0 Introduction

Achieving the goal of carbon emission peak and carbon neutrality is necessary for China’s socio-economic transformation and joint response to global climate change.The national unified carbon emission trading (CET) market officially opened in July 2021.Coal-fired electricity enterprises (EEs) have been introduced into the CET market.With the gradual maturation of the CET market,carbon quota allocation will be tightened, which forces coalfired EEs’ carbon controlling investment and then increases the generating cost.In October 2019, the feed-in tariff(FIT) mechanism of coal-fired electricity was abolished and replaced by a market-based mechanism called “benchmark price + fluctuating range.” The initial round of the benchmark price is often similar to the FIT, which means that there is a limited range of coal-fired electricity prices.Meanwhile, the wholesale price of heat from coal-fired EEs lacks adjustment because it is set by the local governments to ensure the “people’s livelihood.”

In addition to the limited variation in electricity and heating prices, potentially increasing the cost of green certification trading and CET, coal-fired EEs have been experiencing a production cost crisis since September 2021.The purchase of coal accounts for 70% of the production cost of coal-fired EEs.The coal price increased from March 2021, resulting from increasing market demand under limited approved mining capacity.The coal marketbased price mechanism was launched in 2020.Thus, the price mechanism of coal has changed from administrative intervention to market-oriented mechanisms.However,electricity and heat price adjustments have been limited.Coal enterprises (CEs) have difficulty resisting the high price temptation from the market and break MLC because they desire a higher contracted coal price.In summary,coal-fired EEs face the dilemma of relative fixed prices and rising costs under the current policy scenario.At the end of 2021, some coal-fired EEs failed to generate, resulting in electricity and heat shortages.

Thermal coal MLC can effectively alleviate conflicts between coal and EEs [1].In the current complex market and regulatory environment, further research is needed to optimize the design of the MLC to improve the compliance rate, considering the incompleteness of the contract.With the gradual withdrawal of administrative intervention from MLC signing, this study examined the compliance behavior of coal and coal-fired EEs at the micro-level and investigated the improvement in the compliance rate of both contracting parties after embedded reparations in MLC.A sensitive analysis based on multi-agent simulation was applied to determine the critical values of the parameters that determine the behavioral transformation of the contracting parties.This study can be regarded as a response to abnormal market-oriented coal price fluctuations and is significant in promoting the stable development of coal and electricity supply chains.

1 Relative work

In the early stage of coal market-oriented reform, coal prices were determined by the market other than the coal that supplied thermal electricity; this is called the coal price dual-track system [2].In 2004, the National Development and Reform Commission launched the coal-electricity linkage mechanism and revised it in 2012 and 2015 [3].This policy continued until 2019 [4, 5].Governments issued documents to promote the signs and fulfillment of thermal coal MLC in 2017, 2018, and 2019.

From a practical perspective, the thermal coal MLC has played an essential role in stabilizing coal market prices to maintain them within a reasonable price range [6].References [7-11] explored cases involving coal-electricity contracts globally, presenting an effective long-term coal contract that can promote the coordinated operation of the coal-electricity energy supply chain.Currently, MLC are less stable, with frequent defaults.Reference [12] analyzed the reasons for the difficulties encountered in MLC and suggested that information-sharing can strengthen them.

Improving MLC design has been an attractive research topic.The reasonable price range of coal is located at the core of MLC [13, 14].Reference [15] discussed the range of coal prices in MLC, with the price baseline formed by the cost insurance and freight (CIF) Qinhuangdao.They also proposed a corresponding optimal contract according to the contract for difference (CFD) model.Under the CFD, the Cournot oligopoly and Stackelberg oligopoly models were applied to further analyze the behavior of coal and electricity producers, respectively.Under the Shapley principle, the distribution of benefits between two parties can improve cooperation.Long-term coal contract based on price linkages between coal and other substitutable resources to address uncertainty over the implementation period was proposed in reference [16].To address the problem caused by the Australian coal and electricity markets, the longterm coal contracts were optimized by the CFD in reference[17].Besides the reasonable price range of thermal coal, the expected payoff was investigated in reference [18].It was set as a reference point that induced meaningful subjective losses by comparing actual and contractual expected payoffs, which affected producers’ behavior, even when breaking the signed contract.

According to the studies mentioned above, the methods of setting price ranges of coal in MLC can be mainly summarized by forming a price baseline that is based on historical data, decided by the substitutable resources’prices or by the expected payoffs of the contracting parties.The main form of the contract is referred to as CFD.Game theory (GT) focuses on modeling behavioral interactions between players with conflicting interests.Therefore, applying GT to formalize contracting parties’behaviors is reasonable.The theoretical models applied to investigate contracting parties’ behavior from the aforementioned studies are GT models, including the Cournot and Stackelberg oligopoly models.However,traditional GT assumes that players are perfectly rational and have a determined information structure, which ignores decision-makers’ limited rationality and learning ability.Evolutionary game theory (EGT) relaxes the assumption of perfect rationality by considering the learning mechanism,which has become an important research methodology in socio-economic and management fields [19].Given that EGT provides important theoretical support for interpreting various common social phenomena, we adopted EGT to formalize the behaviors of coal and coal-fired EEs.

In addition to the “reasonable price range,” structural changes in MLC can enhance the fulfillment rate [20-22].In reference [23], contingent compensation was introduced in contract design, which can effectively inhibit the default behaviors of complex product of systems (CoPS).A hybrid contract structure composed of long-term and short-term contracts was proposed in references [24, 25] that delt with unexpected situations.

Considering the gradual reduction of administrative intervention in thermal coal MLC [26], improving contract performance is no longer feasible by relying on administrative subsidies or orders.We were enlightened by the concept of “contingent convertible bonds” in the financial industry.The concept of “reparation” is introduced and embedded in the conventional fixed-price MLC to enhance the performance of contract parties.

In this study, the behaviors of contracting parties under MLC-embedded reparation were investigated by EGT,which provided the trajectory of behavioral ESSs.The concern is that numerical simulation can supplement the deficiency of theoretical model analysis which lacks analysis for the evolving process and parameter sensitivity.In reference [27], the numerical simulation results verified that price fluctuations in emissions trading led to the risk faced by both parties, which was negatively related to the length of the initial effective offer interval of the CFD.Reference[28] designed the optimal incentive contract between banks and cooperative intermediaries based on the GT and verified the critical ratio values of the optimal contract under asymmetric information by numeric simulation.From the mentioned research, the simulation verifies the theoretical analysis results and helps determine the critical values of the model parameters that induce player behavior.

We discussed existing research on improving MLC using a reasonable price range, structure adjustment,theoretical model, and simulation technology.With dramatic changes in the market and policy environment,research on MLC considering carbon emissions and floating coal prices are limited.This study investigated MLC-embedded reparation under the current complex decision environment.The subsequent research consists of the following steps.First, we formalized the behavioral evolution of heterogeneous coal and coal-fired electricity enterprises based on an asymmetric evolutionary game model, proved the existence of ESSs, and explored the behavior-driven mechanisms of both parties.Second,a multi-agent simulation was applied to verify the convergence process of the two groups of ESSs and we determined the threshold values of the carbon quota’s price, market-orient coal price, and varying reparation,which impacted the transformation of contractual behaviors; then we proposed policy implications.Finally,we summarized the research and discussed future areas of research.

2 Theoretic Modeling and Analysis

2.1 Problem description and assumptions

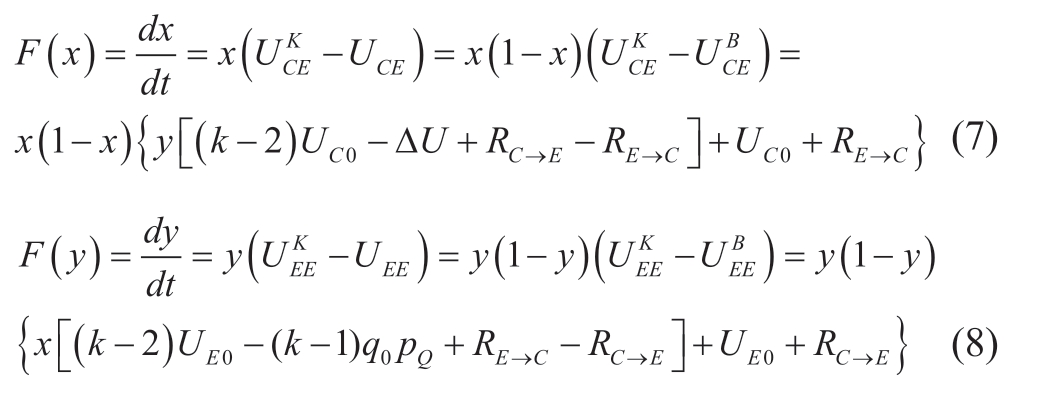

To stabilize the supply of coal and electricity, a group of CEs and coal-generated EEs signed thermal coal MLC with a contracted price denoted as pC yuan/ton.Fluctuations in the coal market-orient price and CET during the contract period (typically 3-5 years) are likely to result in unstable returns for both contracting parties.A party with an impaired expectation of utility tends to break contracts.For CEs and EEs, the set of behaviors is {keep the contract,break the contract}.The party is required to pay reparations to the other party if it defaults, which are denoted as R.Table 1 summarizes the model parameters.

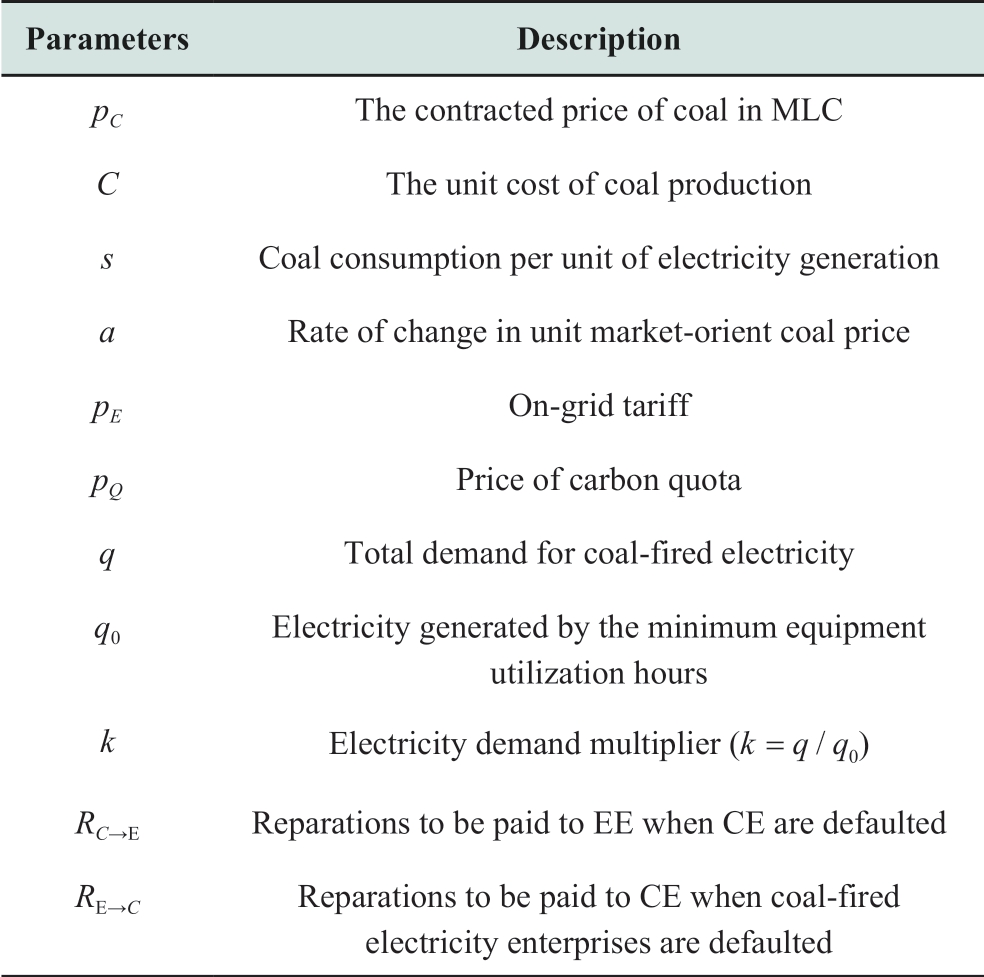

Table 1 The description of parameters

To simplify the utility form, three middle utilities are defined.The utility of EE from electricity generation in the minimum equipment utilization hours is denoted as UE0 and calculated by U E0= ( p E - pC ) ·q0; the utility of CE from supplying demand for electricity generation in the minimum equipment utilization hours is denoted as UC0 and calculated by UC0=(pC - c )· q0 ·s; the additional utility of CE from the market when they default MLC is denoted as ΔU and calculated by ΔU=(apC -c )·Δq·s.According to the current provisions of MLC, the following assumptions are made.

Assumption 1: If coal and coal-fired EEs default, the utilities of both parties are zero.

Assumption 2: The carbon quotas for coal-fired EEs only cover the electricity generated during the minimum equipment utilization hours.A coal-fired EE purchases extra carbon quotas from the CET if the generating hours are greater than the minimum hours.

Assumption 3: The coal supply meets the demand for electricity generated during the minimum equipment utilization hours.

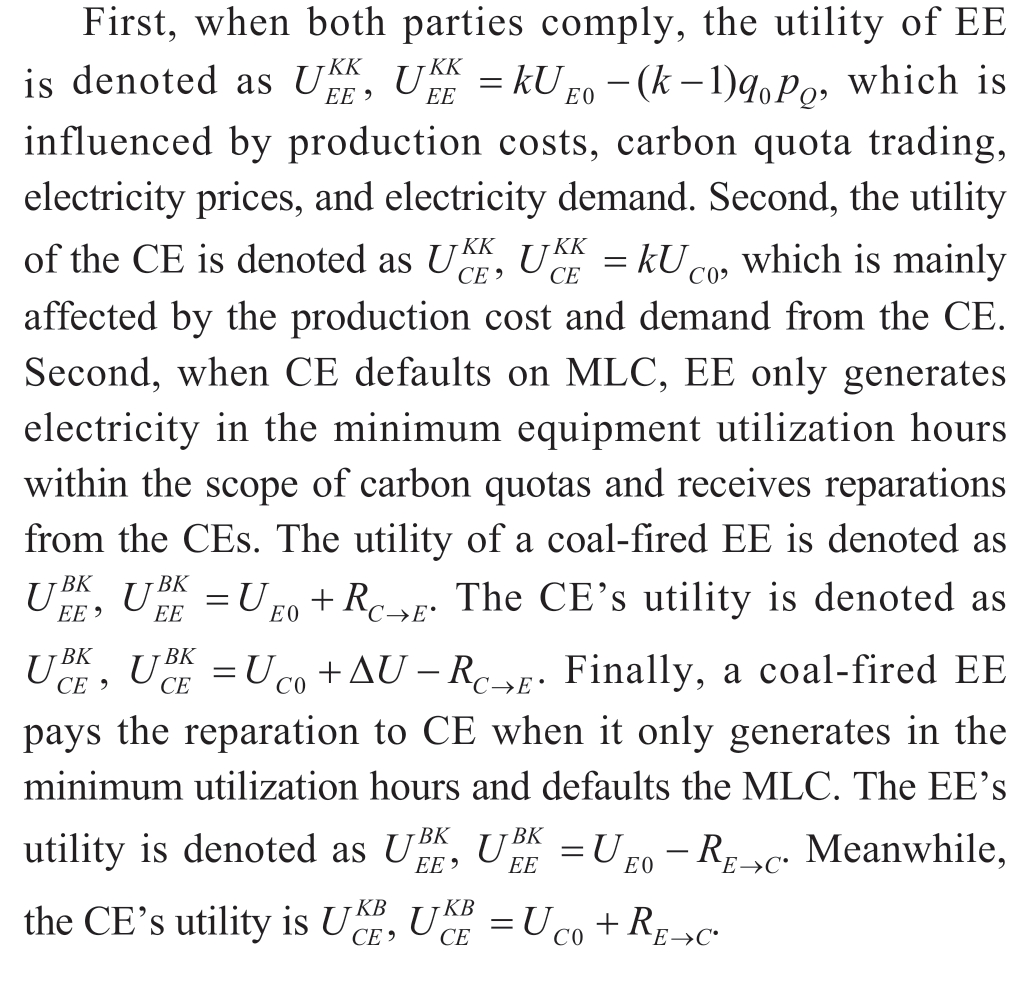

Based on the above assumptions, the utilities of different behaviors of both parties during the contract period are calculated as follows:

2.2 Payment Matrix and Replication Dynamics Analysis

Enterprises from the two groups are randomly paired,and behavior is selected during the contracting period.Table 2 presents the payoff matrix.

Table 2 Payment matrix of coal and coal-fired electricity enterprises

The probability of “compliance” of coal and coal-fired EEs during the contract period are respectively denoted as x and y.The corresponding probabilities of “default” are 1-x and 1-y.The average expected utilities are analyzed and calculated as follows:

The expected utility of CE’s “compliance” is,

The expected utility of CE’s “default” is,

Then, the average expected utility of CEs is

The expected utility of thermal EEs’ “compliance” is,

The expected utility of coal-fired EEs’ “default” is,

The average expected utility of coal-fired EE is,

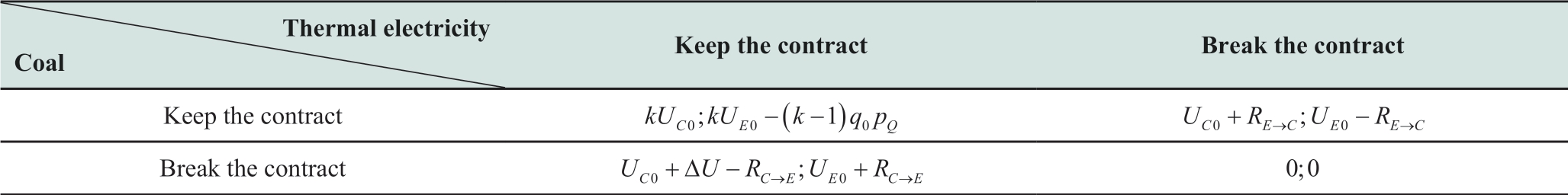

The replicator dynamics (RD) equation is applied to formalize the evolution of behaviors in two groups with random pairing in an iterative game.The RD equations for coal and coal-fired EEs are derived from Equations (1)-(6).

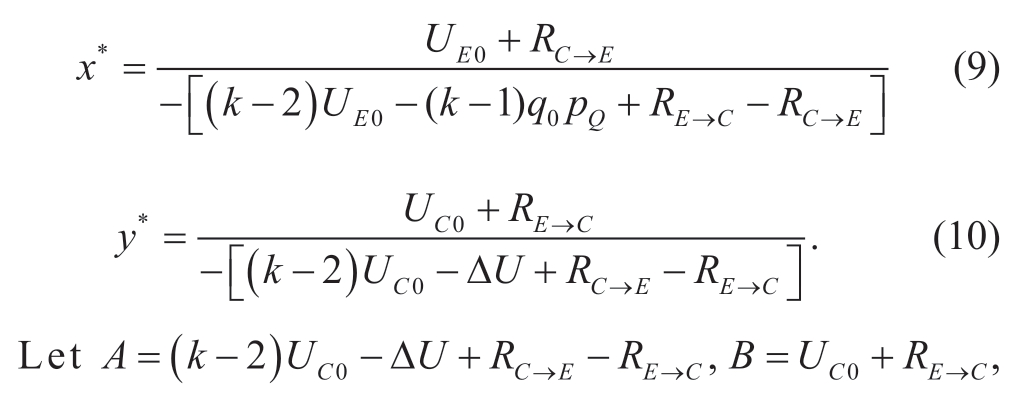

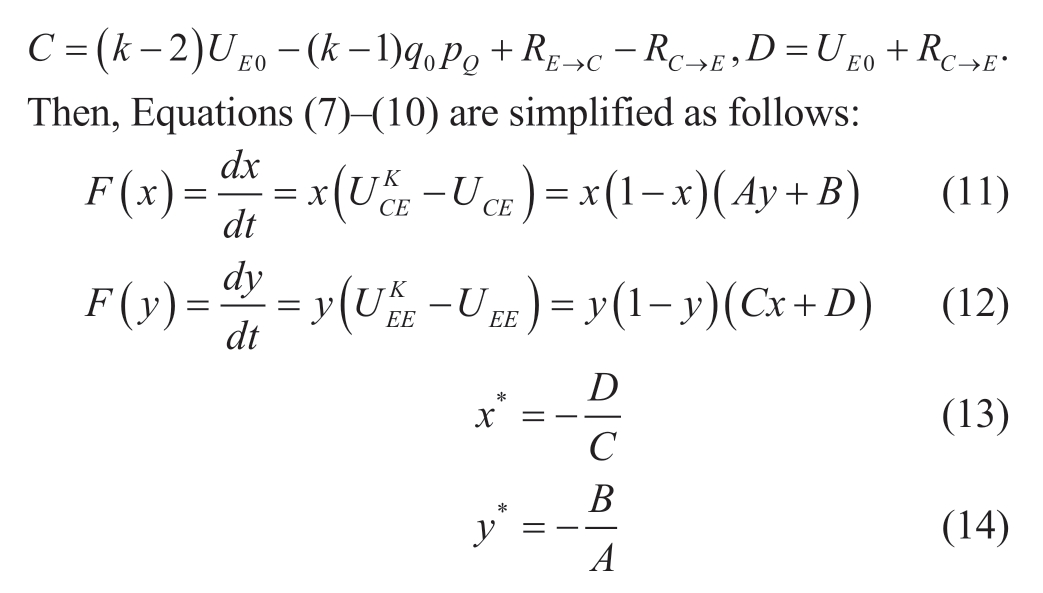

Let![]() The possible equilibria points of the system are inferred from Equations (7) and (8).They are denoted as P1 (0, 0), P2 (1, 0), P3 (0, 1), P4 (0,0), and

The possible equilibria points of the system are inferred from Equations (7) and (8).They are denoted as P1 (0, 0), P2 (1, 0), P3 (0, 1), P4 (0,0), and![]() is calculated using Equations (9) and (10).

is calculated using Equations (9) and (10).

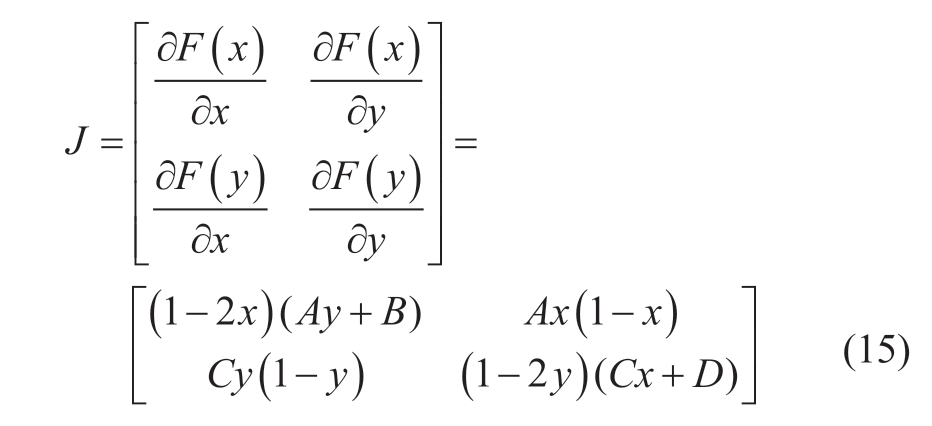

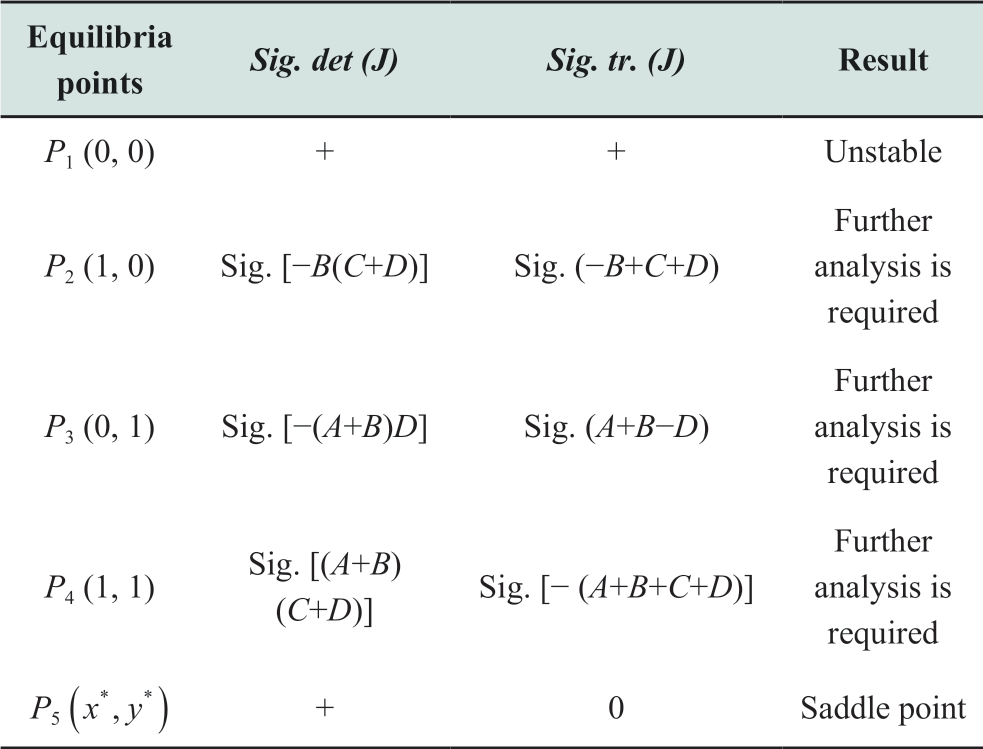

The evolving stable strategy of this dynamic system is solved, and the Jacobian matrix is obtained by the partial derivatives of x, y, which is further calculated as

From the Jacobian matrix, the values of matrix determinant det (J) and trace tr.(J) are calculated.Signs det(J) and tr.(J) indicate whether the equilibria points are an ESS or not.Table 3 shows the process of ESS analysis.

Table 3 Analysis of ESSs for equilibria points

Based on Table 3, P2, P3, and P4 should be further evaluated.Reference [37] presented sufficient conditions for the asymptotic stability of the linear time-varying system of the genera at the origin.According to this study, the stability of the equilibria point in the above model can be inferred from the sign of the eigenvalue of the corresponding linear zigzag system in the origin state.The equilibria point is ESS if the corresponding eigenvalues of the Jacobian matrix are negative.Therefore, P4 (1, 1) is ESS if A + B > 0 and C + D > 0.P3 (0, 1) is ESS if A+B < 0 and D> 0.

2.3 Comprehensive phase diagram and behaviordriven analysis

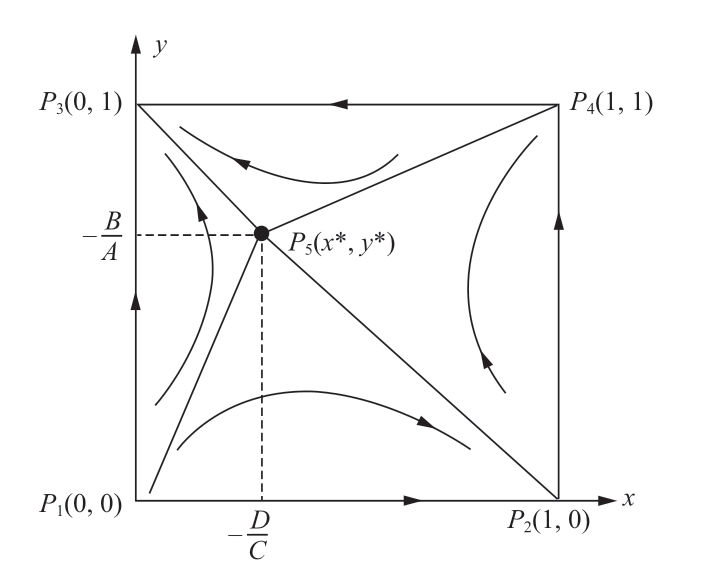

A comprehensive phase diagram was constructed according to the ESS formation, as shown in Fig.1.

Fig.1 Comprehensive phase diagram of coal-electricity enterprises

According to Fig.1, combining the connotations of A, B,C, and D with the precondition for the existence of ESS, we discuss the process of ESS formation as follows.

(1) CEs tend to satisfy demand of coal in the minimum equipment utilization hours.They continue to supply coal if (k - 1) U C 0>ΔU -RC →E.It means the additional utility deducting reparation to coal-fired EEs is less than the utility from “compliance.” CEs continue to supply coal; otherwise,they choose to “default” MLC.

(2) After minimum equipment utilization hours, coalfired EEs continue generating according to electricity demand if (k - 1) U E 0- ( k - 1) q0pQ >RE →C.The remaining utility from additional generation after carbon quota trading is greater than the reparations to be paid for “default.” Coal-fired EEs choose “compliance;” otherwise, they choose “default.”

Based on the above discussion, reparation is a key factor that drives the contractual behaviors of both parties.Naturally, the market-oriented coal price, carbon emission trading price, and electricity demand also impact the utilities of both parties.For further research, we establish a simulation model in the next section to validate the existence of ESSs.We also adjust the relevant parameters and control variables to observe their influence on the convergence process.

3 Multi-agent-based simulation of the evolutionary process

3.1 Simulation design and data collection

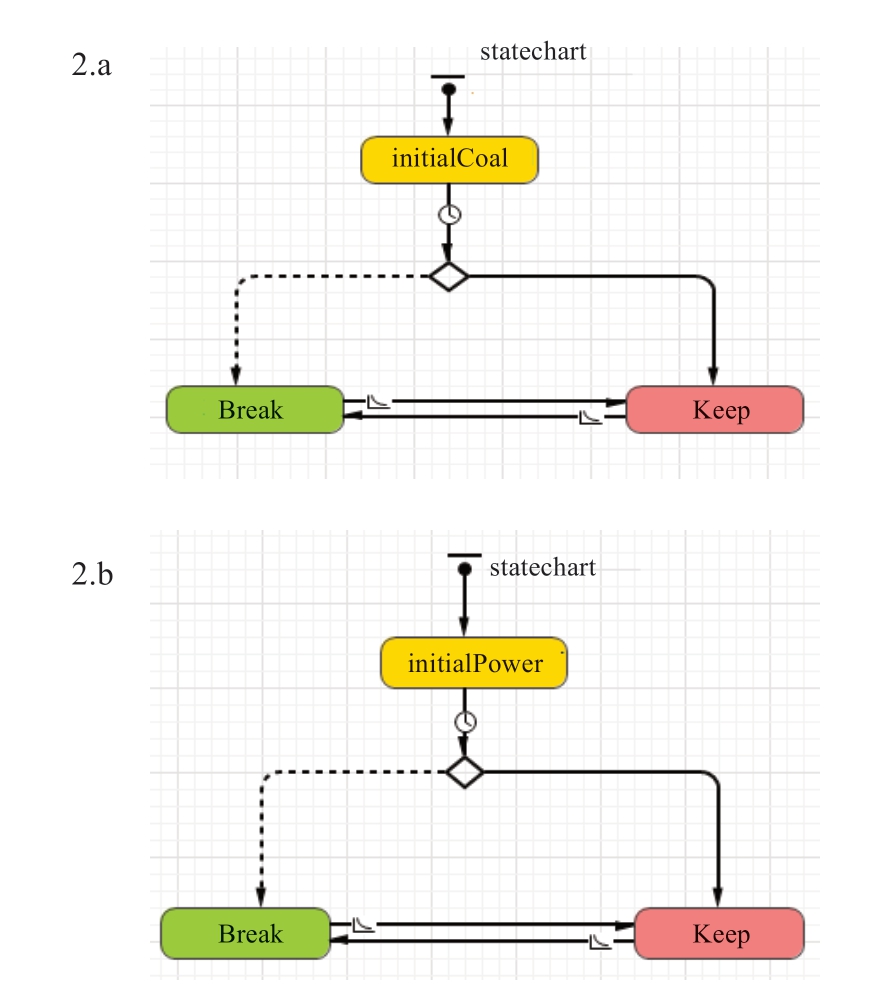

To optimize the design of the contract and improve the “compliance” ratio of MLC, this section simulates the evolutionary process of randomly paired CEs and EEs based on a multi-agent system.Three types of agents are designed in the simulation system: coalAgent, electricityAgent and mainAgent.The coalAgent and electricityAgent correspond to the individual coal and coal-fired EEs in MLC.The mainAgent controls the communication process in the form of messages.A total of 10000 coalAgents and electricityAgents have been created in the initial process.The agents’ state is counted in each simulation step, which provides the basis for analyzing the evolving probability of “compliance.” Fig.2 shows the state chart of these two agents and illustrates the state-transfer process.

Fig.2 The state chart of Agents

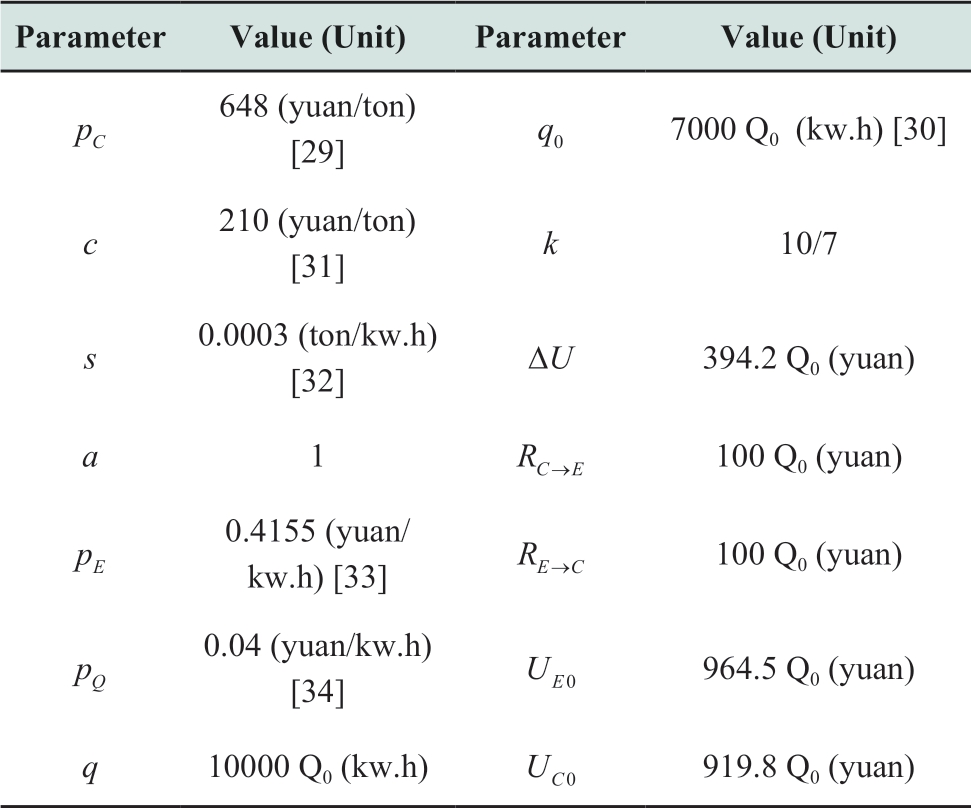

The values of parameters are set in Table 4.

Table 4 Values of calculation-related parameters

The adjustment of a illustrates the fluctuation in marketoriented coal prices.In the initial state, we assume that the initial market-oriented coal price is the same as the agreement price pc, which varies by adjusting a from 1 to other values.Q0 is the production constant (Q0 > 0).The electricity generation capacity of a coal-fired EE is set to 10000 Q0 kw.h, generated by the minimum utilization hours of equipment, accounting for 70% [31].

In the initial state, the value of q0 was set to 7000 Q0 kw.h.We then calculated the electricity demand multiplier k,k=q/q0=10/7.The additional utilities of coal enterprises acquired from default are ΔU, ΔU=(apC - c )·Δq ·s=394.2 Q0, and the utilities of coal-fired EEs acquired from compliance are UE0, U E0= ( p E - pC ) ·q0=964.5 Q0.The utility of the coal enterprise acquired from the compliance is UC0, UC0=(pC - c )· q0 ·s=919.8 Q0.The reparations are denoted as RC →E and RE→C, which are set to the same value as 100 Q0 in the initial state.

3.2 The process of behavioral evolution of CEs and EEs

Once the simulation clock advances, each coalAgent and electricityAgent select “compliance” or “default”by comparing the utilities from different behaviors.Accordingly, the proportion of “compliance” agents in the CE and EE group is regarded as the probability of“compliance” adoption.We verified the existence of ESSs and analyzed the sensitivity of the parameters in the convergence process through simulations.

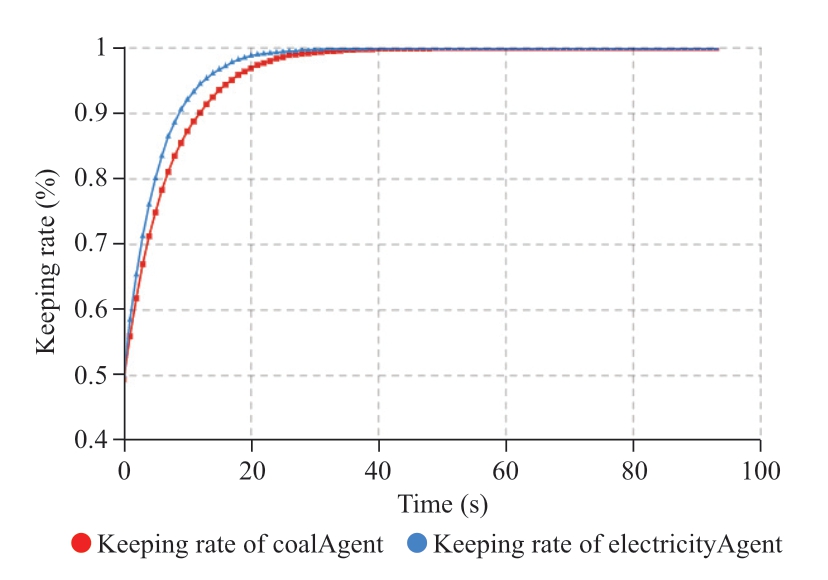

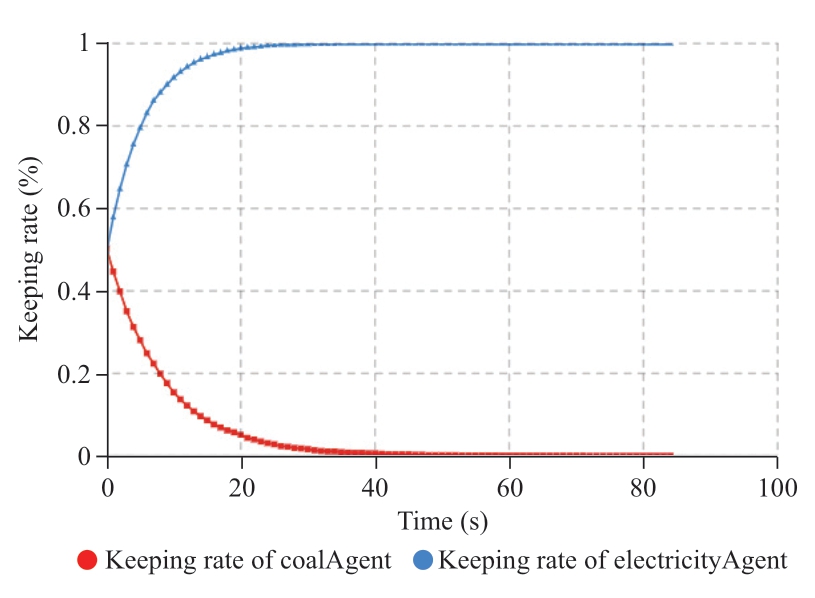

· Under the initialization scenario

In the initialization, the parameters are set according to Table 4.The values of A+B and C+D are calculated as A+ B = ( k - 1 ) U C 0-ΔU + RC →E= 100 Q0 > 0,C+ D =(k - 1) U E 0- ( k - 1) q0pQ + RE → C = 393.357 Q0>0, which satisfies the existence condition of ESS (1, 1).The experimental simulation results are shown in Fig.3.

Fig.3 The convergence process of ESS (1,1)

As Fig.3 shows, the proportions of “compliance” in both groups continuously increase when A+B > 0 and C+D > 0; then, both groups converge to ESS (1,1).Under the initial scenario, both groups select “compliance” since the utilities from “compliance” are greater than the utilities left after paying reparations for “default.” The convergence trend to“compliance” of EEs is slightly faster than that of CEs.

In recent years, the market-oriented coal price has fluctuated and is higher than the agreed price in MLC.The fuel cost of EEs can be relative stable under the constraint of MLC, which has prompted EEs to stabilize generation and select “compliance” actively.

· Under the reality scenario

Recently, the market price of coal has risen sharply because of the strong market demand.The contracted price is 700 yuan/ton, which is approximately 31% higher than the previous price of 535 yuan/ton [30].The current market-oriented coal price of 5500 kcal is between 650 and 950 yuan/ton.

Accordingly, we adjusted the contract price to 700 yuan/ton, whereas the market price of coal is 850 yuan/ton.Then, the value of ΔU, A+B, and D can be calculated:ΔU=(apC -c )·Δq·s=575.82 Q0, A+B=-34.82, D= 908.5.The simulation results are shown in Fig.4.

Fig.4 The convergence process of ESS (0,1)

From Fig.4, the proportion of compliance that individuals choose in EEs increases and that in CEs decreases when A+B < 0 and D > 0.The contracting parties converge to ESS (0,1).Coal-fired EEs select “compliance”because their utility from “compliance” is greater than that from “default.” On the contrary, coal enterprises eventually select “default” when the additional utility from “default”after deducting reparations is still greater than its utility from “compliance.”

The simulation results show that the two groups converge to ESS (0, 1) after adjusting the value of the parameters according to the current coal-electricity supply scenario, which is consistent with reality.Defaulting of coal enterprises in late autumn 2021 validates the simulation process.

3.3 Sensitivity analysis

3.3.1 Initial “compliance” rate

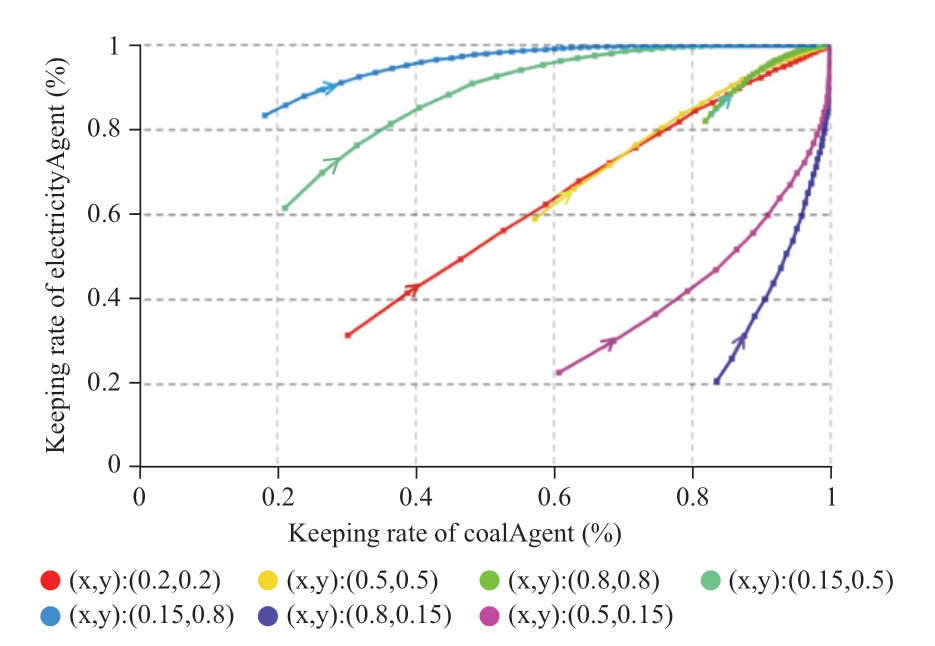

The initial “compliance” rate explains the differences in each group.The initial compliance rate (x, y) is set as(0.2, 0.2), (0.5, 0.5), (0.8, 0.8), (0.15, 0.5), (0.15, 0.8),(0.8, 0.15), and (0.5, 0.15).

· Effect on ESS (1,1)

The evolving processes of the CEs and EEs under the initialization scenario are shown in Fig.5.

Fig.5 Effect of initial compliance rate on the convergence of ESS (1,1)

According to Fig.5, when both parties converge in“compliance,” the impacts of the initial “compliance” rate of the two groups on the process of convergence are as follows: (1) The EEs converges in “compliance” slightly faster than the CEs if the initial “compliance” rates of the two groups are the same.(2) When the initial compliance rates of both groups increase simultaneously, the trend of convergence to “compliance” of EEs is significantly faster than that of CEs.(3) Enterprises’ group with a high initial“compliance” rate will quickly converge to “compliance” at the beginning, while converging slowly at the later stage.

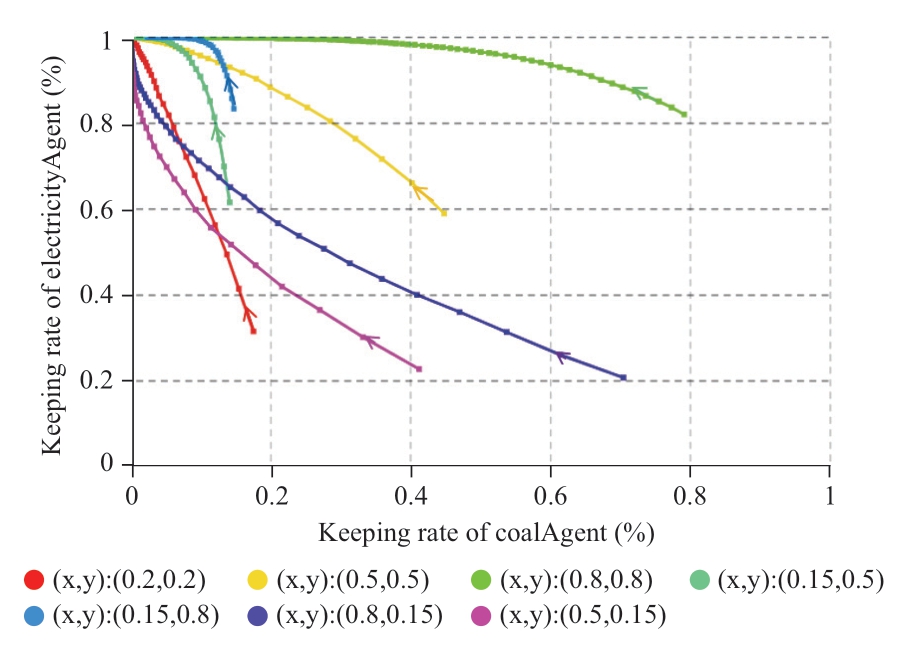

· Effect on ESS (0,1)

Under the reality scenario, the processes of behavioral convergence are shown in Fig.6.

From Fig.6, when the two groups converge to different behaviors, the impacts of the initial “compliance” rates are summarized as follows: (1) The EEs’ trend of convergence to “compliance” is slightly faster than the CEs trend to“default” if the initial compliance rates of two groups are same.(2) When the initial compliance rates of both groups increase simultaneously, the rate at which EEs converge in “compliance” is significantly faster than the rate at which CEs converge to “default.” (3) The trend of the CEs’convergence to “default” slows down with the increasing initial “compliance” rate.Meanwhile, EEs with a high initial“compliance” rate quickly converge to “compliance” at the beginning and then slowly decrease at the later stage.

Fig.6 Effect of initial compliance rate on the convergence of ESS (0, 1)

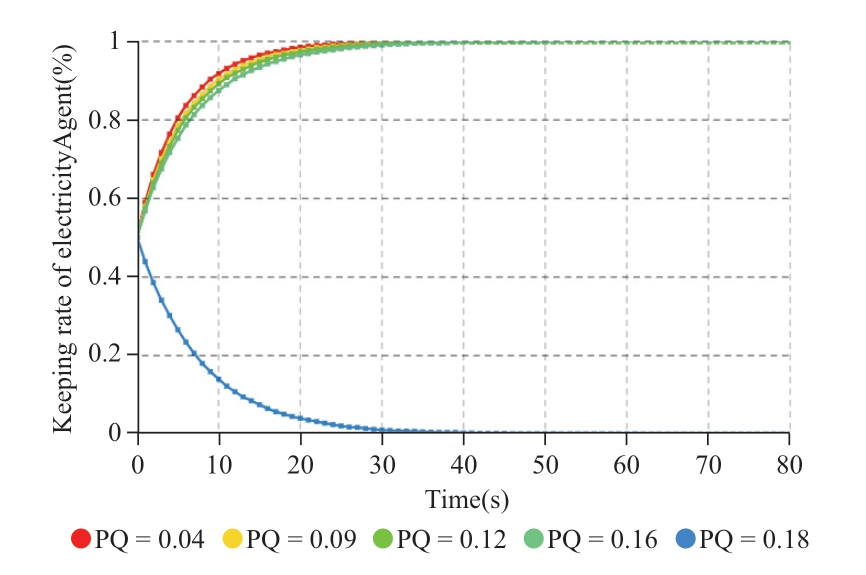

3.3.2 Impact of pQ on the behavior of coal-fired electricity enterprises

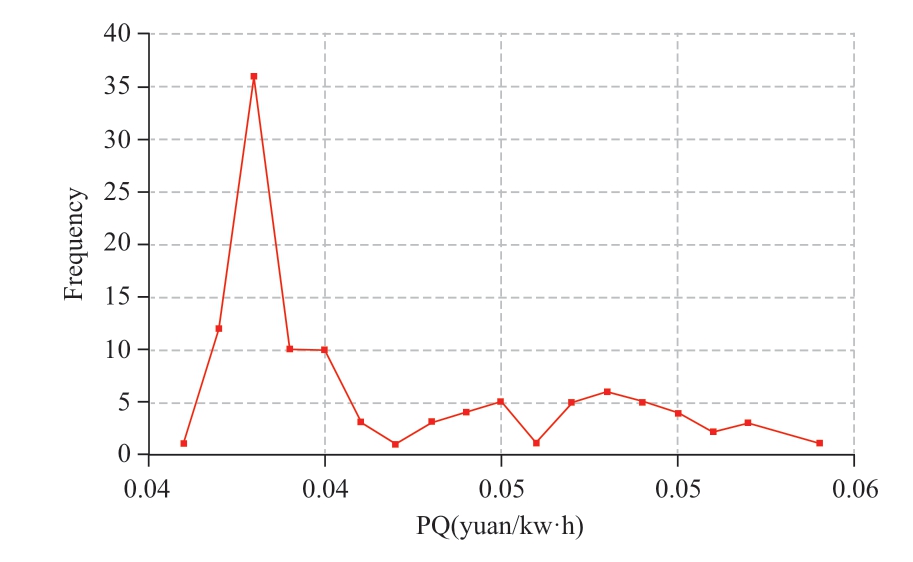

The carbon quota trading prices per unit of electricity are shown in Fig.7.

Fig.7 History prices of carbon quota per unit of electricity [35]

pQ is respectively set at 0.04, 0.09, 0.12, 0.16, and 0.18.The evolving processes of the corresponding EEs are shown in Fig.8.

Fig.8 Impact of pQ on the convergence process of EEs’behavior

From Fig.8, the convergence rate of EEs to“compliance” slows down as the price of the carbon quota per unit of electricity increases from 0.04 to 0.16.However,the difference is not significant, indicating that the cost of the carbon quota per unit of electricity is limited when the carbon quota is relatively sufficient.However, when the cost of carbon quota per unit of electricity reaches 0.18 and exceed 40% of the feed-in tariff (0.4155 yuan per kw.h), coal-fired EEs face losses in electricity generation.Therefore, they will choose to “default” on MLC.

From the distribution of pQ shown in Fig.7, the maximum value of pQ is 0.06 yuan/kw.h, which means the carbon emission trading slightly impact on EEs under the current carbon emission quota allocation mechanism.

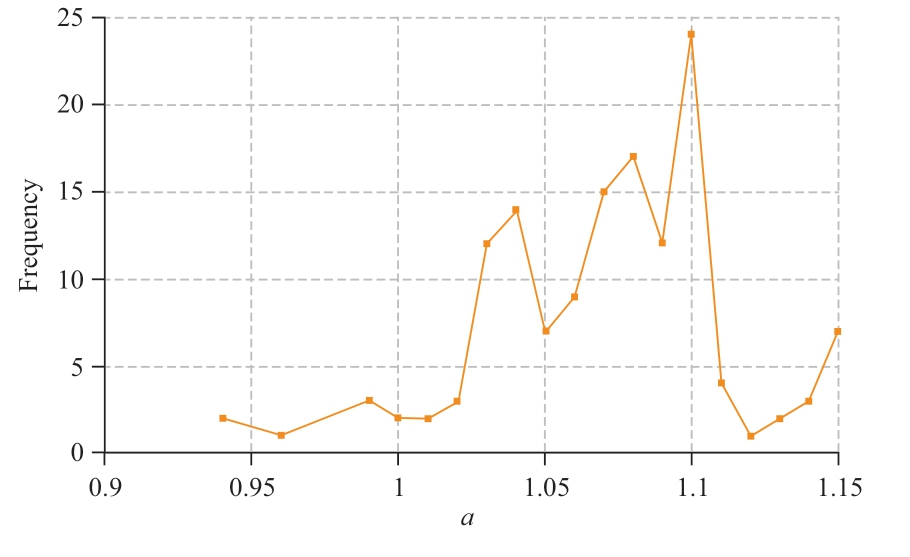

3.3.3 Impact of a on the behavior of coal enterprise

a reflects fluctuations in the market coal price relative to MLC prices.The market price of 5500 kcal of coal in Qinhuangdao from 2018 to 2020 was collected.The distribution of a is shown in Fig.9.

Fig.9 Historical fluctuation of coal price a [36]

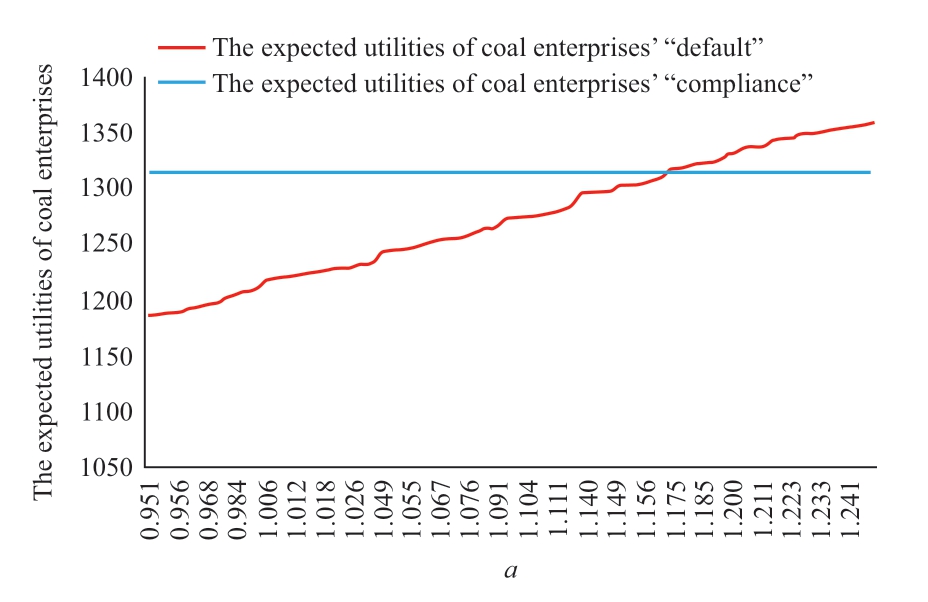

According to the distribution of parameter a, we applied random sampling to extract 200 values of a.Then,the corresponding expected utilities were obtained by Monte Carlo simulation when CEs maintain or break the MLC.The results are shown in Fig.10.

Fig.10 The expected utilities of CEs under different a

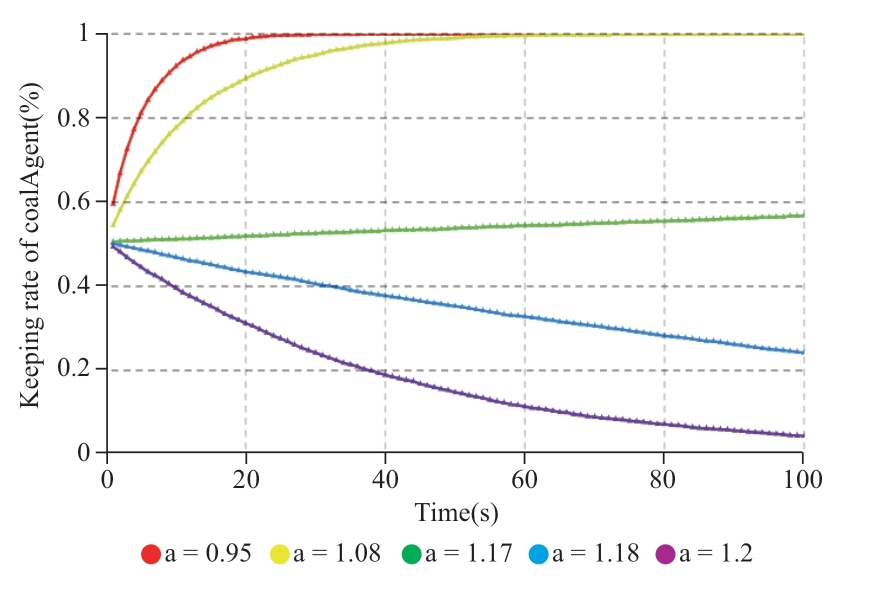

From Fig.10, the expected utility of CEs’ “compliance”is stable, whereas the expected utility of CEs’ “default”continues to increase with a.Second, when the value of a is approximately 1.175, the expected utilities of CEs are equal regardless of the behavior.Finally, the expected utilities of CEs’ “default” are greater than CEs’ expected utilities from “compliance.” We found that 1.18 can be regarded as the critical value of a.Further verifying the consequence,a is set at 0.95, 1.08, 1.17, 1.18, and 1.2.The processes of behavioral evolution of CEs are shown in Fig.11.

Fig.11 Impact of a on the convergence process of CEs’compliance behavior

From Fig.11, if the market-oriented coal price keeps increasing (a keeps increasing beneath 1.175), the“compliance” willingness of CEs gradually decreases, and the trend of convergence to “compliance” slows down.If the market-oriented coal price continues to increase to greater than the contracted price by 18% (a=1.18), CEs will choose to “default” MLC.Finally, the CEs will accelerate convergence to “default” with the increasing a from 1.18.

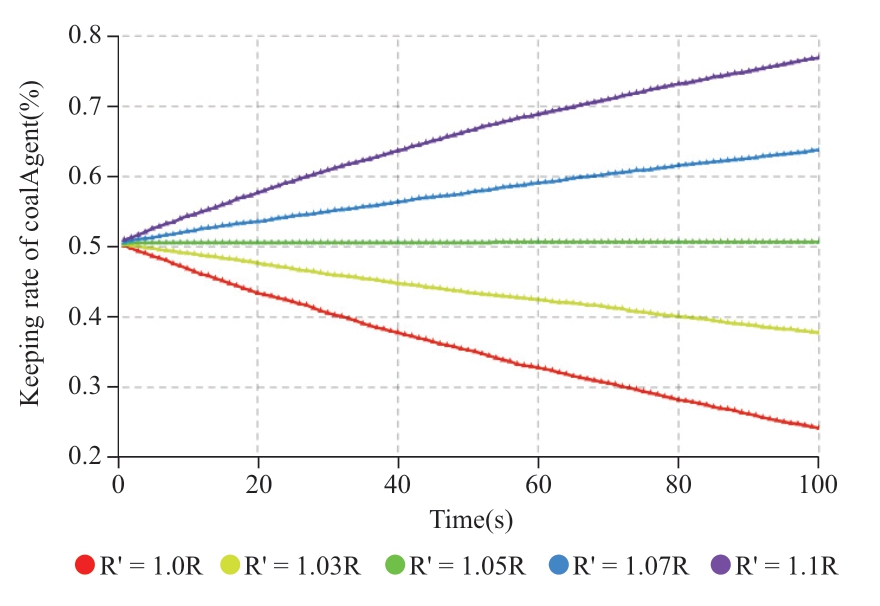

3.3.4 Impact of RC→E on behavior of coal enterprises

From the above analysis, the market-orient coal price 1.18 pc can be considered as the price threshold for the CE’s behavioral selection.RC→E and RE→C are assigned the same values as in the initialization scenario.The adjusted reparation is denoted by RC→E′.We observed the varying of CEs’ “compliance” by adjusting the value of RC→E′.RC→E′ is respectively set at 1.03 RC→E0, 1.05 RC→E0, 1.07 RC→E0, and 1.10 RC→E0.The evolution of CE behaviors is shown in Fig.12.

According to Fig.12, the CEs’ convergence to“default” slows with increasing reparation when the coal market price is at the threshold value.The increasing RC→E accelerates CEs’ convergence in “compliance.”Thus, if the reparations paid for “default” is higher than RC→E0 by 5%, the additional utility acquired from“default” after deducting reparations is less than its utility from “compliance.”

Fig.12 Impact of reparation on the convergence process of CEs

3.3.5 Discussion: policy implication

Based on the results of ESS and the simulation, we summarize the policy implications as follows:

(1) Given the ESS analysis, the coal enterprises are in a “strong” position under the current policy and market scenario.Therefore, a dynamic reparation mechanism should be established, which means that the CEs’ reparation should be adjusted upward according to the increasing price in the coal market and the limited variation in coal-fired electricity prices.The MLC-embedded dynamic reparation will intimidate coal enterprises’ default selection by considering unattractive, remaining additional utility.

The results of the simulation prove that CEs would select “default” if the market-orient coal price is 18% higher than the contracted price.Furthermore, CEs would turn to “compliance” if the original reparation to be paid for“default” is increased by 5%.

(2) In the current scenario of carbon quota allocation,coal-fired EEs tend to satisfy electricity demand, even if the profit decreases with the rising carbon quota price.Furthermore, EEs would select “default” if the cost of the carbon quota per unit of electricity exceeds 40% of the feedin tariff.Therefore, the fluctuation in the carbon quota price is a key factor in the tightening of carbon quotas.

(3) We must establish a reasonable market-oriented electricity-price mechanism.Coal-fired electricity is highquality electricity that has demand in high value-added industries [38].Therefore, the price of coal-fired electricity will rise because of its high quality [39], which leads to an improvement in coal-fired EEs’ profits.

The electricity market provides an opportunity for coalfired EEs to improve profit [39], while CET makes coalfired EEs undertake corporate social responsibility, which solves the coal-electricity conflict with less administrative intervention.

4 Summary and future work

In this study, we examined the contracting behavior of coal and coal-fired EEs in the context of decarbonization.An evolutionary game model was established to formalize the behavior selection process of the two groups under a reparation mechanism.A simulation based on a multi-agent system was applied to verify the ESS and determine the critical values of the parameters.

The results of this study are helpful for further understanding the contractual behavior of coal and coalfired EEs.In addition, reparation is introduced to optimize the contract design, which can help deepen the coalelectricity synergy and thus achieve a stable electricity supply in the mid-long term.

With the development of CET, we will investigate how the initial carbon quota allocation impacts the price in Chinese Certified Emission Reduction and influences the stability of MLC.

Acknowledgements

This paper is supported by the Fund of Education Ministry Humanity and Society (No.18YJCZH016).I would like to show my deepest gratitude to professor Upmau Lall.The idea of this paper has been formed when I was at Columbia University in the City of New York as a visiting scholar.

Declaration of Competing Interest

We declare that we have no conflict of interest.

References

[1] Kefford B M, Ballinger B, Schmeda-Lopez D R, et al.(2018)The early retirement challenge for fossil fuel power plants in deep decarbonisation scenarios.Energy Policy, 119: 294-306

[2] Zhou H C (2019) Effectiveness of implementation and promotion countermeasures of medium and long-term contracts of electric coal.China Electricity Industry, Vol.2: 8-11

[3] Guo G (2019) Exploration on coal enterprises' development of electricity and coal price linkage mechanism.Bohai Economic Outlook, Vol.1: 56-57

[4] Qu G J (2020) Exploring the optimization direction and effective ways of supplier management in large coal enterprises.Enterprise Reform and Management, Vol.4: 32-33

[5] Huang Z J (2020) Exploration of nuclear energy and green development.Resource Information and Engineering, 35(2):118-122

[6] De Jong A, Smit K (2019) Collaboratives to improve industrial maintenance contract relationships.Journal of Quality in Maintenance Engineering, 25(4): 545-562

[7] Han X M, Lin X Y (2012) Characteristics of U.S.Coal Electricity Contracts and Implications for China.Technology Economics,31(6), 115-119

[8] Yucekaya A (2013) Multi-objective fuel supply for coal-fired power plants under emission, transportation and operational constraints.Energy Sources, Part B: Economics, Planning, and Policy, 8(2): 179-189

[9] Wu W B (2016) Anatomy of the U.S.coal-electricity linkage mechanism.Enterprise Reform and Management, Vol.4: 188

[10] Sun H (2018) An introduction to the role of electricity transfer trading of generation contracts in the Guangdong electricity market.Low Carbon World, Vol.10: 108-110

[11] Eguchi S, Takayabu H, Lin C (2021) Sources of inefficient power generation by coal-fired thermal power plants in China:A metafrontier DEA decomposition approach.Renewable and Sustainable Energy Reviews, 138: 110562

[12] Cicala S (2015) When does regulation distort costs? lessons from fuel procurement in US electricity generation.American Economic Review, 105(1): 411-444

[13] Sharma A, Jain D (2021) Game-theoretic analysis of green supply chain under cost-sharing contract with fairness concerns.International Game Theory Review, 23(2): 2050017

[14] Schaefer A (2021) Rationality, uncertainty, and unanimity:An epistemic critique of contractarianism.Economics and Philosophy, 37(1): 82-117

[15] Tan Z F, Yu C, Jiang H A, et al.(2011) A risk-return equilibrium optimization model for contract negotiation between coal suppliers and electricity producers.Systems Engineering Theory and Practice, 31(11): 2108-2114

[16] Wang D, Nie R, Liu Y (2016) Research on the linkage effect of coal and electricity prices in China based on complex network model.Systems Engineering, 34 (8): 75-83

[17] Coulomb R, Lecuyer O, Vogt-Schilb A (2019) Optimal transition from coal to gas and renewable power under capacity constraints and adjustment costs.Environmental and Resource Economics,73(2): 557-590

[18] Herweg, Fabian, Karle, Heiko, Mueller, & Daniel (2018)Incomplete contracting, renegotiation, and expectation-based loss aversion.Journal of Economic Behavior & Organization, 145(c),176-201

[19] Sikhar Barari, Gaurav Agarwal, W J (Chris) Zhang, et al.(2012)A decision framework for the analysis of green supply chain contracts: An evolutionary game approach.Expert Systems With Applications, 39(3): 2965-2976

[20] Ma C H, Wong W K (2021) A theoretical foundation for games of complete/incomplete contracts.International Journal of Financial Engineering, 8(1): 2150010

[21] Baskoro F R, Takahashi K, Morikawa K, et al.(2021) Multiobjective optimization on total cost and carbon dioxide emission of coal supply for coal-fired power plants in Indonesia.Socio-Economic Planning Sciences, 101185

[22] Zhai H B, Rubin E S, Grol E J, et al.(2022) Dry cooling retrofits at existing fossil fuel-fired power plants in a water-stressed region: Tradeoffs in water savings, cost, and capacity shortfalls.Applied Energy, 306: 117997

[23] Chen Z D, Qin X Z (2018) Evolutionary analysis of the inhibitory effect of embedded contingent compensation on the breach of contract of cops Journal of management engineering, 32 (4): 186-194

[24] Sharf M, Besselink B, Molin A, et al.(2021) Assume/guarantee contracts for dynamical systems: Theory and computational tools.IFAC-Papers OnLine, 54(5): 25-30

[25] Keshavarz M, Iranmanesh H, Dehghan R (2021) Modelling the Iranian petroleum contract fiscal regime using bargaining game theory to guide contract negotiators.Petroleum Science, 18(6):1887-1898

[26] Wang J (2020) An empirical study on economic growth, coal price and coal industry profit.China coal, 46 (8): 32-38

[27] Huang S J, Yang J, Chen Q A, et al.(2016) A contract for difference negotiation model of generation side carbon emissions trading based on risk benefit equilibrium.Chinese management science, 24(1): 124-133

[28] Ashrafzadeh S S, Razmi S, Lotfalipour M R, et al.(2017)Compliance rate of profit-loss sharing and interest-based contracts in islamic banking: a game theory approach.Quarterly Journal of Applied Theories of Economics, 3(4): 1-20

[29] CCTD (2020).Carbon emission trade catalogue.https://www.cctd.com.cn/xiazai.php?data=CCTD%C7%D8%BB%CA%B5%BA%B3%A4%D0%AD%BC%DB%B8%F1&name=CCTD%C7%D8%BB%CA%B5%BA%B3%A4%D0%AD%BC%DB%B8%F1&time=%20where%20%20DATE_FORMAT(END_DATE,%27%Y-%m-%d%27)%20%3E=%20%27-0002-11-30%27.Accessed on 21 January 2022

[30] Shanghai Environment and Energy Exchange (2021) The report on carbon emission market.https://www.cneeex.com/tpfjy/xx/yjybg/tscbg/.Accessed on 20 January 2022

[31] Shanghai Statistical Yearbook (2021).http://tjj.sh.gov.cn/tjnj/nj20.htm?d1=2021tjnj/C0601.htm.Accessed on 21 January 2022

[32] Coal resources website (2021).http://www.shxcoal.com/investors/announcement.Accessed on 21 January 2022

[33] China electricity council (2021).https://cec.org.cn/search/index.html?search=%E7%94%B5%E5%8A%9B%E5%B7%A5%E4%B8%9A%E7%BB%9F%E8%AE%A1%E6%95%B0%E6%8D%AE.Accessed on 21 January 2022

[34] Shanghai Municipal Development & Reform Commission (2021).https://fgw.sh.gov.cn/fgw_jggl/20211101/43d3d6f44dac49c594f 6a0b26732ec39.html.Accessed on 21 January 2022

[35] Shanghai environment and energy exchange (2021).https://www.cneeex.com/qgtpfqjy/mrgk/2021n/.Accessed on 21 January 2022

[36] Xiben information (2021).http://www.96369.net/news/558/558293.html.Accessed on 21 January 2022

[37] Lu Q S, Peng L P, Yang Z Q (2010) Ordinary differential equations and dynamical systems.Beijing University of Aeronautics and Astronautics Press

[38] Chen Y L, Ye C (2013) Comprehensive evaluation of power quality based on ideal interval model China energy.Energy of China, 35(11): 28-33

[39] Sun H P, Kporsu A K, Taghizadeh-Hesary F, et al.(2020)Estimating environmental efficiency and convergence: 1980 to 2016.Energy, 208: 118224

Received: 21 December 2021/ Accepted: 28 March 2022/ Published: 25 April 2022

Yan Chen

js044@gyu.cn

Yalin Chen

chen.yalin@nufe.edu.cn

Yaqing Mou

yqmou98@163.com

Shilong Ye

slgye@ucdavis.edu

2096-5117/© 2022 Global Energy Interconnection Development and Cooperation Organization.Production and hosting by Elsevier B.V.on behalf of KeAi Communications Co., Ltd.This is an open access article under the CC BY-NC-ND license (http: //creativecommons.org/licenses/by-nc-nd/4.0/ ).

Biographies

Yalin Chen received her bachelor and doctor’s degree in System Engineering from Wuhan University, Wuhan, China, in 2001 and 2006 respectively.She is an associate professor in Department of Management Science, Nanjing University of Finance and Economics, Nanjing,China.She had been at Columbia University in the City of New York as a visiting scholar in 2015.Her research interests include complex system modeling and simulation.She has published papers in journals that focus on sustainable development of energy system.She has been directed or engaged in several high-level projects supported by the National Natural Science Foundation and Education Ministry Foundation of Humanity and Society.

Yaqing Mou received her bachelor’s degree from Beijing Information Science and Technology University, Beijing, China, in 2020.She is now pursuing her Master’s degree of Management Science and Engineering in Nanjing University of Finance & Economics,Nanjing, China.Her research interests include complex network, evolutionary game and multi-market contracts in energy system.

Shilong Ye majors in applied math, College of Letter and Science, University of California Davis, California, USA.His research interests include power system planning and operation.

Yan Chen received her master’s degree in computer science from Xi’an Jiaotong University, Xi’an, China, in 2005.She is now an associate professor in Department of Computer Science, Guiyang University,Guiyang, China.Her research interests include data processing and computer simulation.She had engaged in the design of Guizhou energy management information system and published papers involved CET platform design and optimization.

(Editor Dawei Wang)