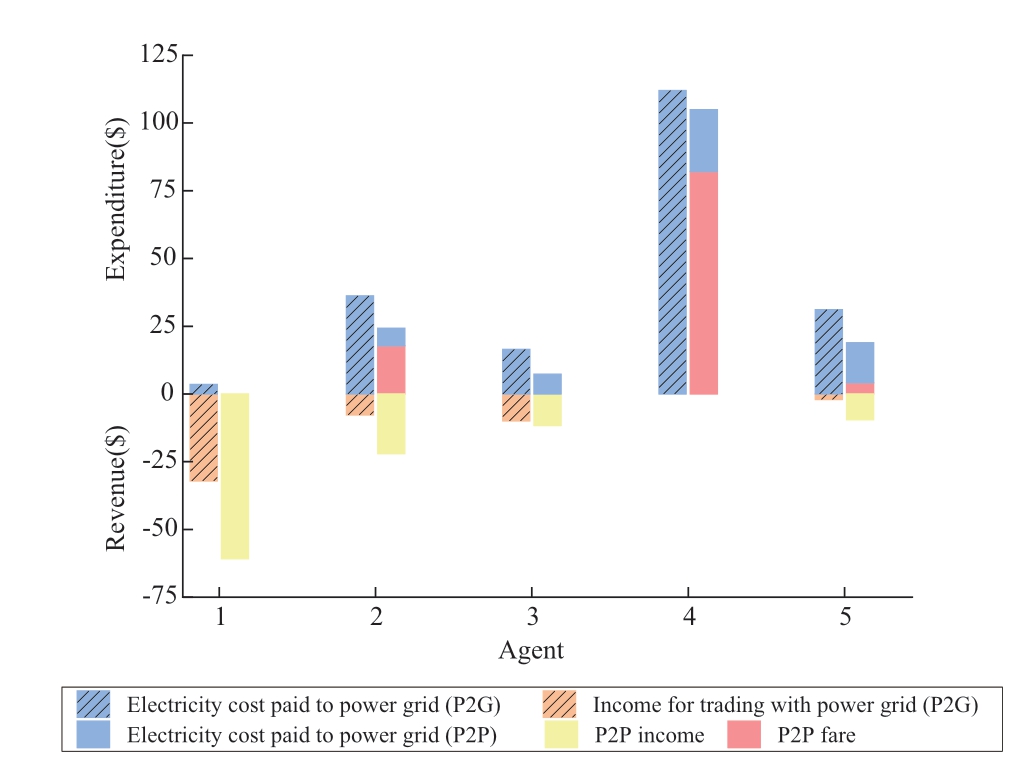

3.3.1 Comparison of P2G mode and AGV mechanism based P2P trading

P2G refers to trading only with the grid.In Fig.6,we compared expenditure and revenue for P2G and P2P in the daytime.In each set of bar graphs,the left part indicates expenditure and revenue for P2G,and the right one shows those of P2P trading.

Fig.6 Expenditure and revenue of P2G and P2P trading

The cost of all five agents decreased compared with P2G.The cost of purchasing electricity from the grid is reduced because of P2P trading.Moreover,sellers gain more profits through P2P trading,making it a preferred choice rather than selling energy to the grid.Prosumer 4 has no income because it has no extra energy.The P2P transaction based on the AGV mechanism reduces the dependence on the power grid by completely allocating available surplus energy in the microgrid.

3.3.2 Comparison of AGV mechanism and VCG mechanism

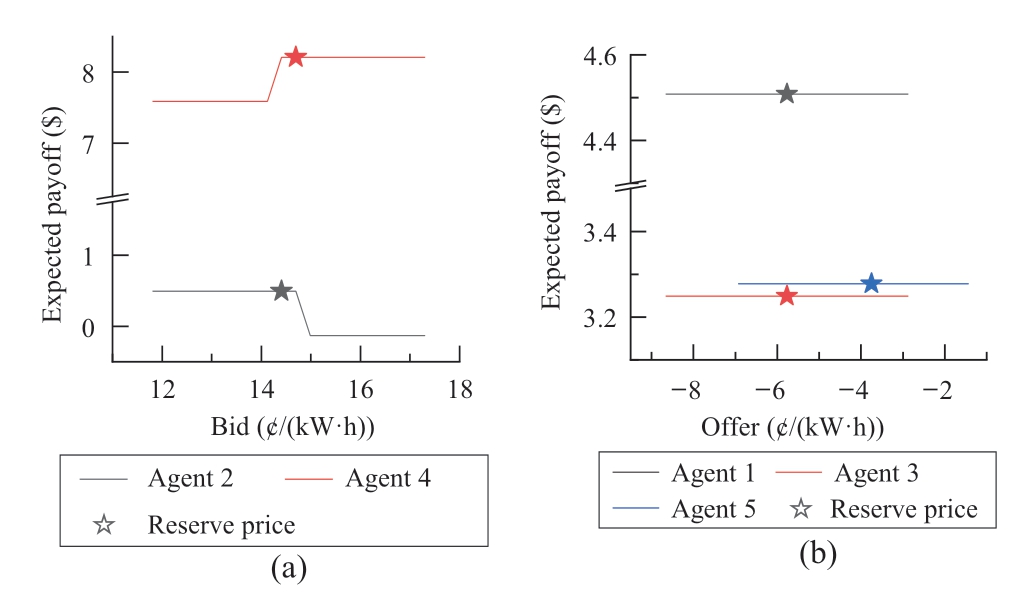

Taking period 12 as an example,the AGV mechanism is compared with the VCG mechanism,as shown in Tables 4 and 5.

Comparing Tables 4 and 5 with Tables 2 and 3,the P2P transaction power are the same because both VCG and AGV mechanisms are efficient mechanisms that can maximize the social welfare.The difference between the two mechanismslies in the price settling.Under the VCG mechanism,buyers can purchase energy at a lower price in P2P transactions.However,the total transfer payments of all prosumers are 4.68 $ and 6.76 $.Fig.7 further shows the transfer payment of each trading period.The VCG mechanism is not budgetbalanced,as the total revenue of the sellers is greater than the total expenses of the buyers.As a result,the unbalanced part must be subsidized by the mechanism designer or other institutions,increasing the complexity of transaction settlement.

Table 4 Transaction results at t = 12 under the VCG mechanism

Table 5 Transaction results at t = 16 under the VCG mechanism

Fig.7 Transfer payments in each transaction period under the VCG mechanism

However,the AGV mechanism has limitations compared with the VCG mechanism.The VCG pricing mechanism has a simpler form,not requiring the expectation of other types of agents.Intelligent methods,such as machine learning,are promising ways to improve the computational efficiency of the AGV mechanism.

4 Conclusion

This study proposed an AGV auction mechanism for P2P energy trading,where prosumers participate in the P2P market as sellers or buyers.Through the simulation of P2P energy trading,the following conclusions can be drawn.

1)The AGV mechanism determines the energy distribution and transaction price in the P2P market.KDE can estimate the probability density of bids/offers when the distribution types of the historical information of the agents are unknown.

2)The AGV transaction mechanism discussed is budgetbalanced and Bayesian incentive-compatible.

3)Compared with the traditional P2G mode,the P2P transaction in this study completely facilitates the local transaction of excess PV energy and significantly reduces the total energy cost of the prosumers.The budget balance of the AGV mechanism is more conducive to the development of decentralized transactions compared with the VCG mechanism.

Further research can focus on exploring an improved AGV pricing mechanism and investigating the influence of different kernel functions on the estimation results.

Acknowledgements

This work was supported by National Natural Science Foundation of China(U2066211,52177124,52107134),the Institute of Electrical Engineering,CAS(E155610101),the DNL Cooperation Fund,CAS(DNL202023),and the Youth Innovation Promotion Association of CAS(2019143).

Declaration of Competing Interest

We declare that we have no conflict of interest.

References

[1]Chu S,Majumdar A(2012)Opportunities and challenges for a sustainable energy future.Nature,488(7411):294-303

[2]Zhang H,Li Y,Gao D W,et al.(2017)Distributed optimal energy management for Energy Internet.IEEE Transactions on Industrial Informatics,13(6):3081-3097

[3]Li J,Zhang C,Xu Z,et al.(2018)Distributed transactive energy trading framework in distribution networks.IEEE Transactions on Power Systems,33(6):7215-7227

[4]Sorin E,Bobo L,Pinson P(2019)Consensus-based approach to peer-to-peer electricity markets with product differentiation.IEEE Transactions on Power Systems,34(2):994-1004

[5]Sampath L P M I,Paudel A,Nguyen H D,et al.(2022)Peer-topeer energy trading enabled optimal decentralized operation of smart distribution grids.IEEE Transactions on Smart Grid,13(1):654-666

[6]He L,Zhang J(2021)A community sharing market with PV and energy storage:an adaptive bidding-based double-side auction mechanism.IEEE Transactions on Smart Grid,12(3):2450-2461

[7]Fleischhacker A,Corinaldesi C,Lettner G,et al.(2022)Stabilizing energy communities through energy pricing or PV expansion.IEEE Transactions on Smart Grid,13(1):728-737

[8]Luisa M,Silvestre D(2020)Blockchain for power systems:current trends and future applications.Renewable and Sustainable Energy Reviews,119:109585

[9]Giotitsas C,Pazaitis A,Kostakis V(2015)A peer-to-peer approach to energy production.Technology in Society,42:28-38

[10]Li Z,Lin C,Nan G(2017)Small-scale renewable energy source trading:a contract theory approach.IEEE Transactions on Industrial Informatics,14(4):1491-1500

[11]Leong C H,Gu C,Li F(2019)Auction mechanism for P2P local energy trading considering physical constraints.Energy Procedia,158:6613-6618

[12]Ma L,Wang L,Liu Z(2021)Multi-level trading community formation and hybrid trading network construction in local energy market.Applied Energy,285:116399

[13]Tushar W,Saha T K,Yuen C,et al.(2018)Peer-to-peer energy trading with sustainable user participation:a game theoretic approach.IEEE Access,6:62932-62943

[14]Saad W,Han Z,Poor H V,et al.(2011).A noncooperative game for double auction-based energy trading between PHEVs and distribution grids.2011 IEEE International Conference on Smart Grid Communications(SmartGridComm).Brussels,Belgium.IEEE,267-272

[15]Kang J,Yu R,Huang X,et al.(2017)Enabling localized peerto-peer electricity trading among plug-in hybrid electric vehicles using consortium blockchains.IEEE Transactions on Industrial Informatics,13(6):3154-3164

[16]Liu T,Tan X,Sun B,et al.(2016)Energy management of cooperative microgrids with P2P energy sharing in distribution networks.2015 IEEE International Conference on Smart Grid Communications(SmartGridComm).Miami,FL,USA.IEEE,410-415

[17]Wang X,Xu T,Mu Y,et al.(2022).Congestion management under peer-to-peer energy trading scheme among microgrids through cooperative game.Energy Reports 8:59-66

[18]Rao B V,Stefan M,Brunnhofer T,et al.(2022)Optimal capacity management applied to a low voltage distribution grid in a local peer-to-peer energy community.International Journal of Electrical Power &Energy Systems 134:107355

[19]AlAshery M K,Yi Z,Shi D,et al.(2021)A blockchain-enabled multi-settlement quasi-ideal peer-to-peer trading framework.IEEE Transactions on Smart Grid,12(1):885-896

[20]Lin J,Pipattanasomporn M,Rahman S(2019)Comparative analysis of auction mechanisms and bidding strategies for P2P solar transactive energy markets.Applied Energy,255:113687

[21]Xu S,Zhao Y,Li Y,et al.(2021)An iterative uniformprice auction mechanism for peer-to-peer energy trading in a community microgrid.Applied Energy,298:117088

[22]Exizidis L,Kazempour J,Papakonstantinou A,et al.(2019)Incentive-compatibility in a two-stage stochastic electricity market with high wind power penetration.IEEE Transactions on Power Systems,34(4):2846-2858

[23]Krishna V(2003)5 - Mechanism design.Auction theory.V.Krishna.San Diego,Academic Press:61-82

[24]Ma J,Deng J,Song L,et al.(2014)Incentive mechanism for demand side management in smart grid using auction.IEEE Transactions on Smart Grid,5(3):1379-1388

[25]Wang T,Xu Y,Withanage C,et al.(2018)A fair and budgetbalanced incentive mechanism for energy management in buildings.IEEE Transactions on Smart Grid,9(4):3143-3153

[26]Deng J,Zhang R,Song L,et al.(2013)Truthful mechanisms for secure communication in wireless cooperative system.IEEE Transactions on Wireless Communications,12(9):4236-4245

[27]Ferrero R W,Rivera J F,Shahidehpour S M(1998).Application of games with incomplete information for pricing electricity in deregulated power pools.IEEE Transactions on Power Systems,13(1):184-189

[28]Li T,Shahidehpour M(2005)Strategic bidding of transmissionconstrained GENCOs with incomplete information.IEEE Transactions on Power Systems,20(1):437-447

[29]Wang J,Shahidehpour M,Li Z,et al.(2009).Strategic generation capacity expansion planning with incomplete information.IEEE Transactions on Power Systems,24(2):1002-1010

[30]Liu N,Yu X,Wang C,et al.(2017)Energy-sharing model with price-based demand response for microgrids of peer-to-peer prosumers.IEEE Transactions on Power Systems,32(5):3569-3583

Received:30 September 2022/Accepted:15 November 2022/Published:25 Feburary 2023

Wei Pei

Wei Pei

peiwei@mail.iee.ac.cn

Yujia Chen

chenyujia18@mail.iee.ac.cn

Hao Xiao

xiaohao09@mail.iee.ac.cn

Tengfei Ma

flytengma@mail.iee.ac.cn

2096-5117/© 2023 Global Energy Interconnection Development and Cooperation Organization.Production and hosting by Elsevier B.V.on behalf of KeAi Communications Co.,Ltd.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

Biographies

Yujia Chen received bachelor’s degree at Zhejiang University,Hangzhou,2018.She is working towards Ph.D.degree at University of Chinese Academy of Sciences,Beijing.Her research interests include the power market and mechanism designing.

Wei Pei is working in Institute of Electrical Engineering Chinese Academy of Sciences,Beijing.His research interests include distributed energy and microgrids,and AC/DC hybrid distribution networks.

Hao Xiao received the B.S.degree from Huazhong University of Science and Technology,Wuhan,China,in 2009,and the Ph.D.degree in electrical engineering from the Chinese Academy of Sciences,Beijing,China,in 2015.He is currently an Associate Professor with the Institute of Electrical Engineering,Chinese Academy of Sciences.His research interests include optimal operation and planning of power systems and application of artificial intelligence in power systems.

Tengfei Ma received the Ph.D.degree from Beijing Jiaotong University in 2019.He was a post-doctor of the institute of electrical engineering,Chinese Academy of Sciences,from 2019 to 2021.He was a joint training doctor at the university of Texas at Arlington,USA from 2017 to 2018.Now,he is a research assistant of the institute of electrical engineering,Chinese Academy of Sciences.He has published more than 10 journal papers and hosted or joined more than 5 National Natural Science Foundation projects.His research interests include the modeling,operation and planning of integrated energy system,the engineering game theory in power system.

(Editor Yanbo Wang)